Experience Management and Business Performance

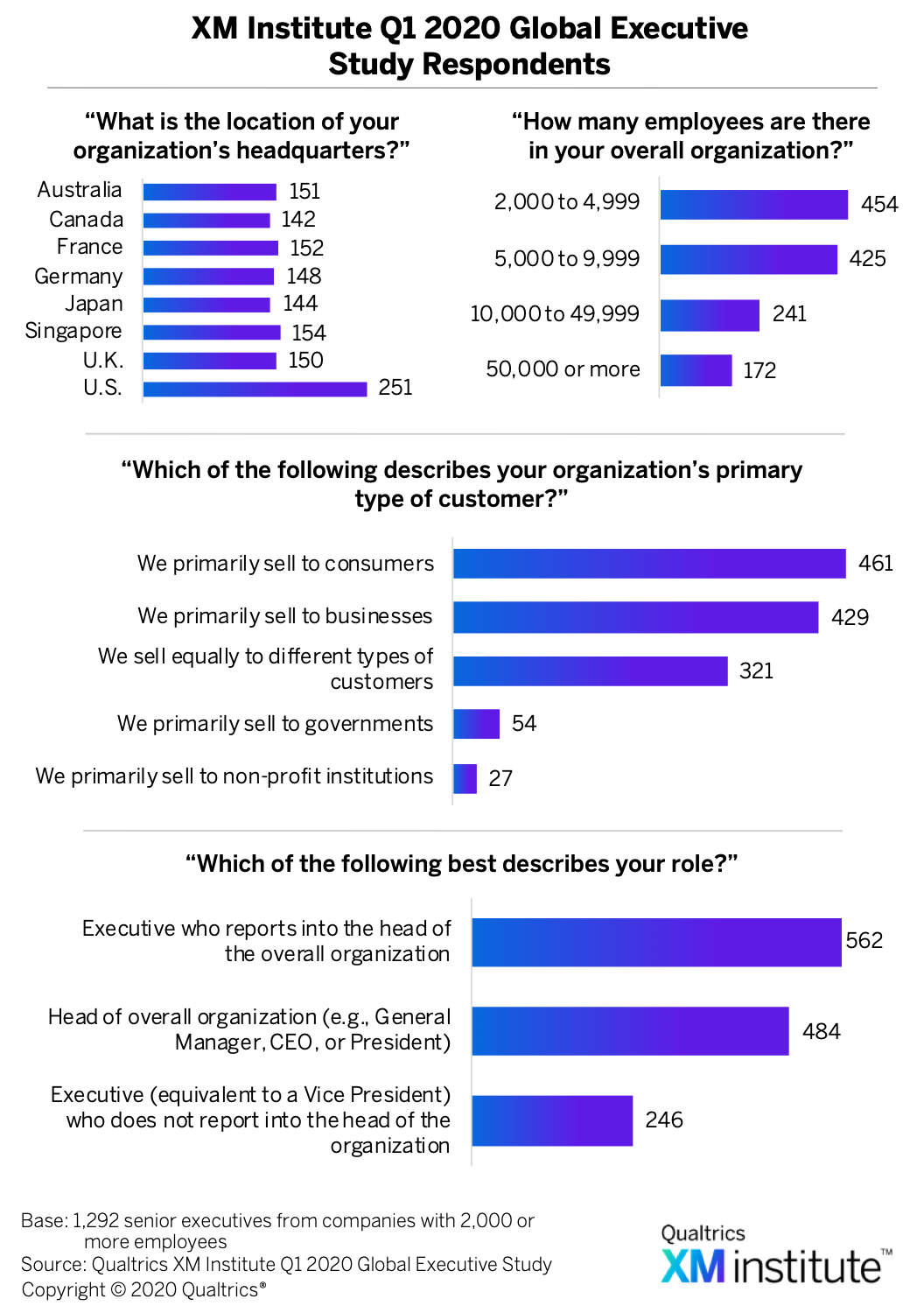

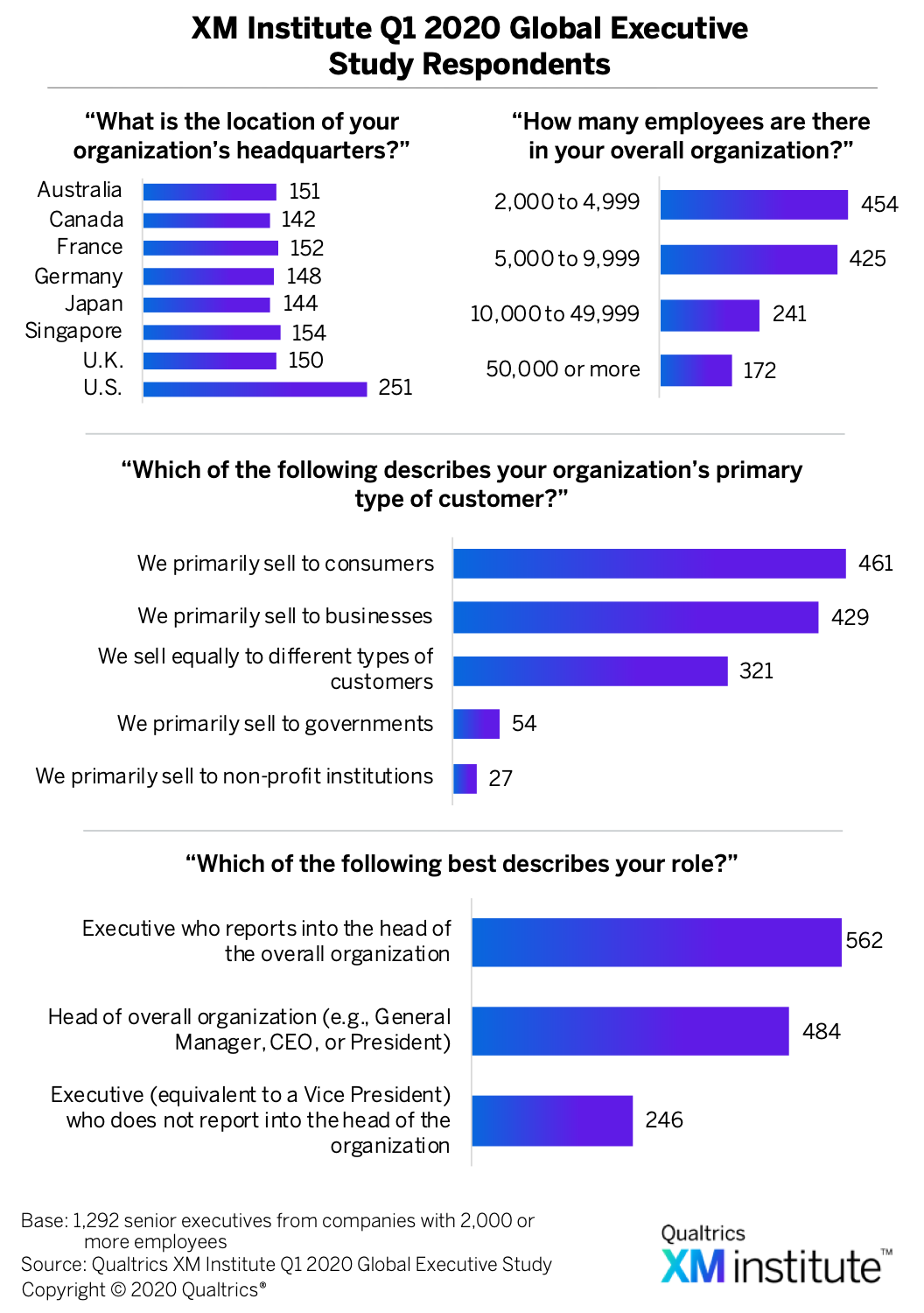

To understand the state of Experience Management (XM) around the world, XM Institute surveyed 1,292 executives of large organizations from eight countries (see Figure 1). We explored how overall XM capabilities affect business results and looked at how performance across each area of XM impacts business success. We also examined how XM performance relates to executive priorities. In doing so, we found striking gaps between those with stronger and weaker performance. The data show that:

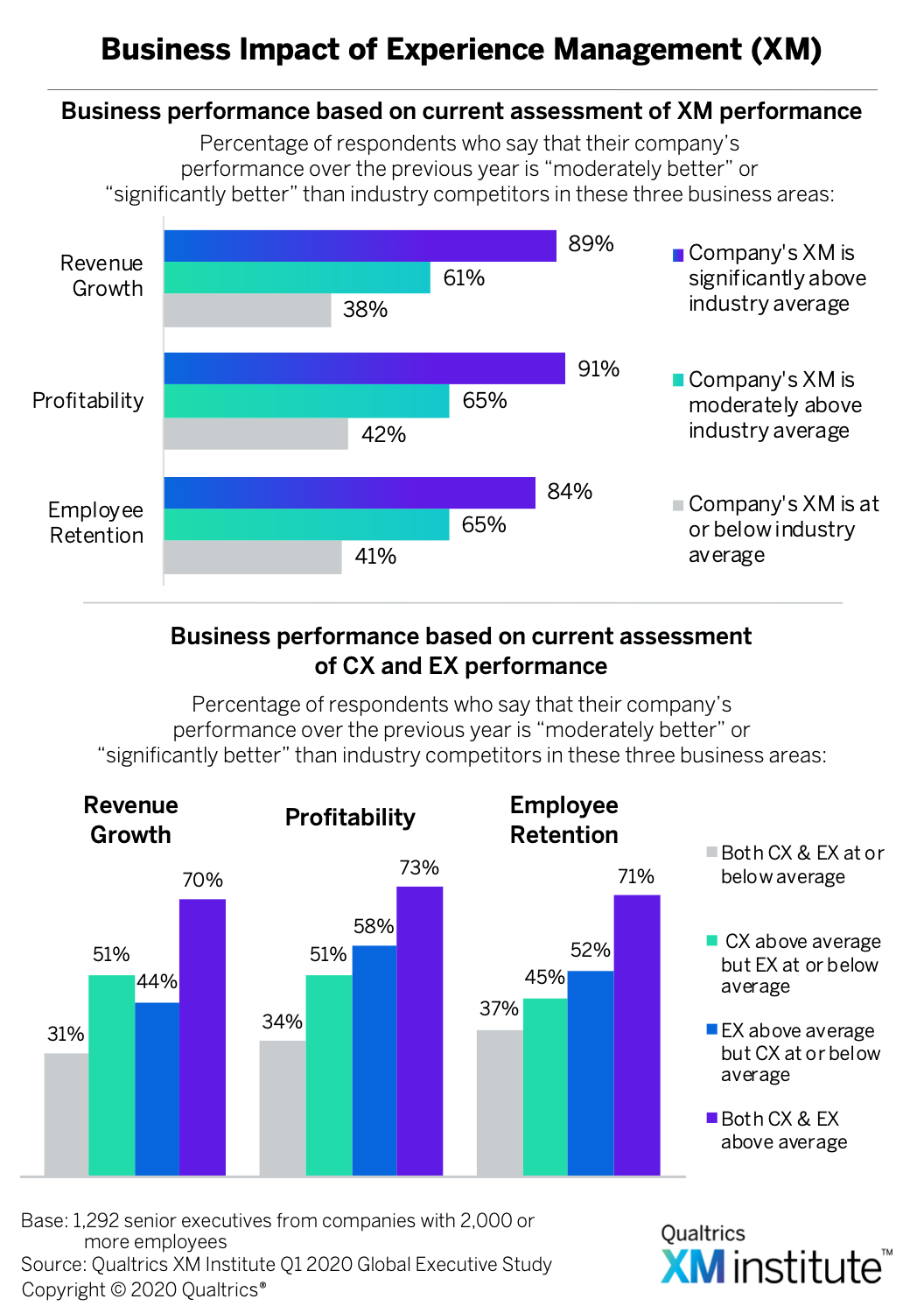

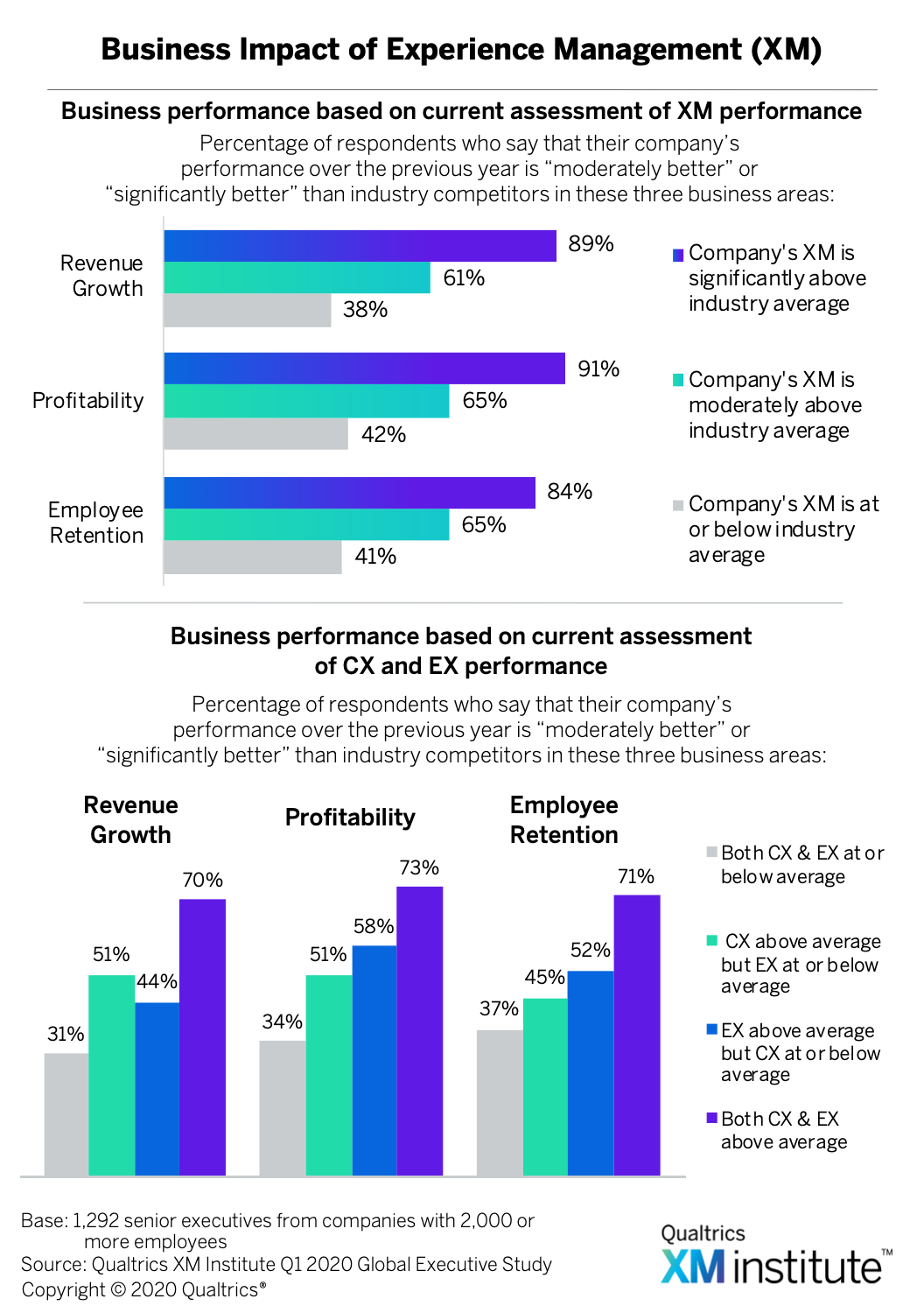

- XM performance is strongly connected with business results. When we asked executives to rate their revenue growth, profitability, and employee retention compared to their industry average, we found that companies with better XM performance are likely to outperform their weaker peers in all three of these business metrics (see Figure 2). Of the respondents who rate their company’s XM as “significantly above average,” 89% report better revenue growth than competitors in the previous year, nine in ten report better profitability than competitors in the previous year, and 84% report better employee retention than competitors in the previous year.

- CX and EX are a powerful combination. Respondents that are better-than-average in both CX and EX reported the strongest business results. Compared to their competitors, these XM leaders outperform other companies by more than 15 percentage points.

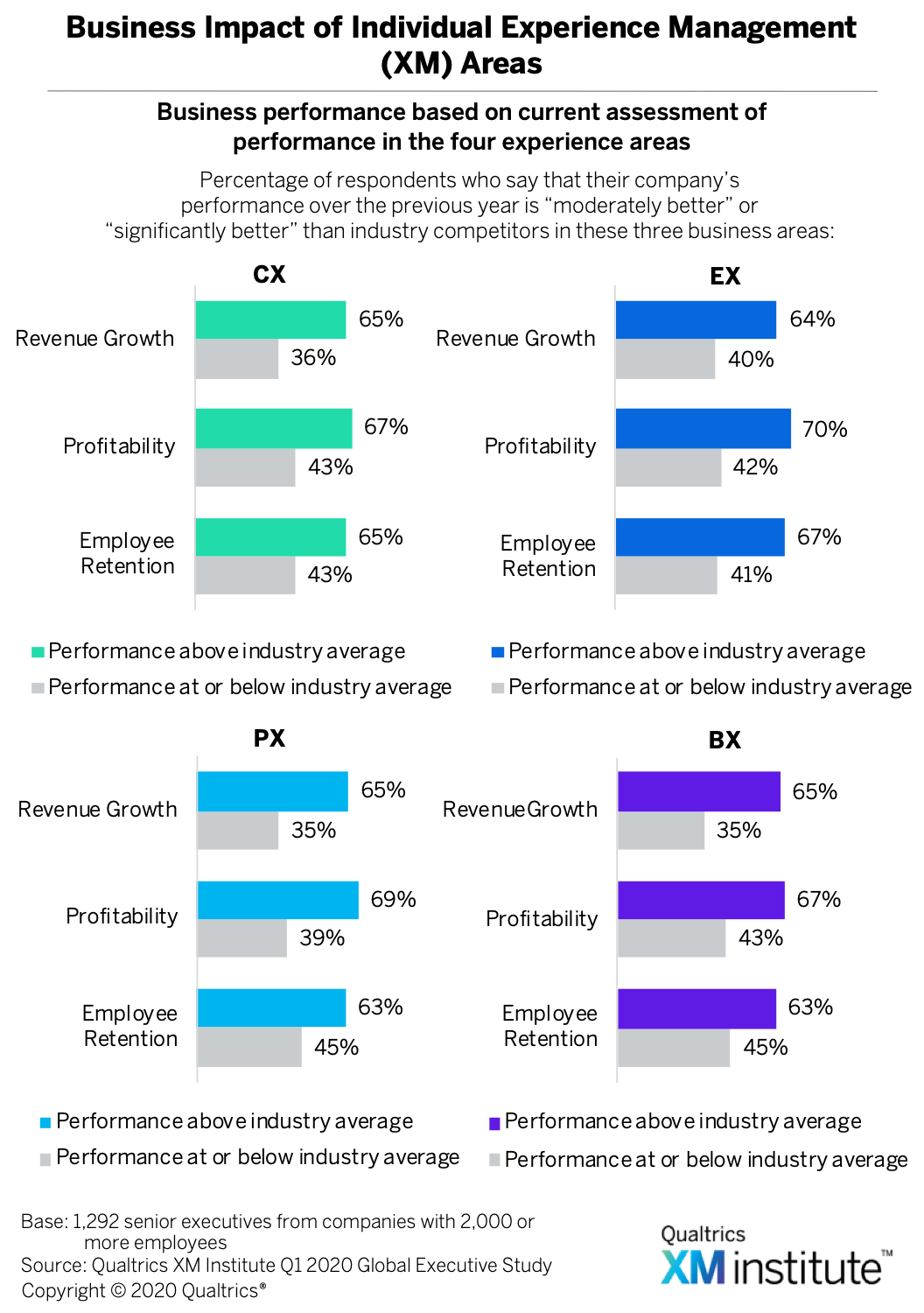

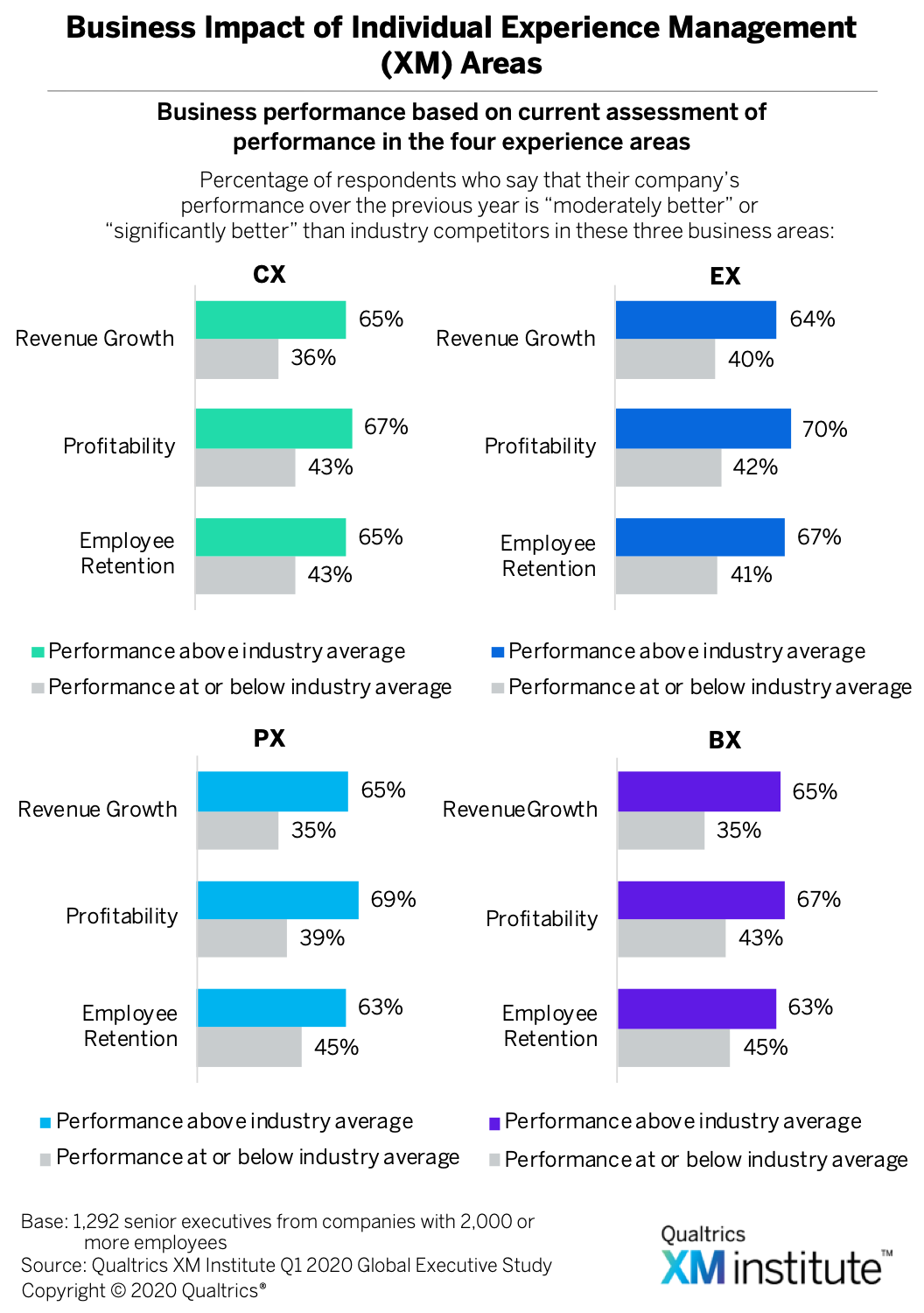

- All experience areas drive business success. When we examined the connection between the individual experience areas—customer, employee, product, and brand—and business performance, we found that companies with higher performance in any one area are more likely to outperform their peers in revenue growth, profitability, and employee retention (see Figure 3). We found that PX and BX leaders have the largest advantage in revenue growth, PX leaders have the largest advantage in profitability, and EX leaders have the largest advantage in employee retention.

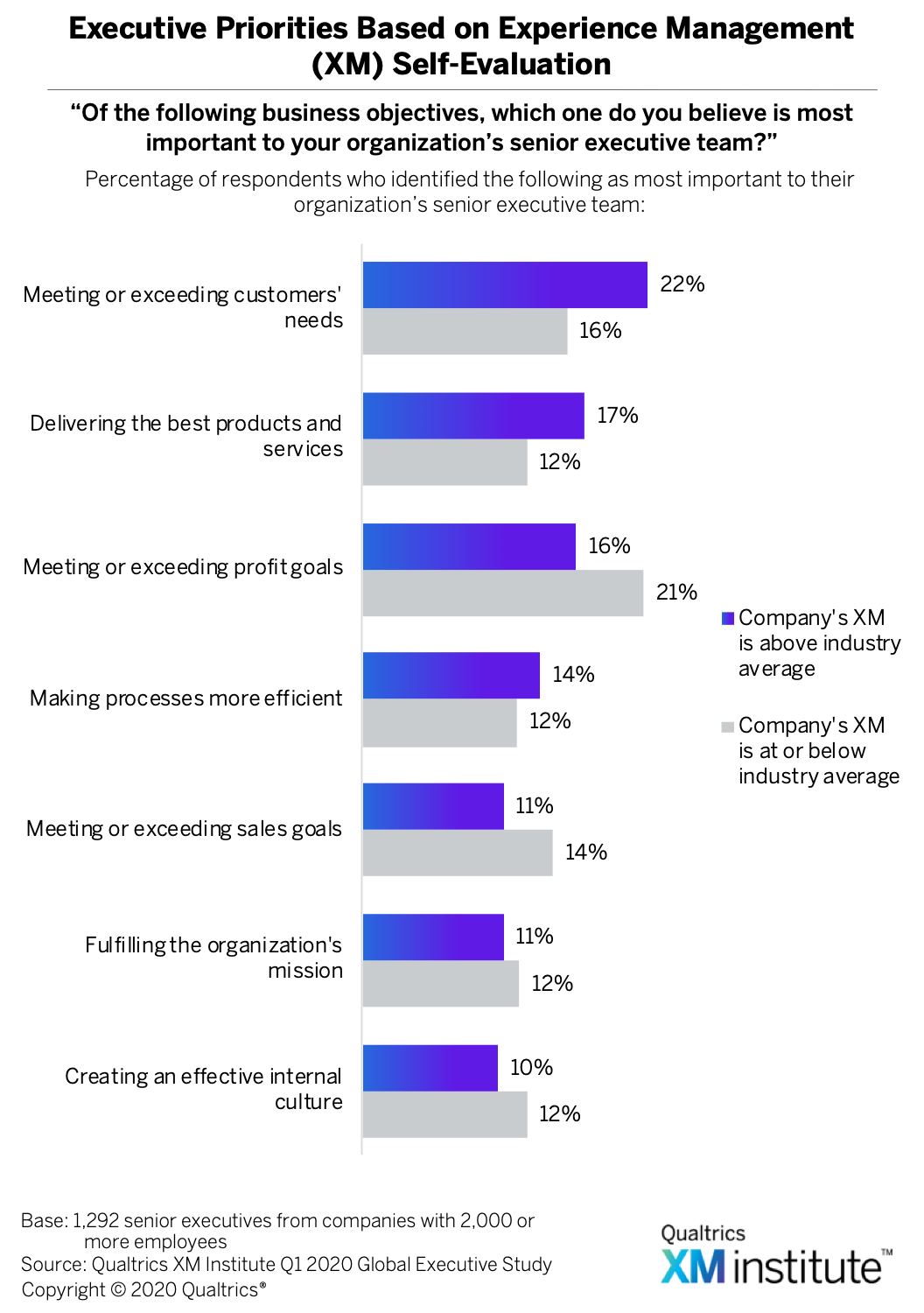

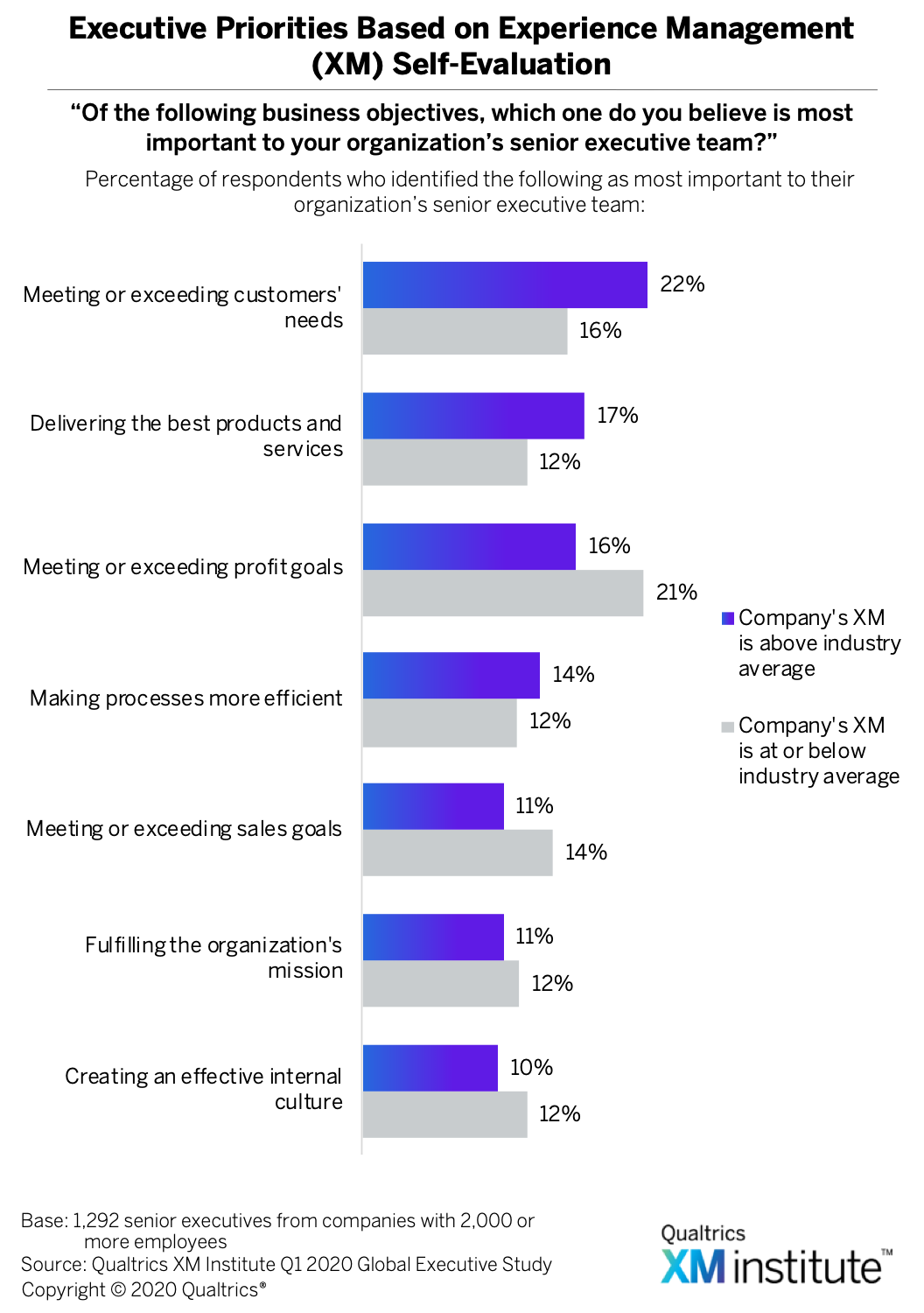

- XM leaders focus on customers, not profits. When we asked respondents to choose the business objective most important to their senior executive team, we found a gap between companies with strong XM performance and companies with weaker XM performance. Respondents who reported above-industry-average XM performance most frequently selected “meeting or exceeding customers’ needs” as a top priority among senior executives (see Figure 4). In comparison, executives at companies with average or below-average XM were most likely to choose “meeting or exceeding profit goals” as their most important area of focus.

Global Trends in Experience Management

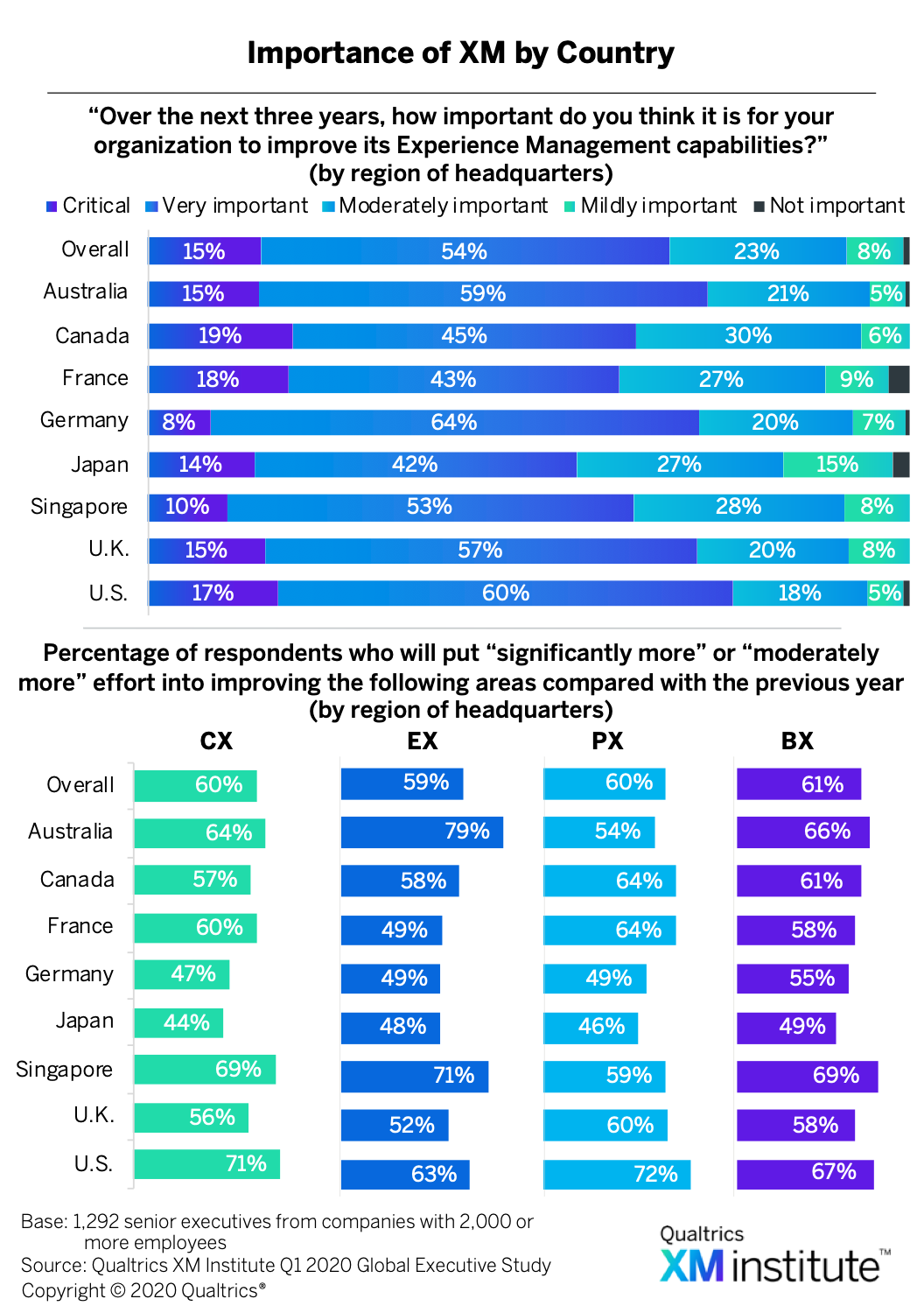

Given the connection between XM and business results, it is no surprise that organizations across the globe recognize the importance of XM. Still, we found that the intensity of interest in XM differs across countries. Our analysis shows that:

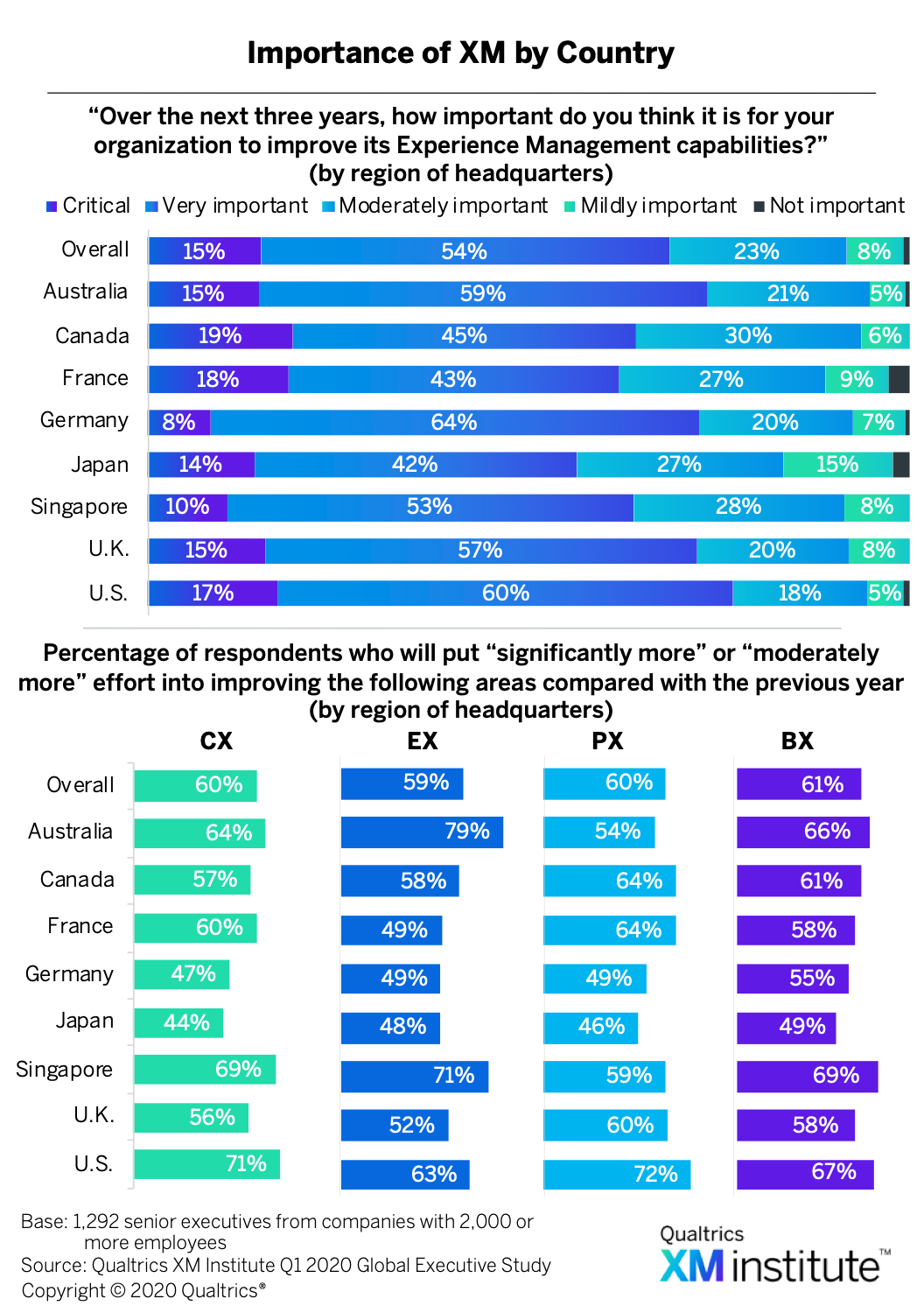

- U.S. executives most frequently view XM as important. At the top of the list, 77% of U.S. respondents believe that improving XM over the next three years is either “critical” or “very important” for their organization (see Figure 5). At the other end of the spectrum, only 56% of Japanese respondents feel the same way.

- Australian executives are the most focused on EX. We examined the percentage of respondents that plan to put “significantly more” or “moderately more” effort into improving the four experience areas. At the top of the list, 79% of Australian respondents plan to increase their focus on EX. U.S. is at the top for CX (71%) and PX (72%), while Singapore is at the top for BX (69%).

- Japanese executives are the least focused on all experiences. Across all four experience areas, Japanese respondents consistently report the lowest percentage of executives planning to put “significantly more” or “moderately more” effort into making improvements compared with the previous year. German respondents followed a similar trend as Japanese respondents, although they were slightly more likely to have plans to improve XM.

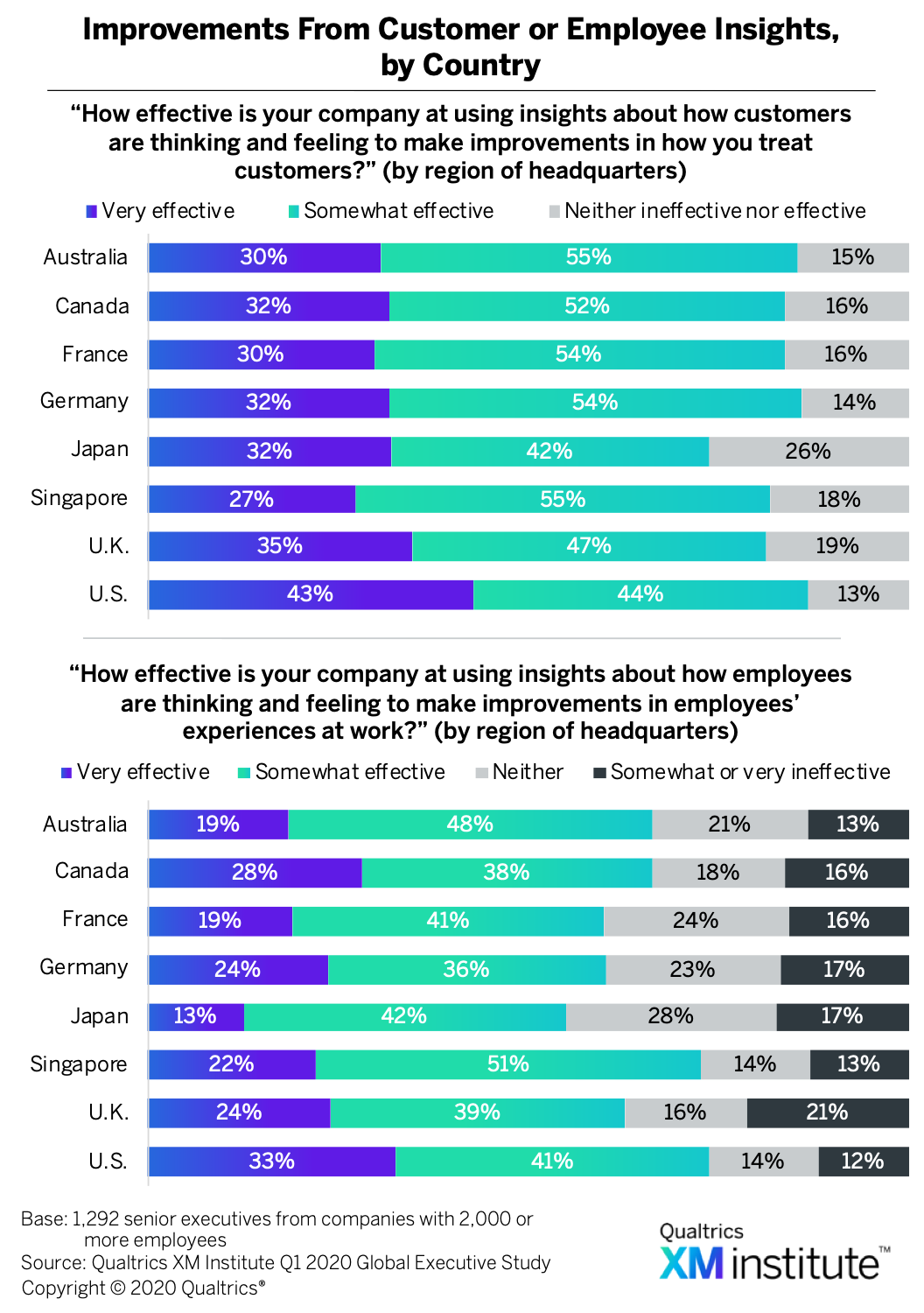

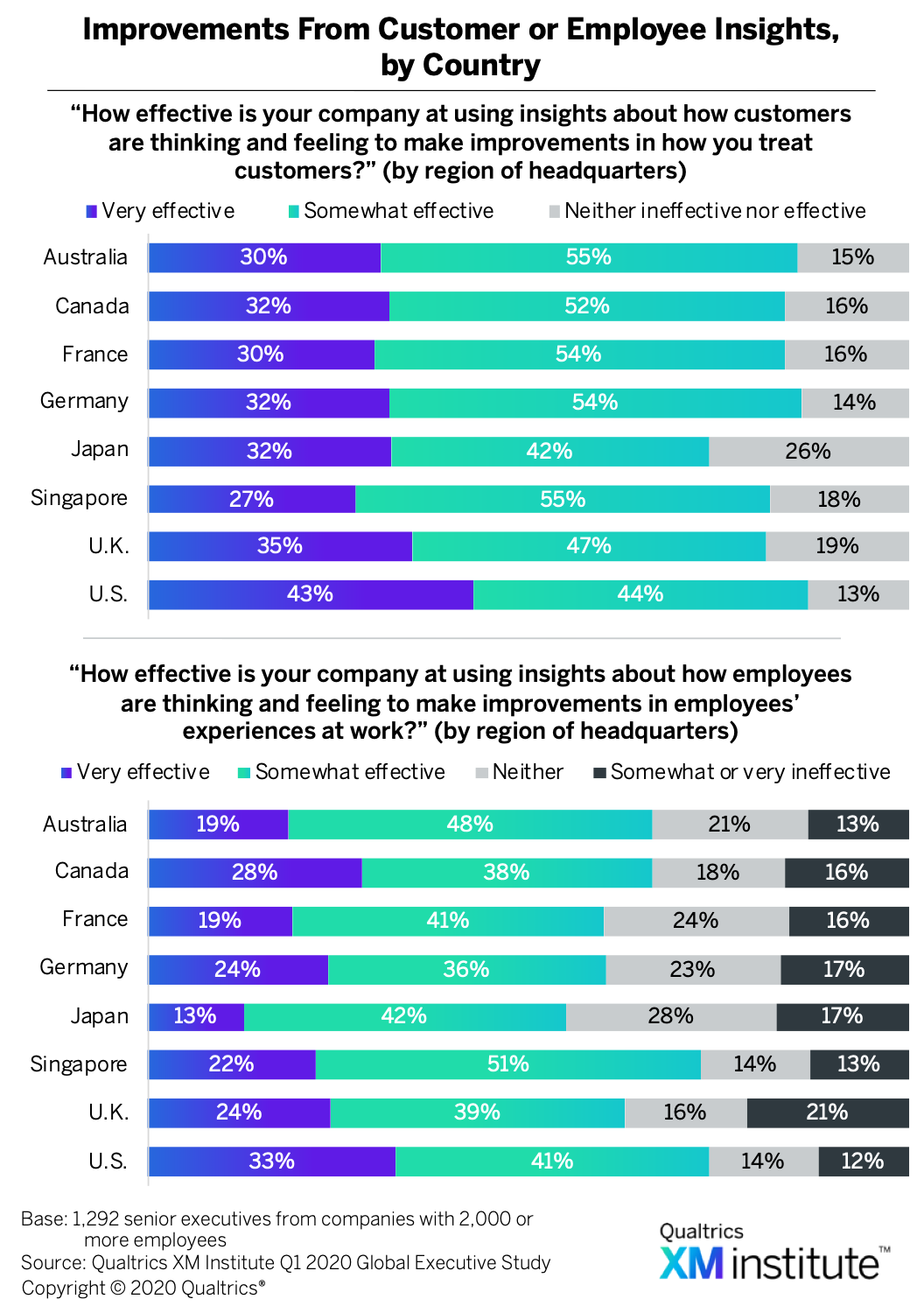

- Executives believe they are effectively using customer insights… The percent of respondents saying they are “very effective” or “somewhat effective” at using customer insights to make improvements in how they treat customers ranges from 87% (U.S.) to 74% (Japan) (see Figure 6).

- …And they are somewhat less effective with employee insights. The percent of respondents saying they are “very effective” or “somewhat effective” at using employee insights to make improvements in how they treat employees ranges from 74% (U.S.) to 55% (Japan).

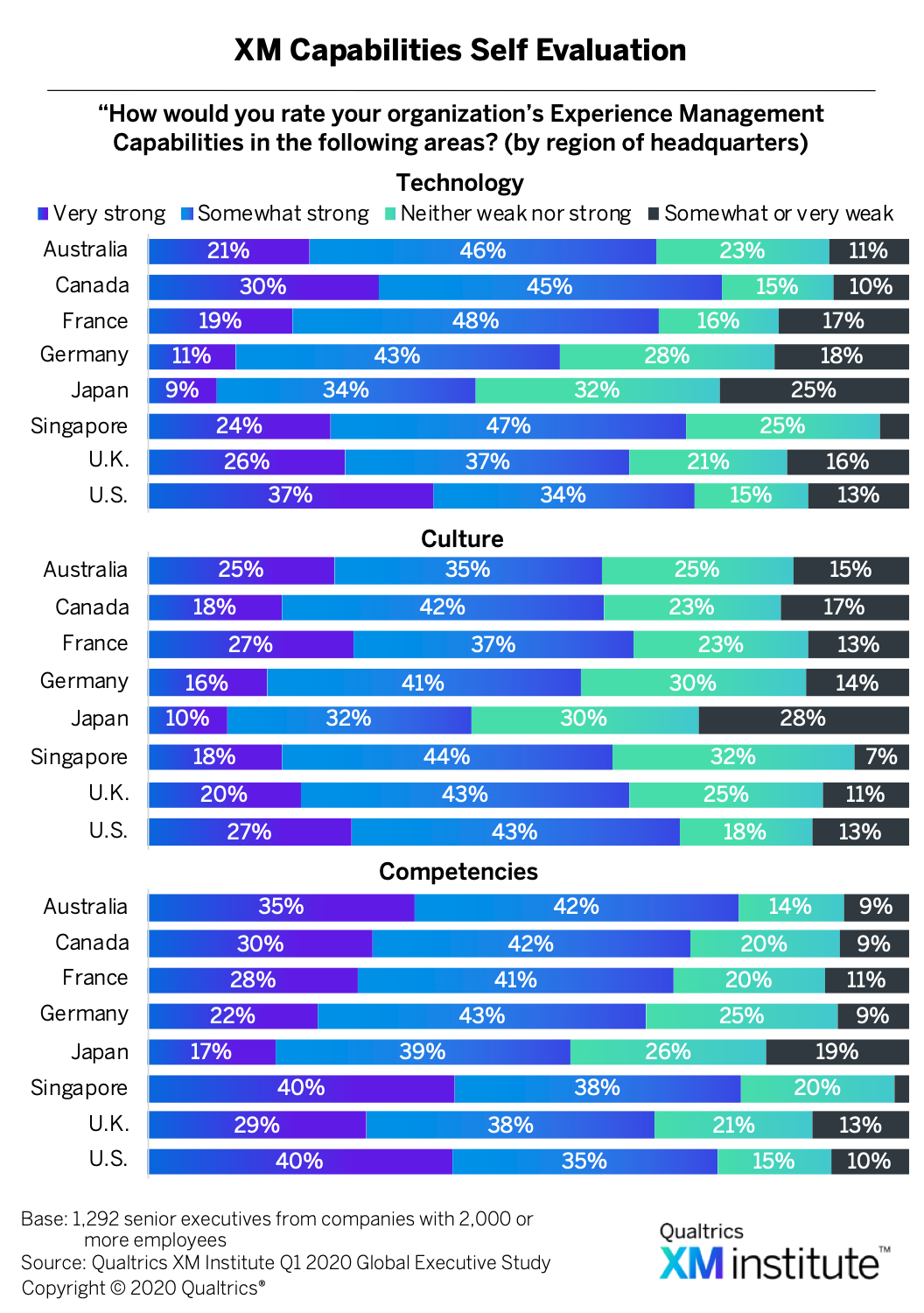

Self-Evaluations Across Culture, Technology, and Competency

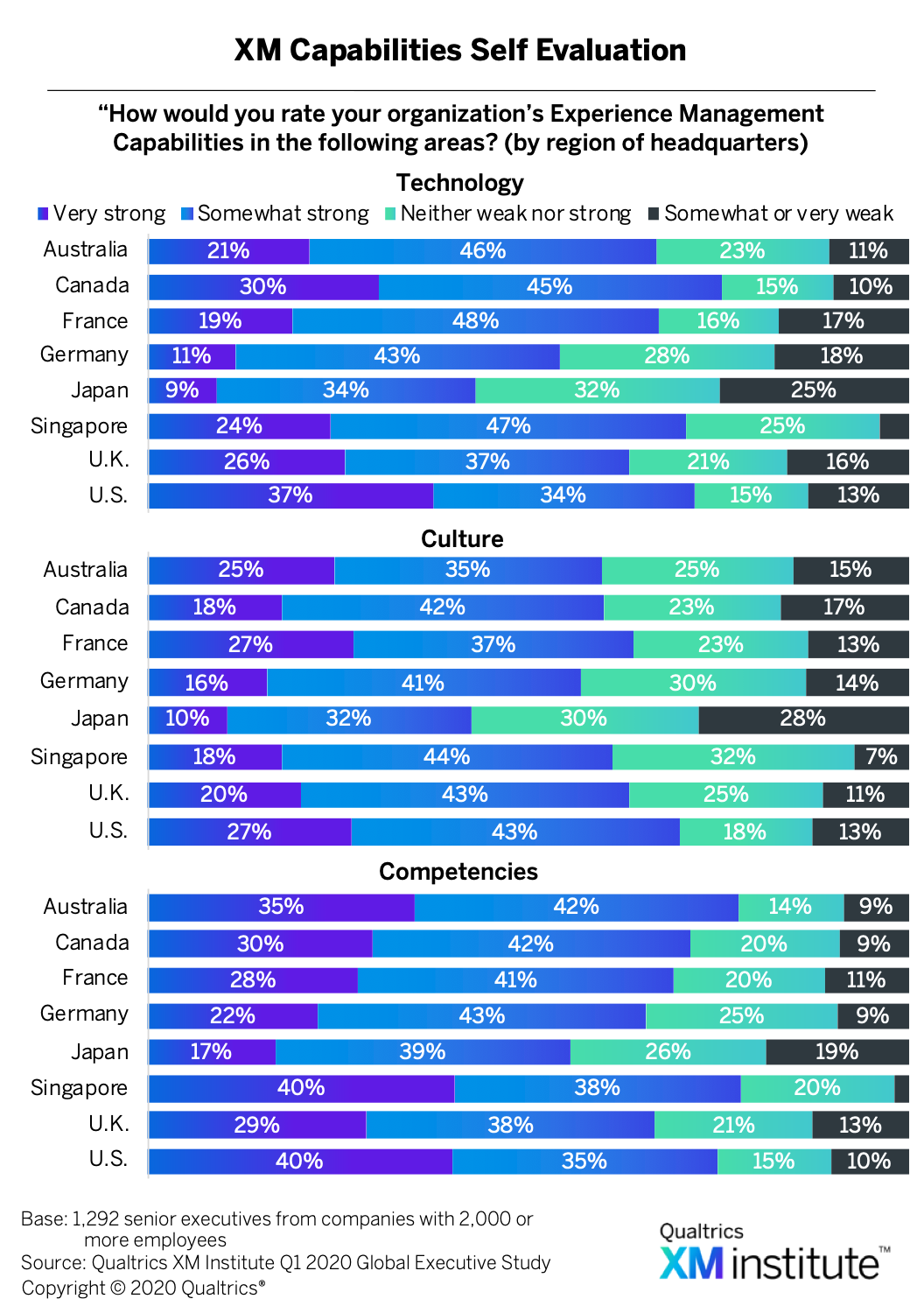

In addition to asking respondents about their XM performance overall and across the four experience areas, we also asked respondents to evaluate their capabilities across the three areas of the XM Operating Framework—technology, competency, and culture.1 When we compared results across the eight countries, we found that (see Figure 7):

- Canadian executives rate highest on technology. Seventy-five percent of respondents from Canada rate their organization’s XM capabilities in technology as “very strong” or “strong.” Organizations from Singapore and the U.S. come in a close second, each with 71% of respondents saying the same.

- U.S. executives rate highest on culture. Seventy-five percent of American respondents rate their organization’s XM capabilities in culture as “very strong” or strong.” Only 42% of Japanese respondents—the lowest of all eight countries—say the same.

- Singaporean executives rate highest on competencies & skills. Seventy-eight of Singaporean respondents rate their organization’s XM capabilities in competency & skills as “very strong” or “strong,” followed closely by Australian respondents at 77%.

Obstacles to XM Success

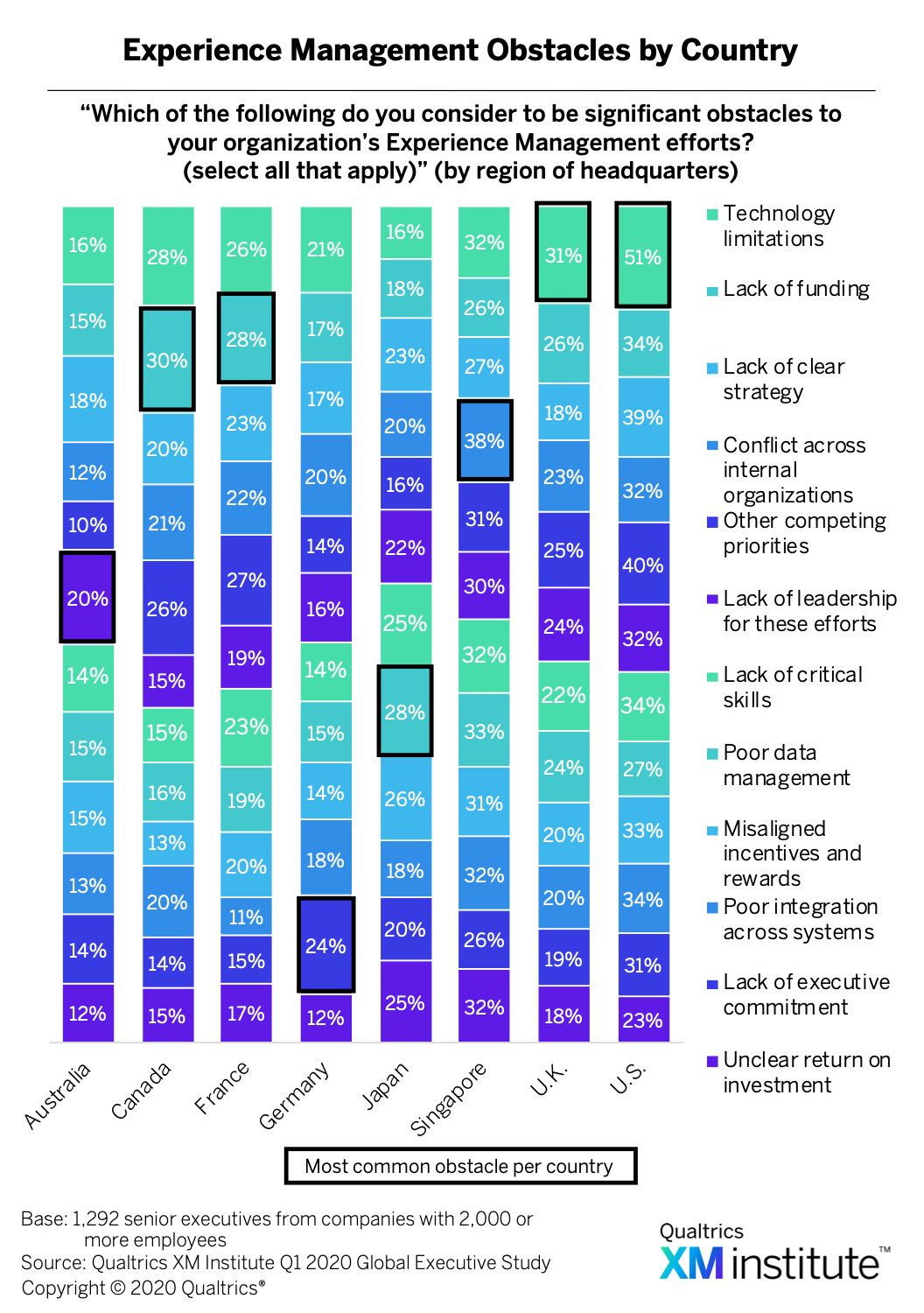

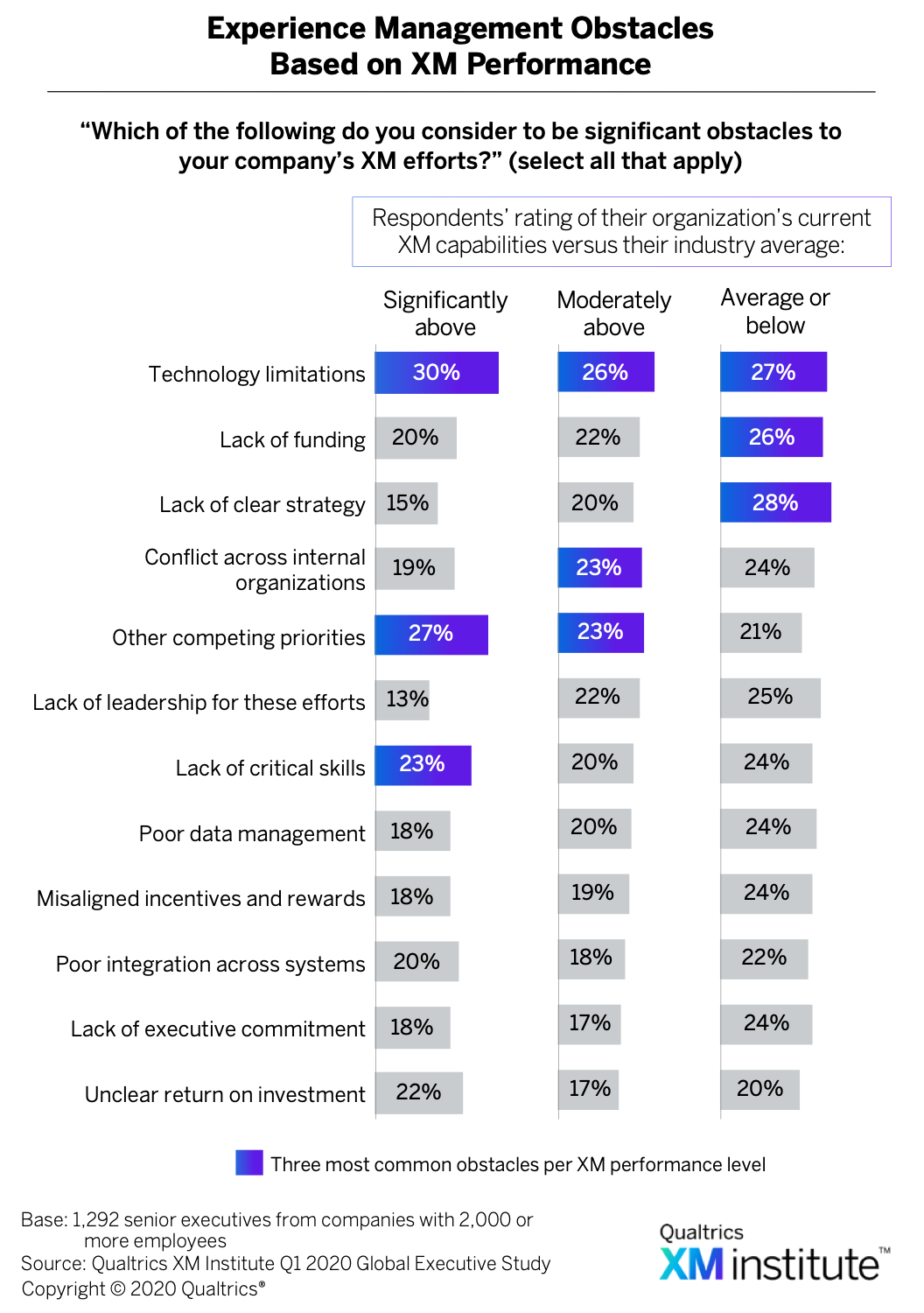

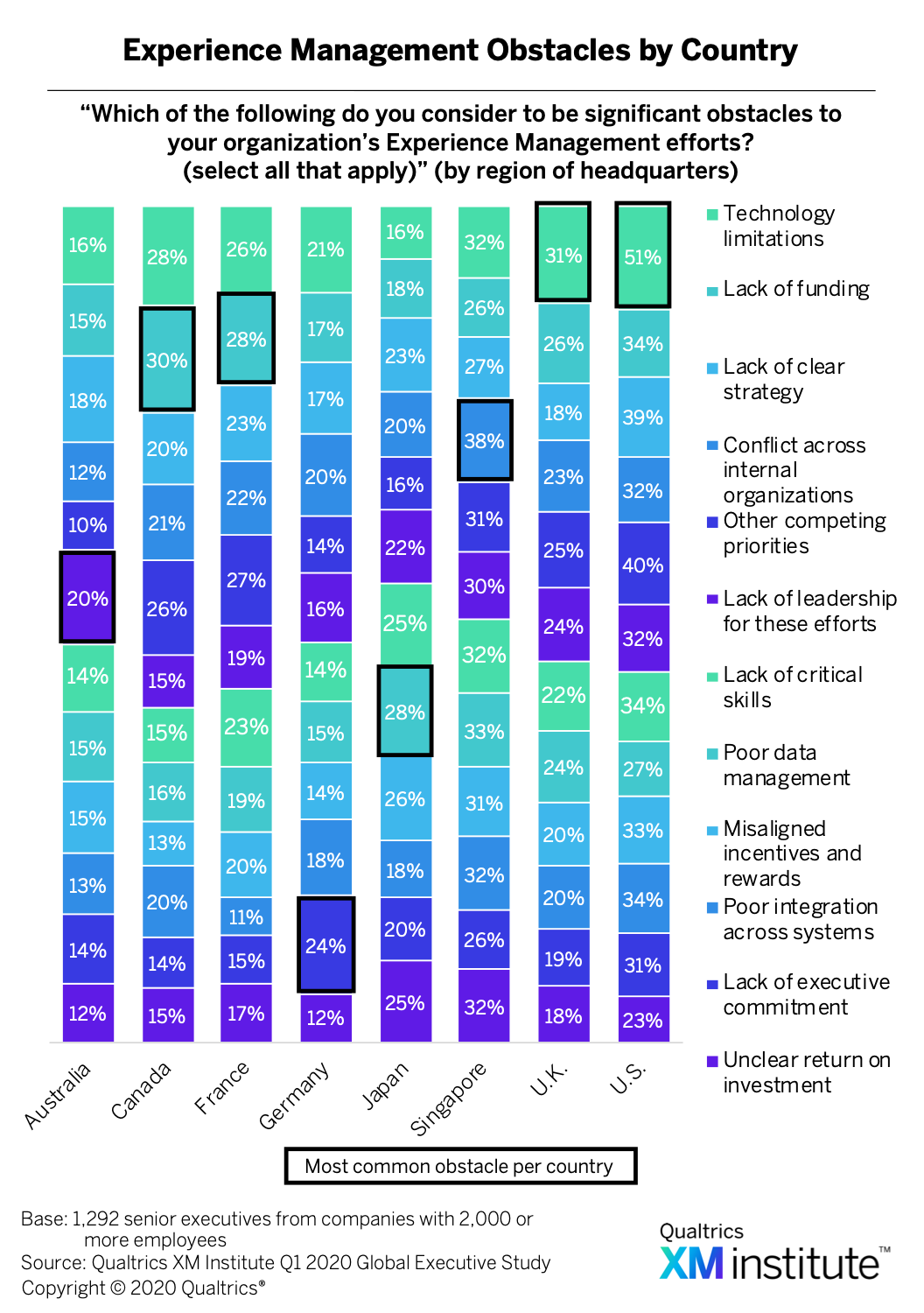

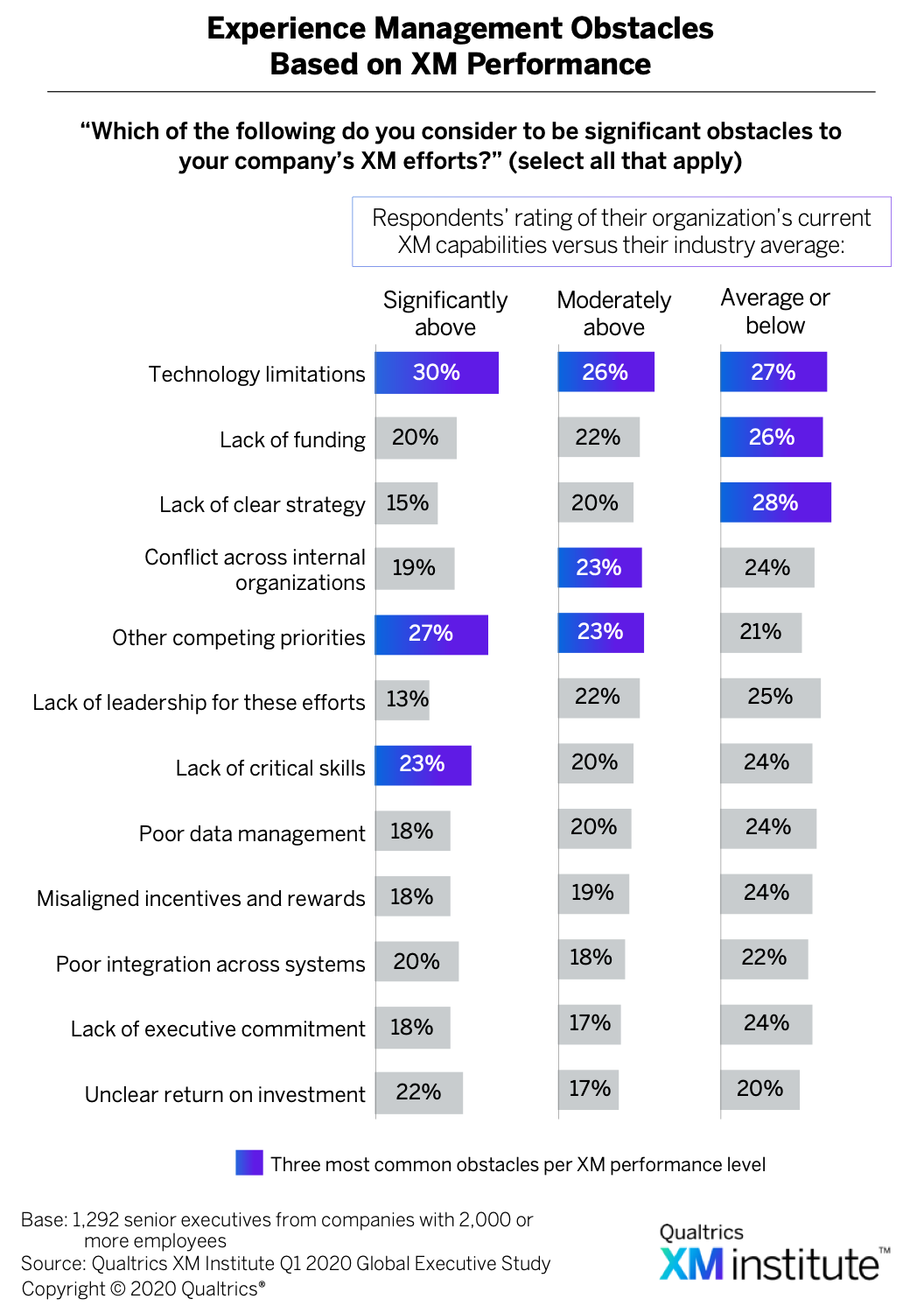

We also asked respondents to select the items that they feel are significant obstacles to their company’s XM efforts (see Figure 8), (see Figure 9). Here’s what we found:

- Technology and funding are key global obstacles. The most frequently selected obstacle was technology limitations, which ranged from a high of 51% in the U.S. to a low of 16% in Australia and Japan. On a per country basis, the most frequently selected obstacles were technology limitations in the U.S. (51%), conflict across internal organizations in Singapore (38%), and technology limitations in the U.K. (31%).

- XM leaders struggle the most with technology. Of the respondents who rated their XM capabilities as “significantly above” their industry average, 30% selected technology limitations as a significant obstacle to their organization’s XM efforts.

- XM laggards lack clear strategy. Respondents who rated their XM capabilities as at or below their industry average most frequently selected lack of clear strategy as a significant obstacle to their XM efforts, followed closely by technology limitations and lack of funding.

The Path to XM Maturity

How can organizations around the world improve their Experience Management? By developing a persistent set of capabilities that will drive their XM maturity (see Figure 10). The XM Institute has developed what it calls the XM Operating Framework, which is focused on building six XM Competencies:2

- LEAD: Architect, align, and sustain successful XM efforts.

- REALIZE: Track and ensure that XM efforts achieve well-defined business objectives.

- ACTIVATE: Equip the organization with the appropriate skills, support, and motivation to achieve desired XM results.

- ENLIGHTEN: Provide actionable insights across an organization.

- RESPOND: Prioritize and drive improvements based on insights.

- DISRUPT: Identify and create experiences that differentiate the organization.

Five Stages of XM Maturity

As organizations build out and master these six XM Competencies, they will evolve through five stages of maturity:

- Stage 1: Investigate. The organization is not focused on XM as a strategic opportunity. Companies in this stage should work on identifying the “best” first steps and building buy-in with senior executives to acquire the resources needed for moving forward.

- Stage 2: Initiate. As leaders see the potential value in XM, they investigate how XM can help their organization and kick off isolated pockets of XM activities. Companies in this stage should work on building a broader understanding of and cross-functional support for the XM strategy. They should also focus on delivering value from their initial efforts so they can gain the next level of executive and organizational commitment.

- Stage 3: Mobilize. Once executives view XM as a strategic priority, the organization taps into full-time XM staff, who distributes insights and drives experience improvements. Companies in this stage should work on developing XM programs that drive action and improve pain points. They should also educate employees across the organization on what good XM behaviors look like and how they can demonstrate them in their individual roles.

- Stage 4: Scale. With strong XM Competencies in place, the organization systematically uses insights to identify and improve experiences and invests in engaging the entire workforce in XM. Companies in this stage should use advanced analytics and XM metrics to improve experiences targeted at narrower segments of people and design new processes that span multiple lines of business. They should also reinforce good XM behaviors by deeply integrating XM into their HR processes.

- Stage 5: Embed. In the final stage of maturity, XM Skills are ingrained across the organization, and it is able to quickly react to shifts in the marketplace. Mature XM programs enable the organization to continuously listen, propagate insights, and rapidly adapt to the needs and expectations of customers, employees, partners, and suppliers.

- See the Qualtrics XM Institute Insight Report, “Operationalizing XM,” (July 2019).

- Ibid.