Key Findings

To understand how organizations plan to use artificial intelligence (AI) to improve customer and employee experiences, we surveyed executives about their Experience Management (XM) needs, their expectations for AI’s impact on their industry and business outcomes, and their current and planned AI initiatives. We found that:

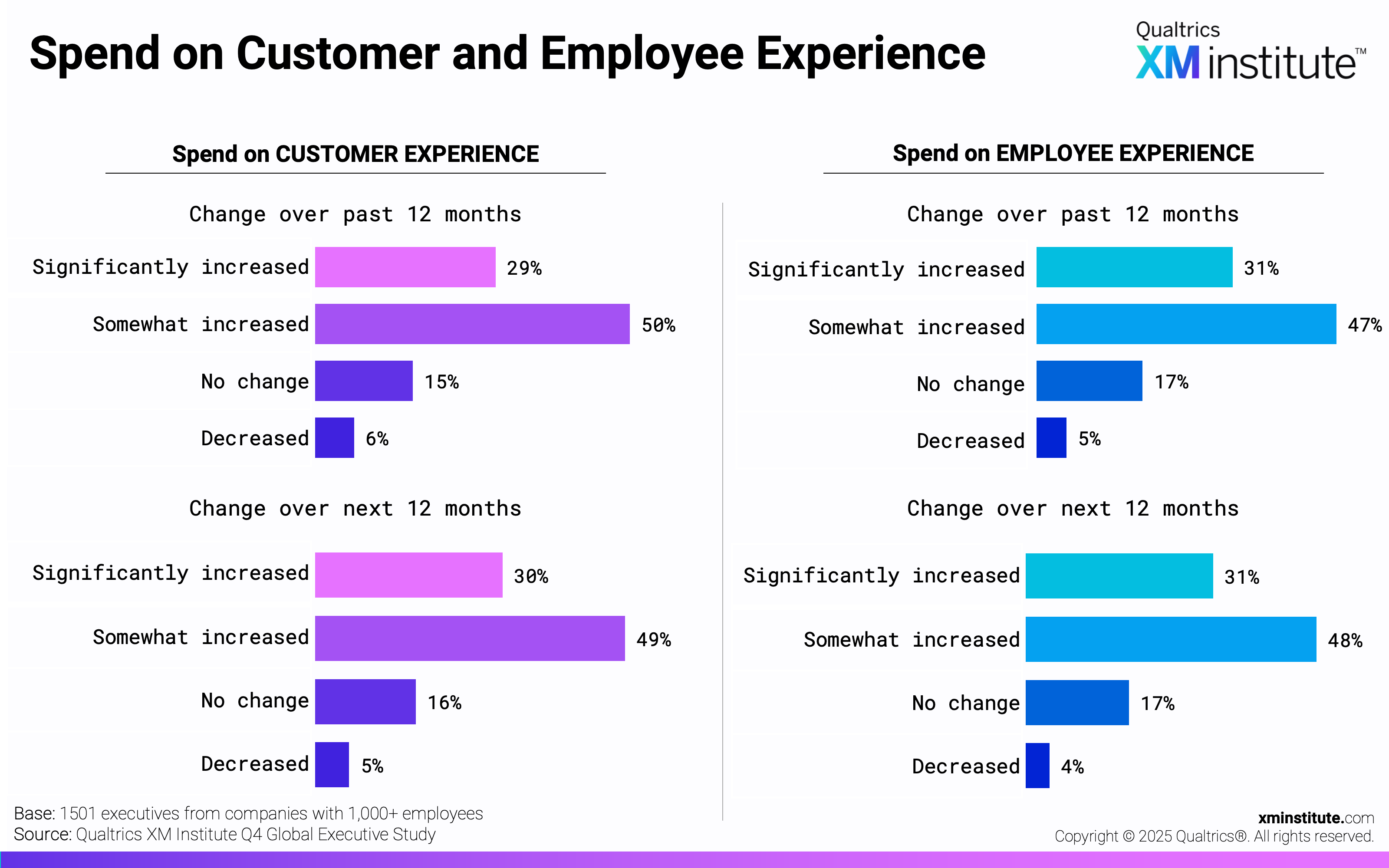

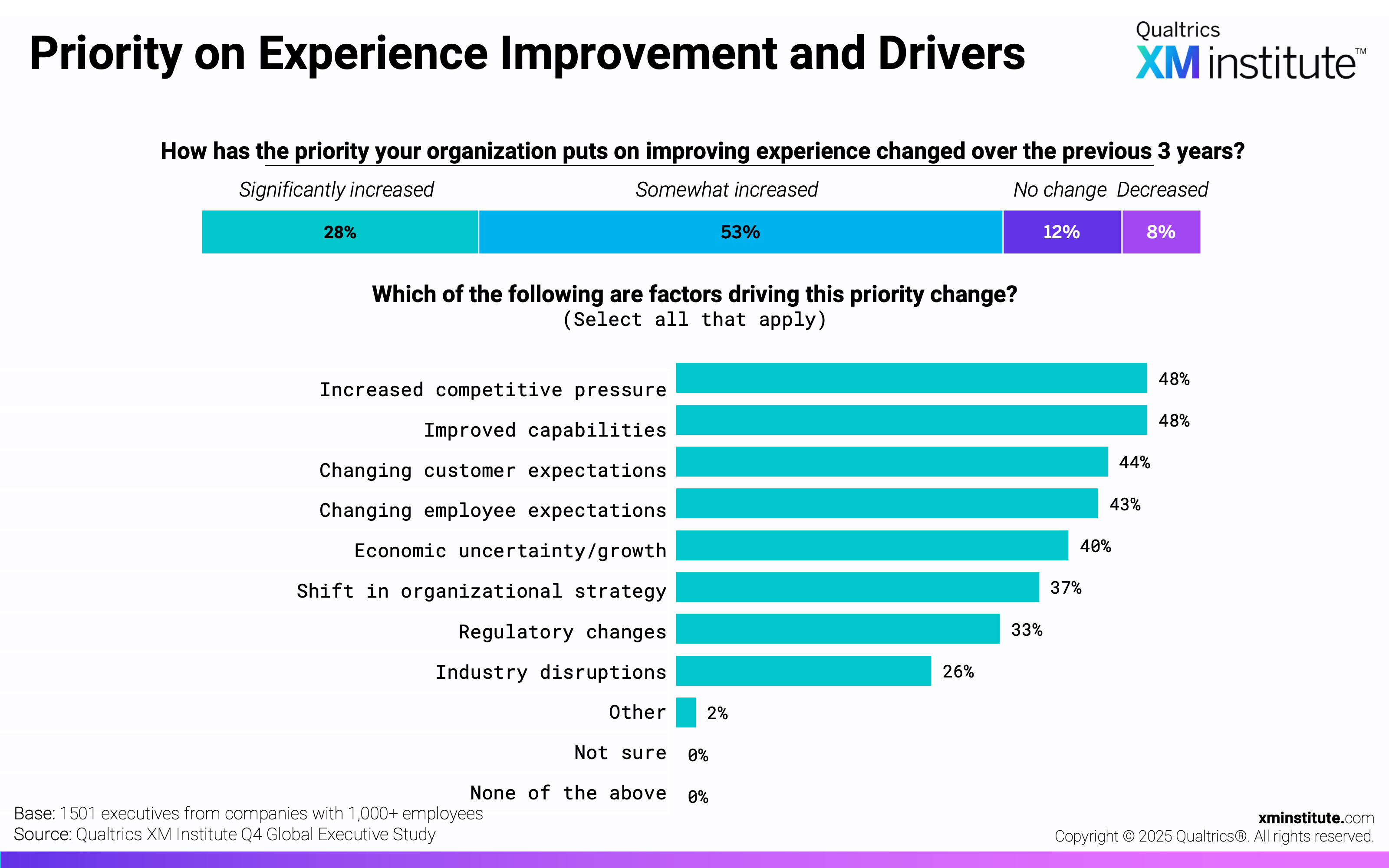

- XM is becoming an increasingly high priority. Eighty-one percent of executives say that improving experiences has become a greater priority for their organization over the past three years. The two most cited drivers of this change are increased competitive pressure (48%) and improved capabilities (48%), closely followed by changing customer (44%) and employee (43%) expectations. Executives plan to increase their spending on both customer experience (CX) and employee experience (EX) over the next 12 months.

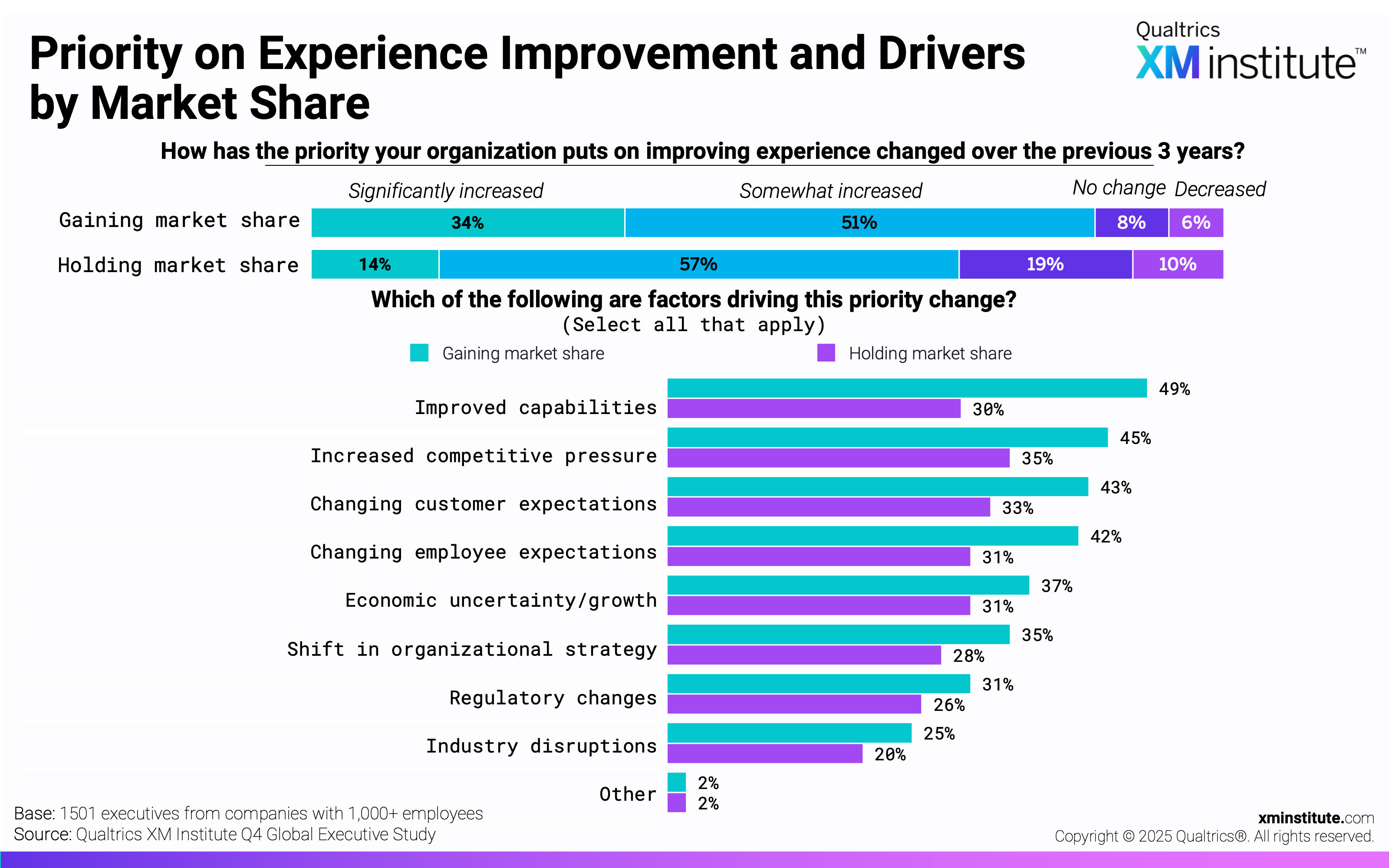

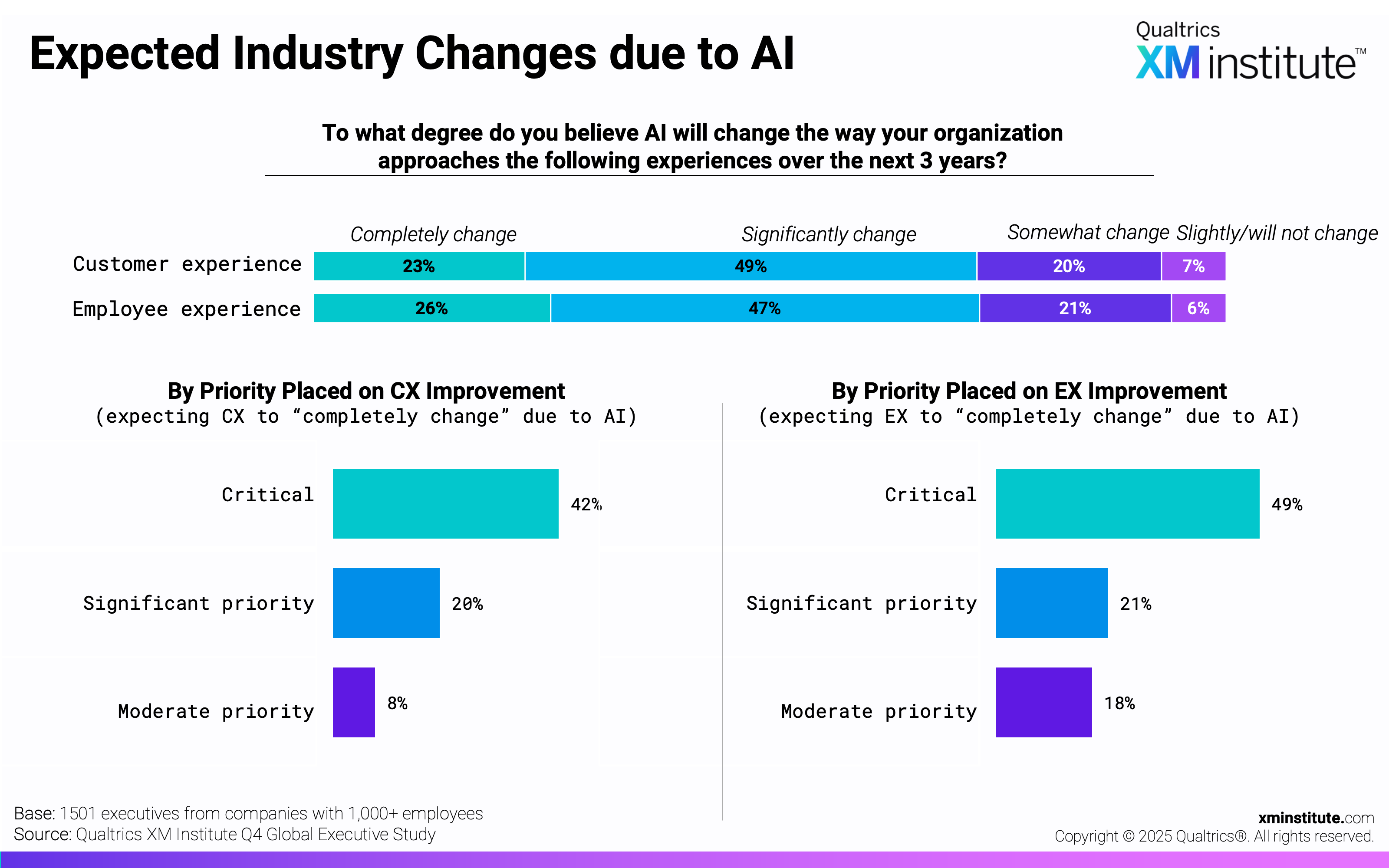

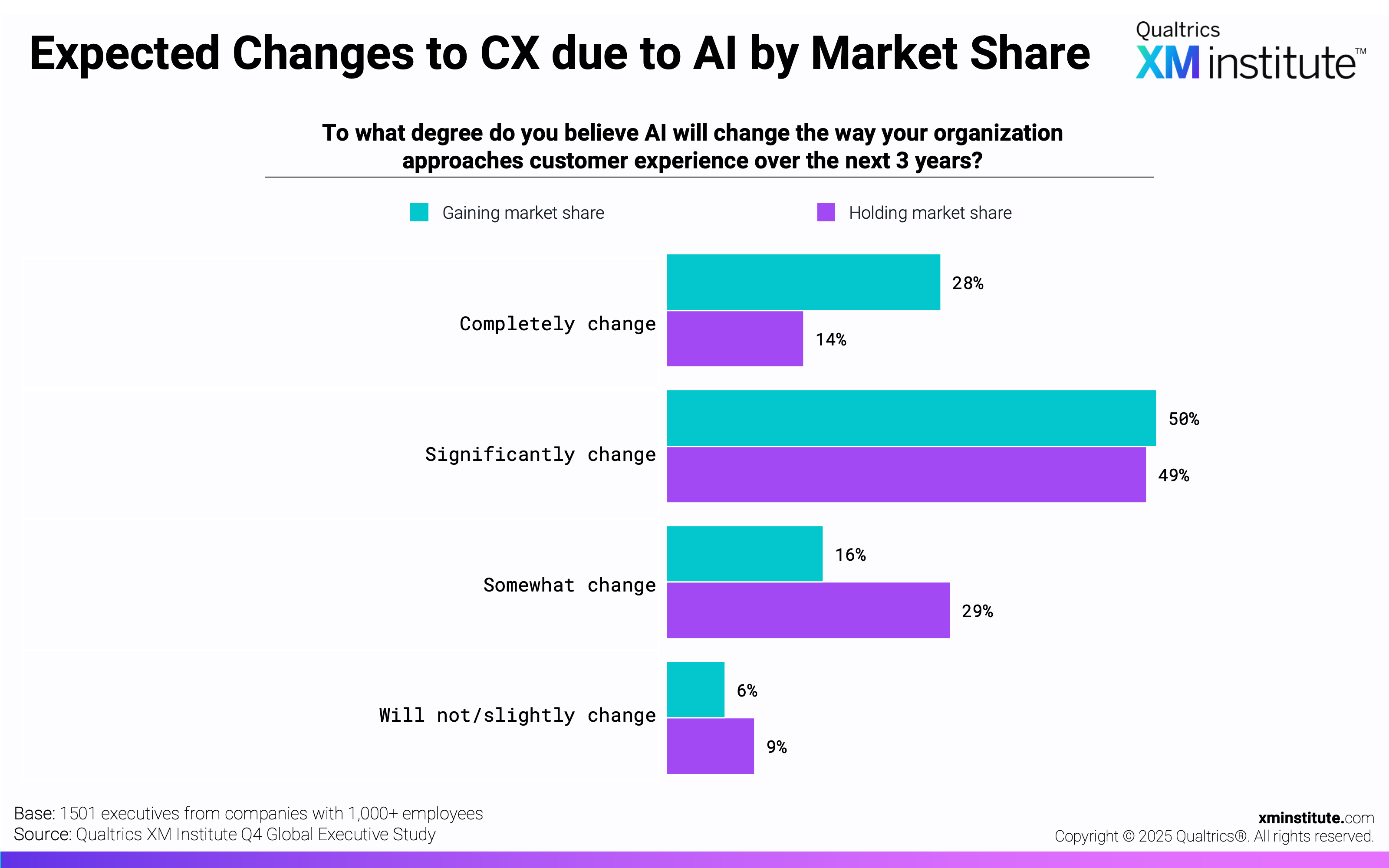

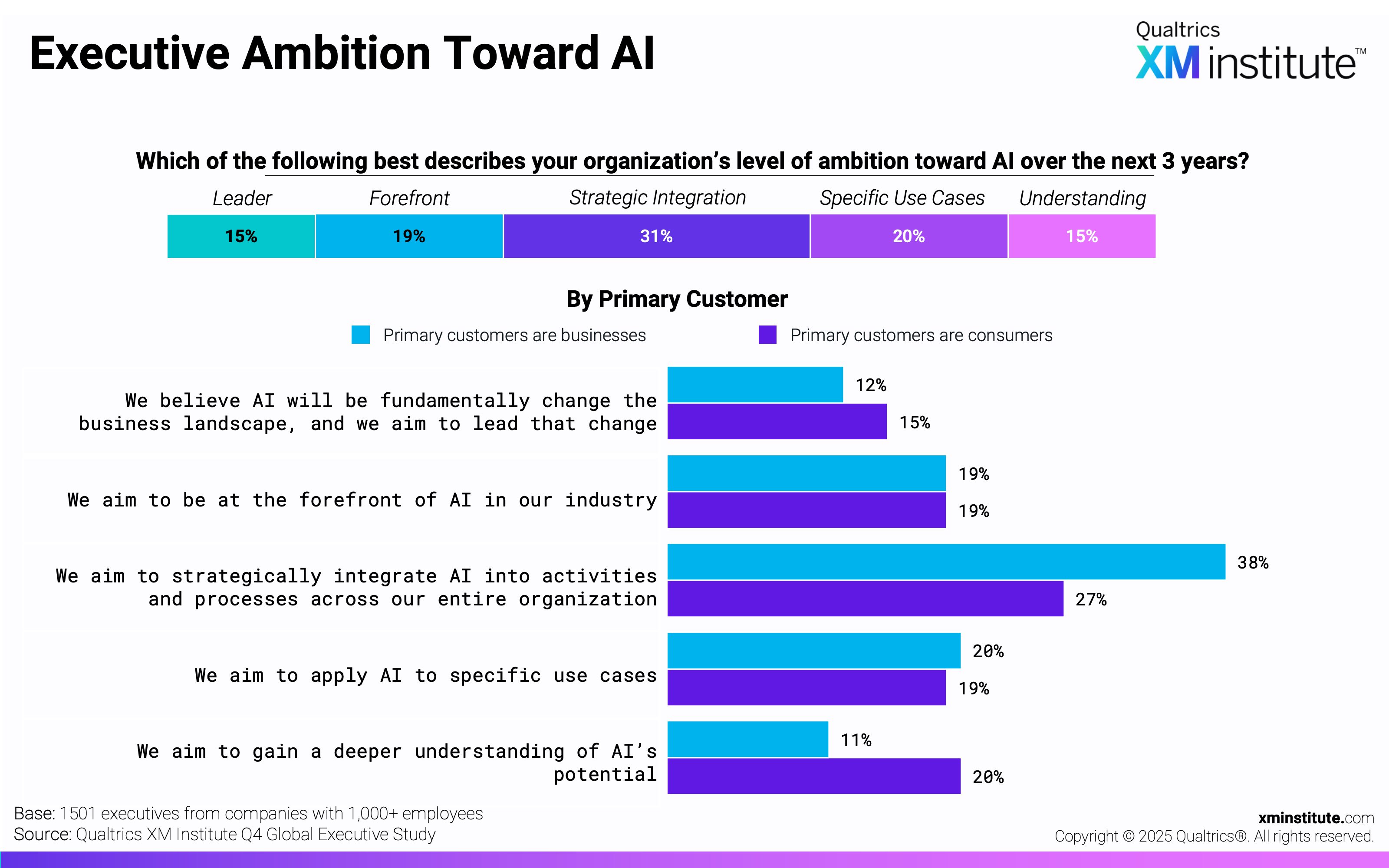

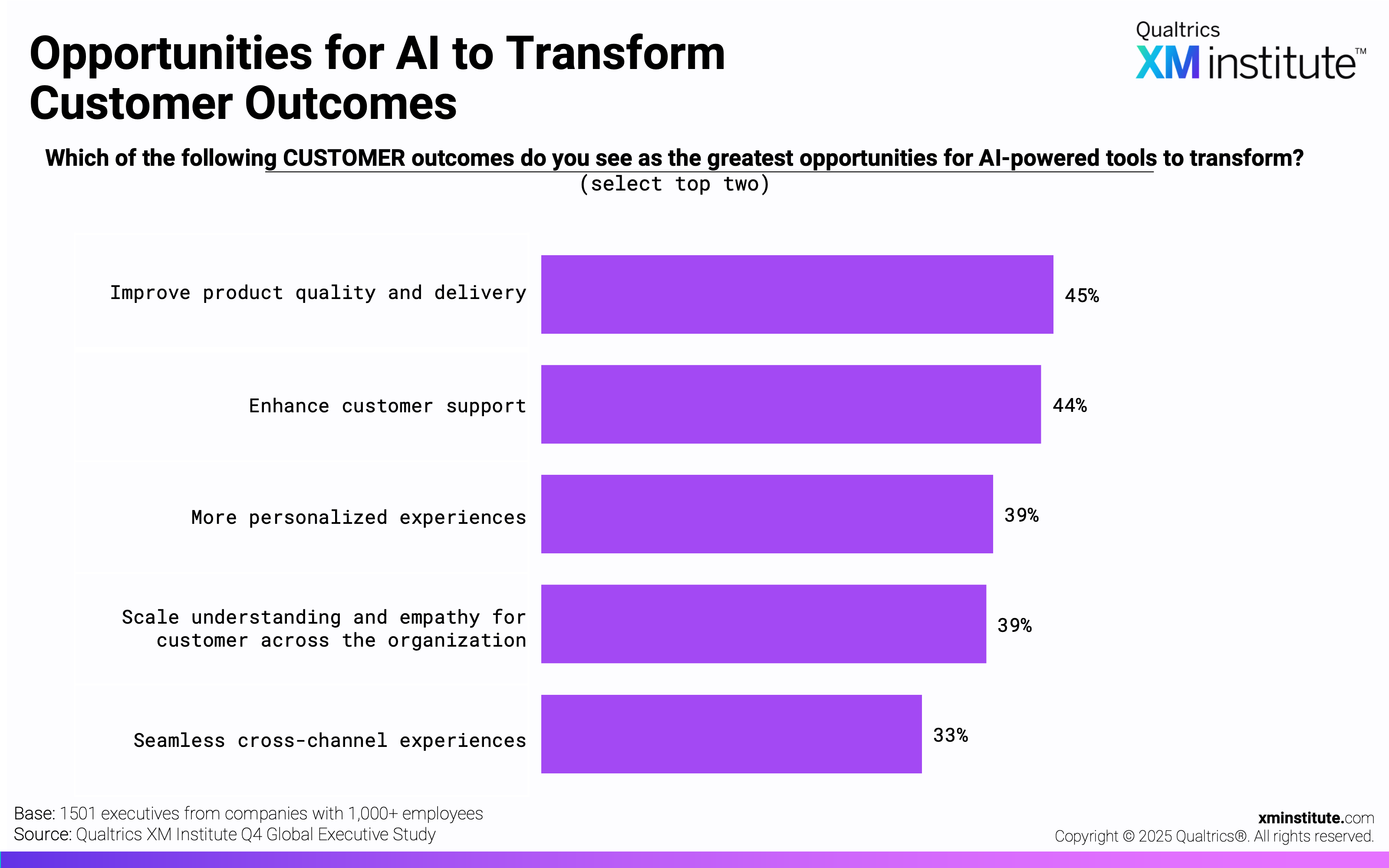

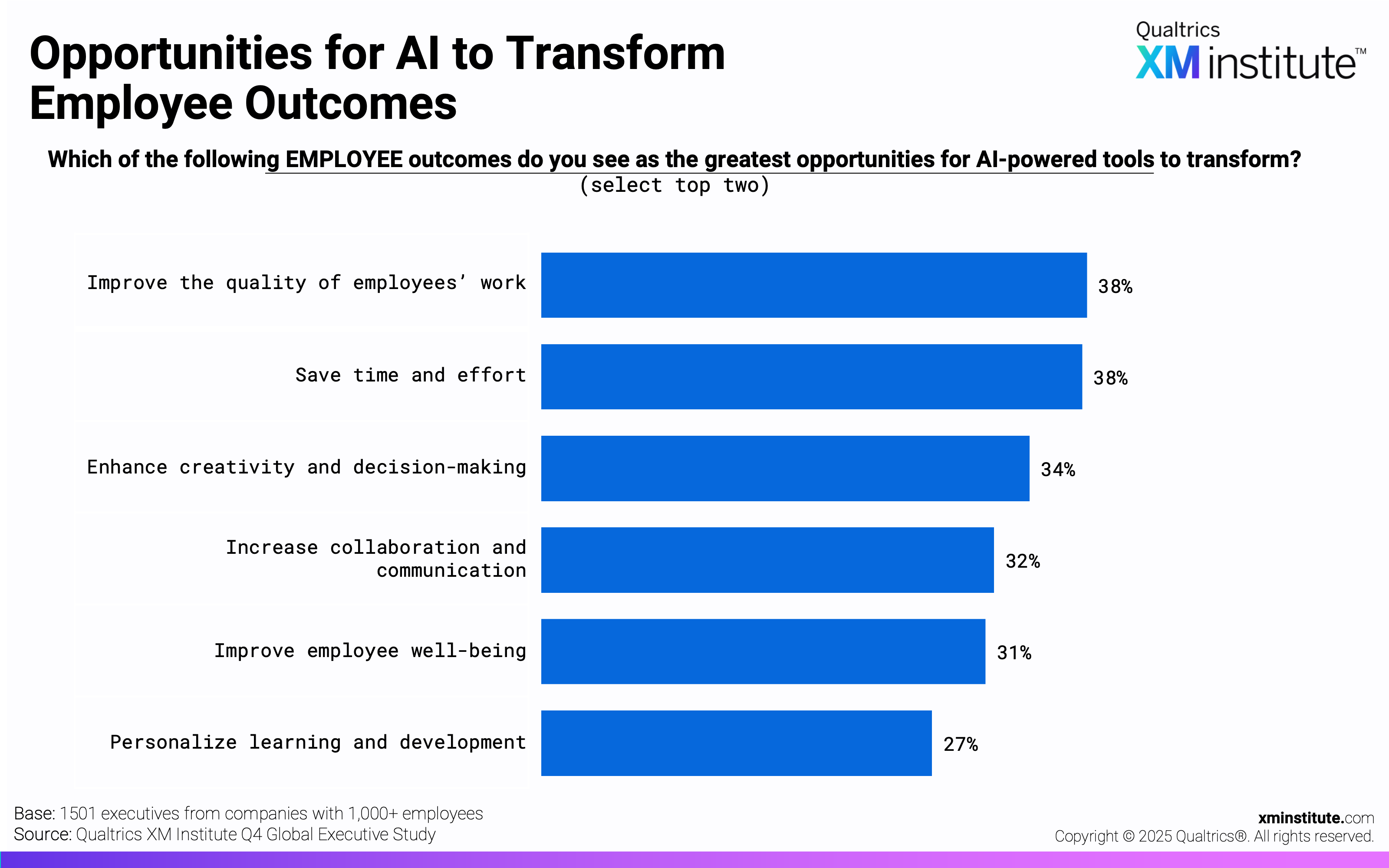

- Market leaders see AI’s transformative potential. Compared to their peers at organizations holding market share, executives at organizations gaining market share (“market leaders”) are twice as likely to say that AI will completely change CX. These leaders expect AI to primarily transform product quality and delivery for customers and quality of work for employees. However, just 15% aim to lead the change AI will bring to their business landscape.

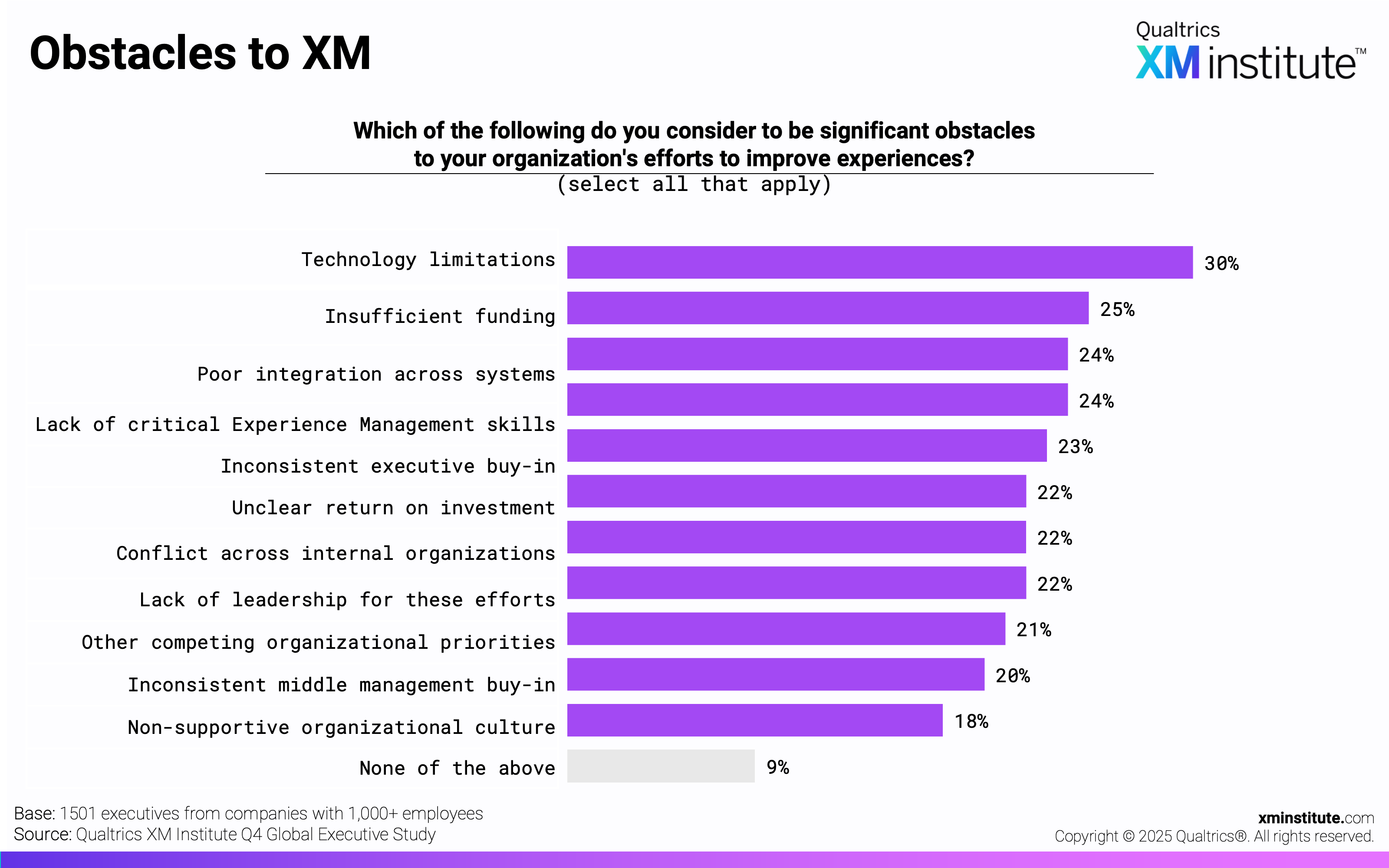

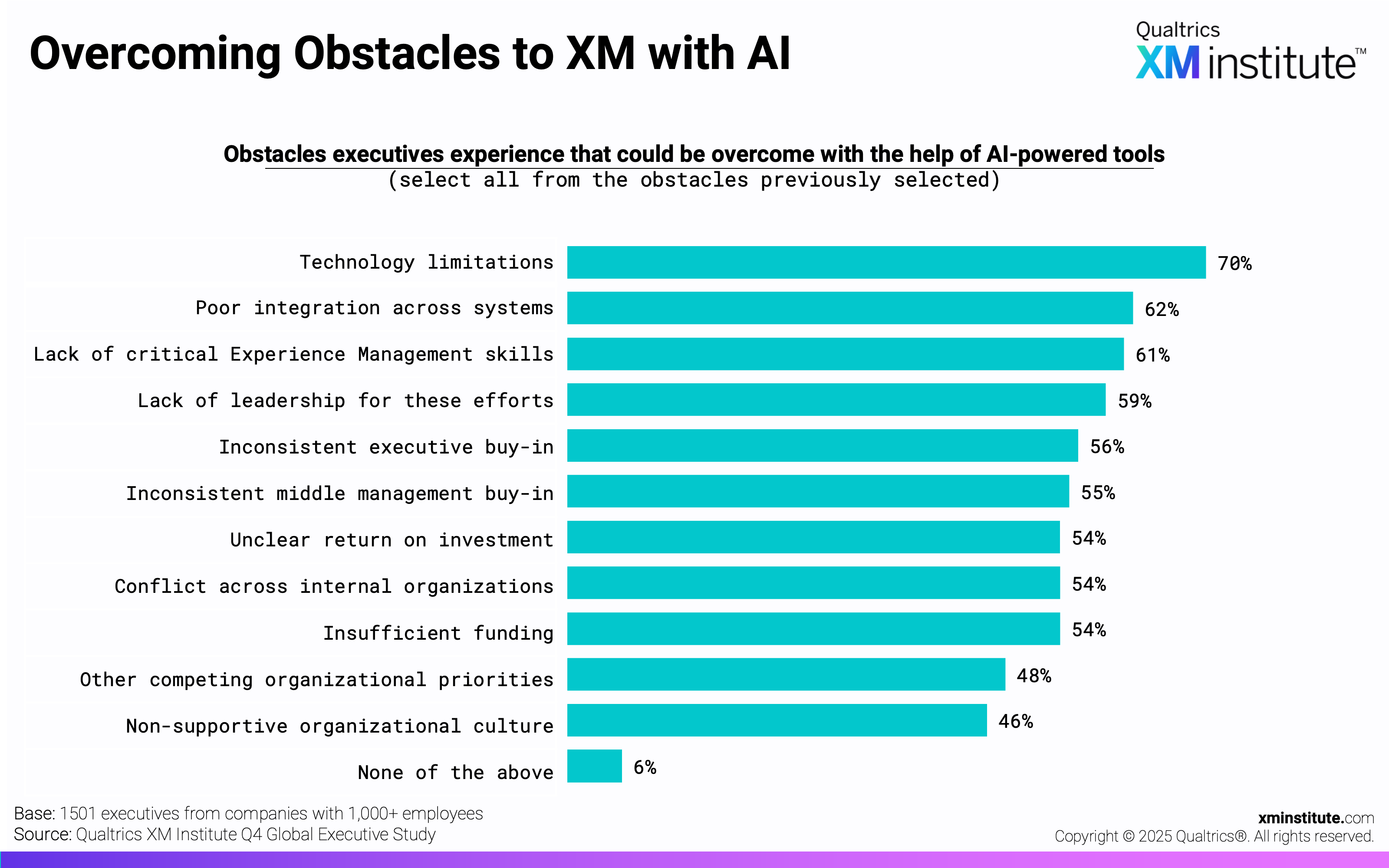

- AI is expected to help overcome XM obstacles. Executives most frequently cited technology limitations as an obstacle to improving experiences (30%); however, a majority of them (70%) believe AI-powered tools could help overcome these constraints. Similarly, executives experiencing poor integration across systems (62%) and lack of critical XM skills (61%) see AI as a potential solution for these challenges as well.

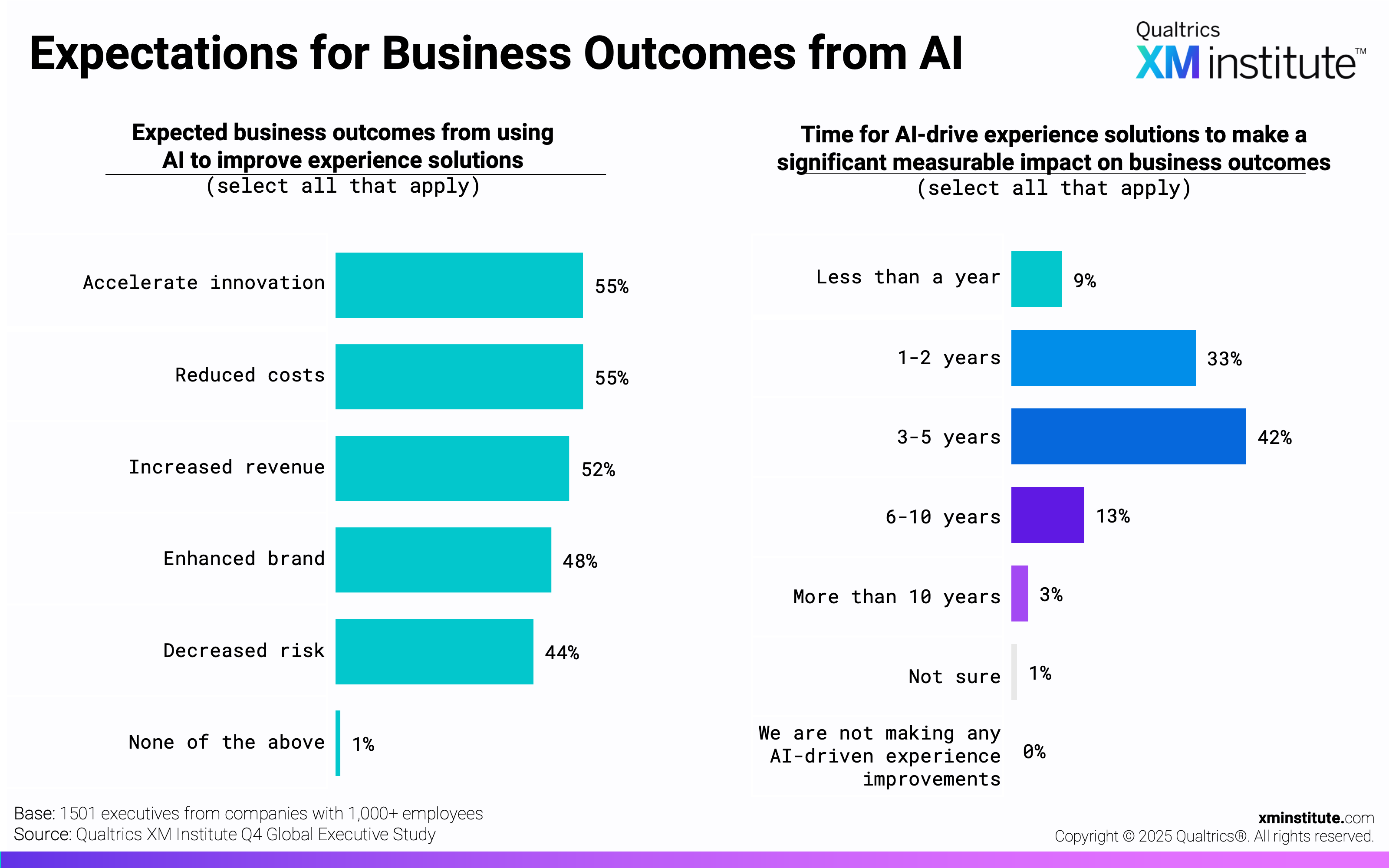

- Executives most expect to see AI accelerate innovation and reduce costs. Executives have high expectations for AI business impact, with more than half anticipating reduced costs (55%) and accelerated innovation (55%) through AI-powered experience solutions. However, they don’t expect these outcomes to materialize immediately. Most executives (58%) expect it to take a minimum of 3 years to see significant measurable results from AI implementation.

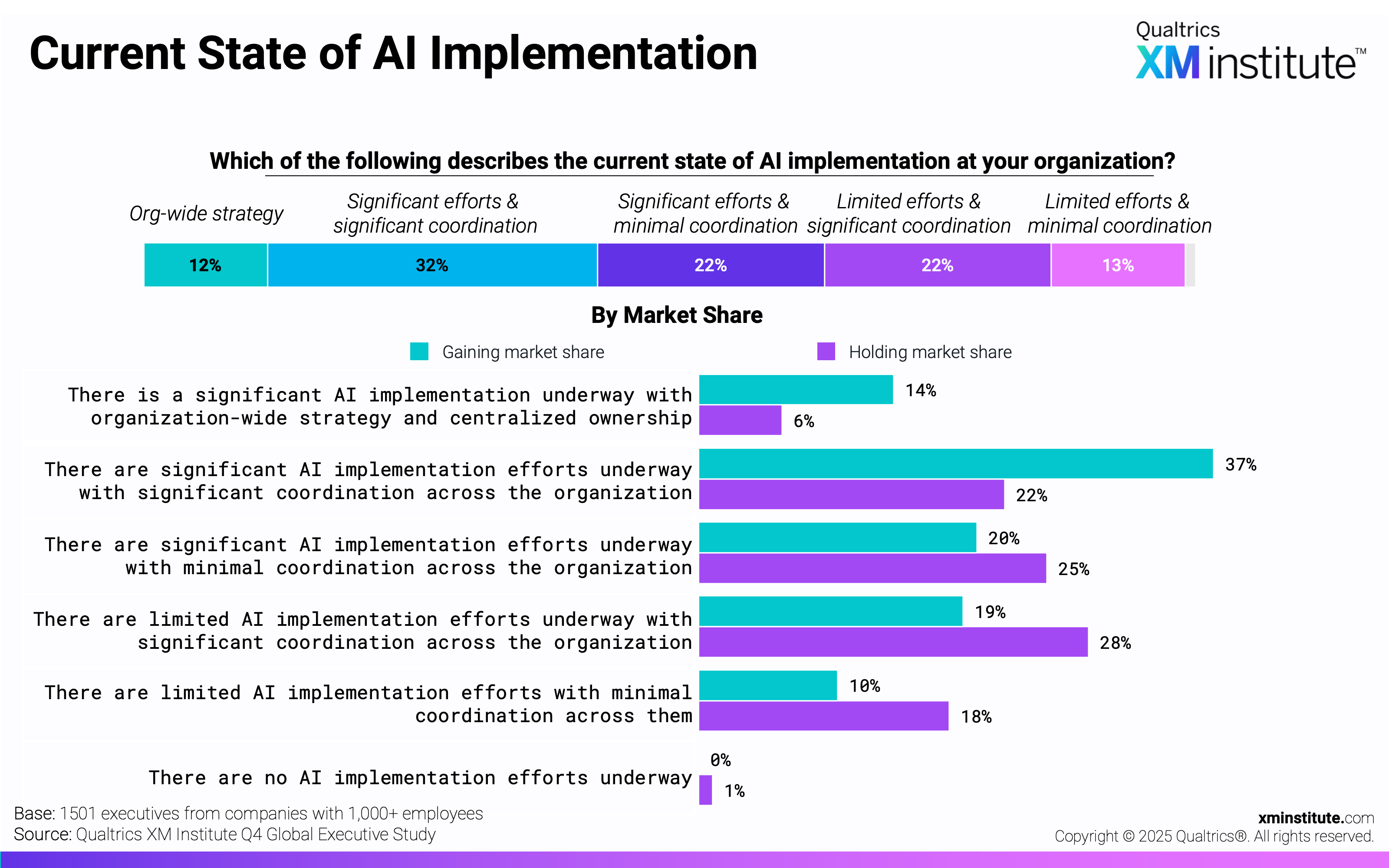

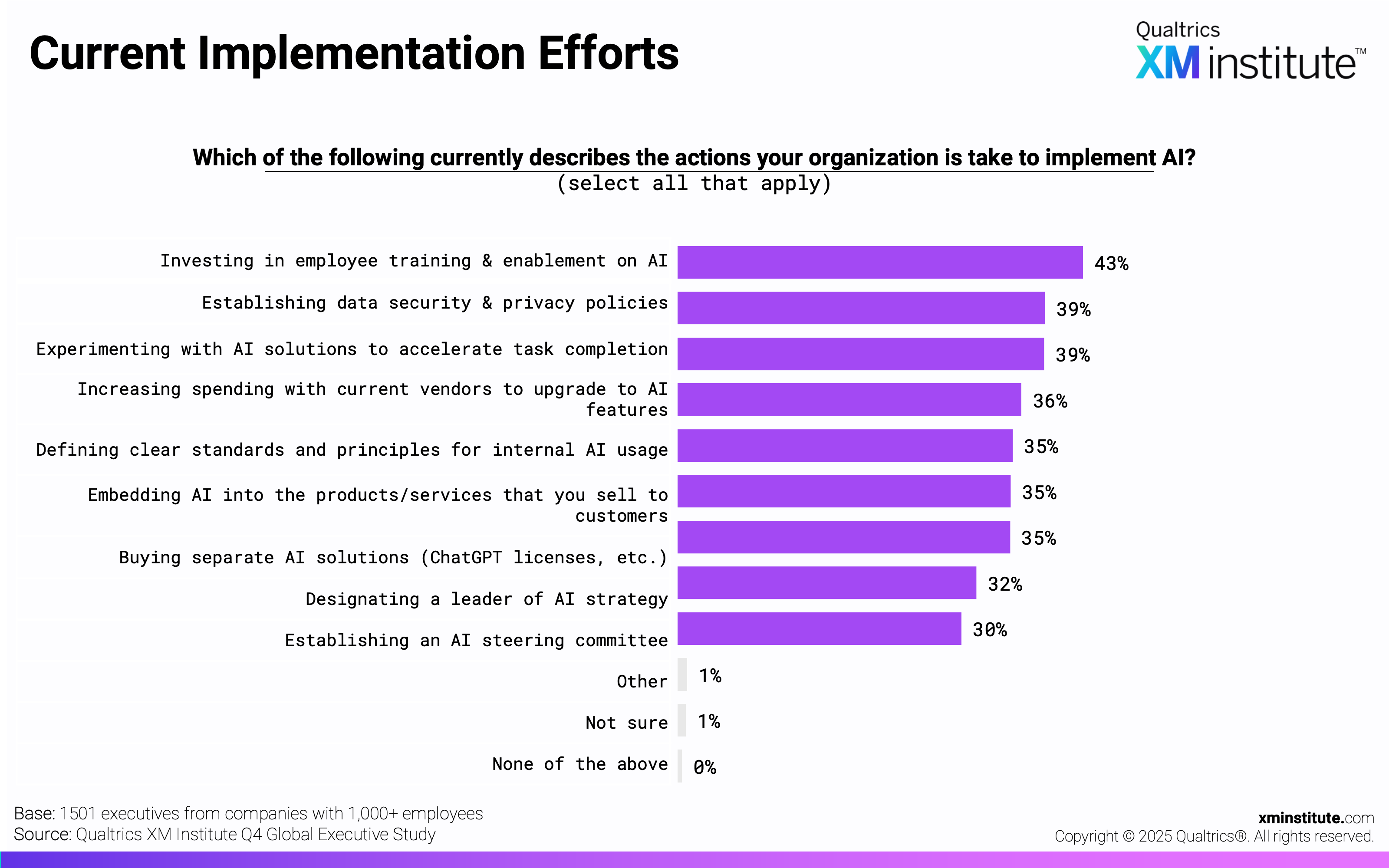

- Almost all companies are making efforts to implement AI. Sixty-six percent of executives consider the current state of their AI implementation efforts to be significant, while just 1% have no efforts underway. Of AI efforts underway, employee training and enablement is the most common activity (43%), followed by establishing data security & privacy policies and experimenting with AI solutions (39% each).

Figures

Here are the figures in this Data Snapshot:

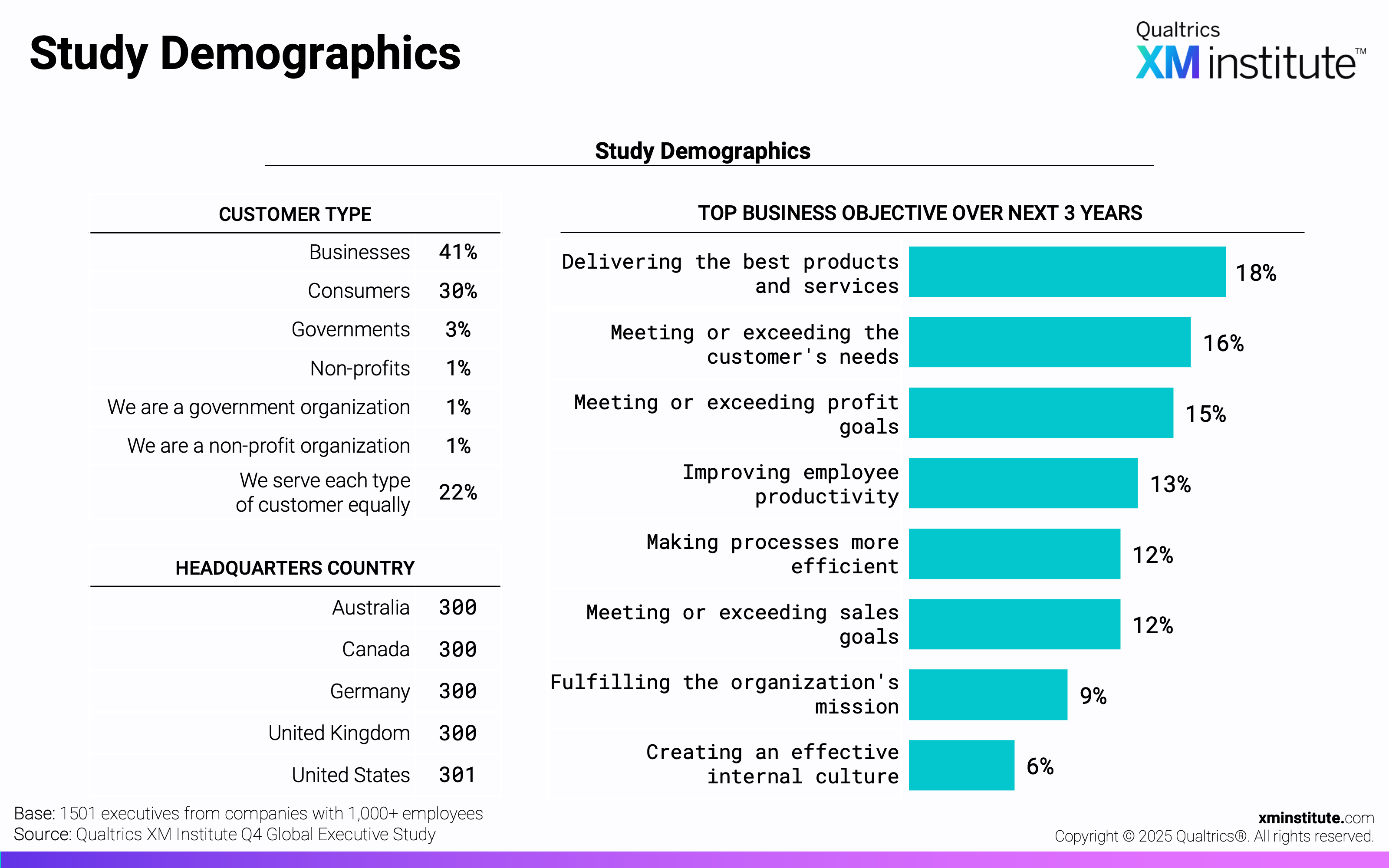

- Study Demographics (see Figure 1)

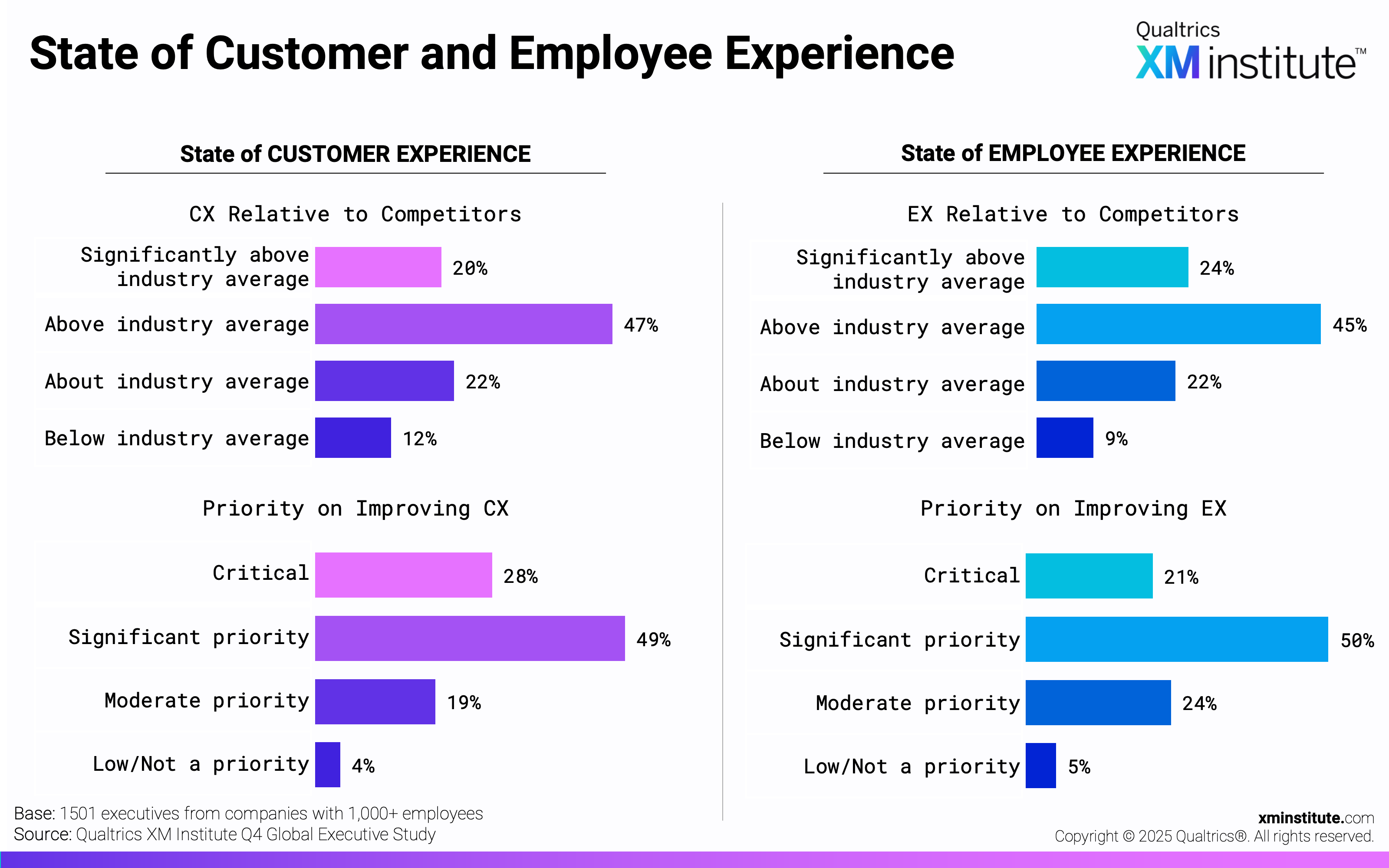

- State of Customer and Employee Experience (see Figure 2)

- Spend on Customer and Employee Experience (see Figure 3)

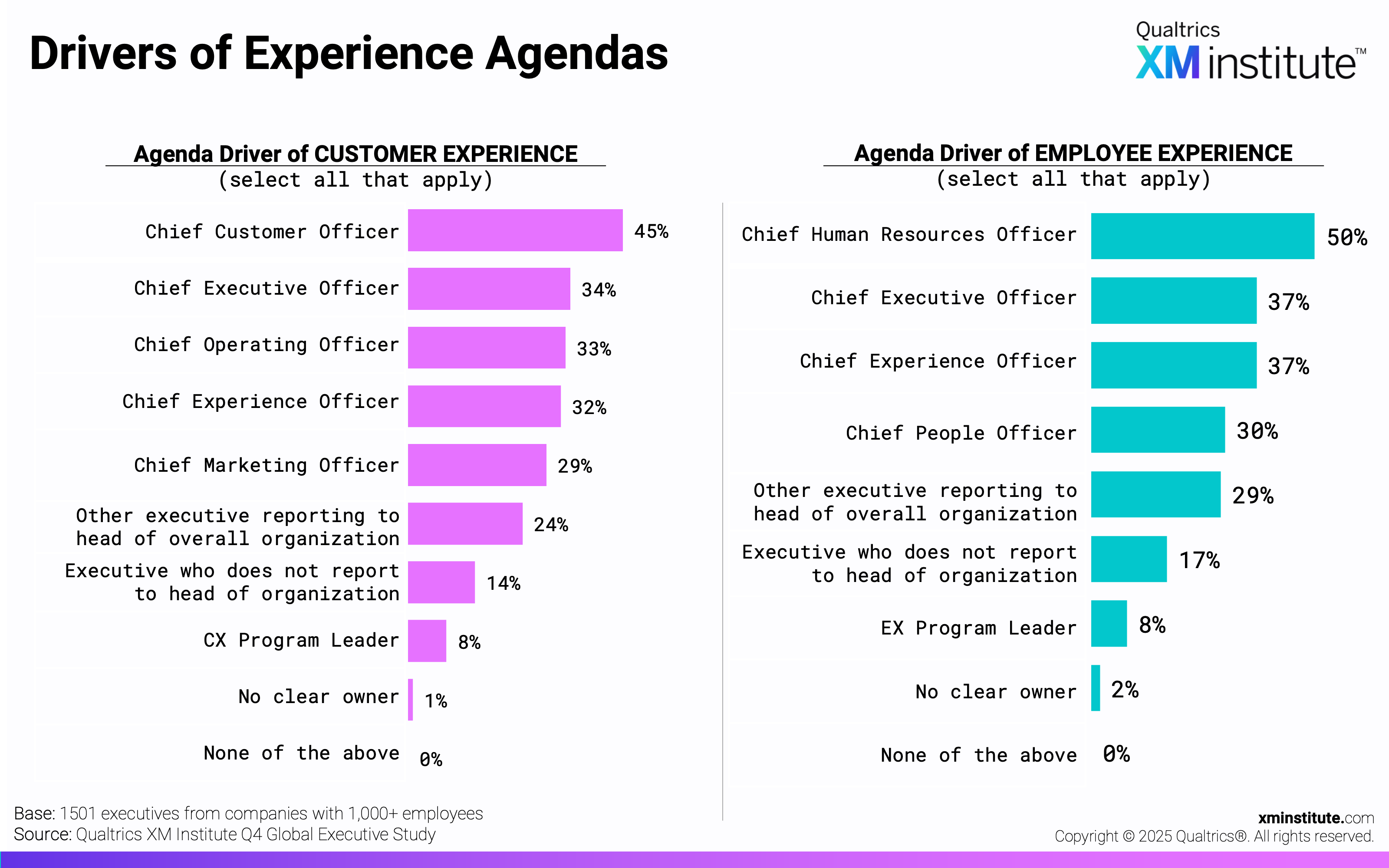

- Drivers of Experience Agendas (see Figure 4)

- Priority on Experience Improvement and Drivers (see Figure 5)

- Priority on Experience Improvement and Drivers by Market Share (see Figure 6)

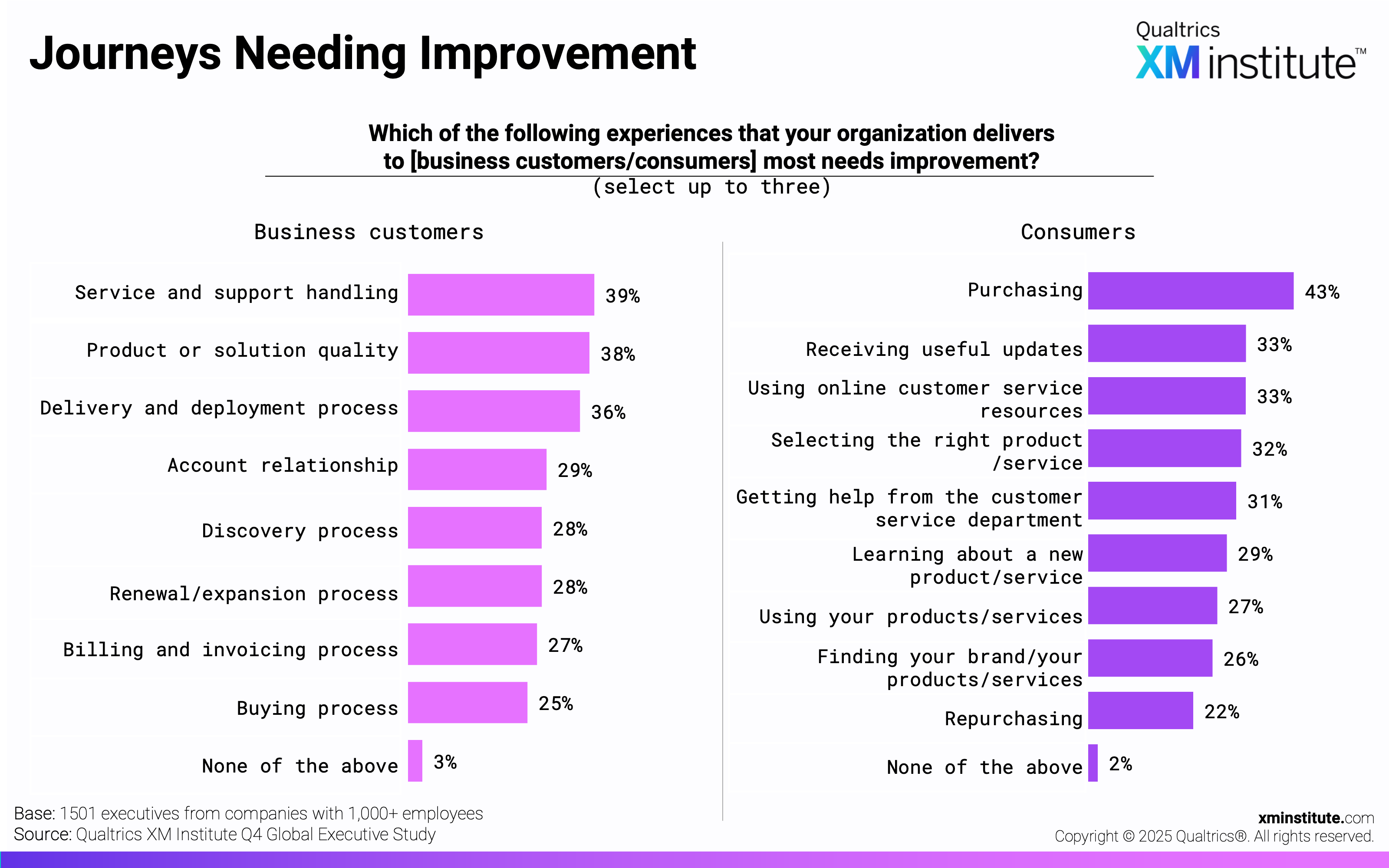

- Journeys Needing Improvement (see Figure 7)

- Obstacles to Experience Management (see Figure 8)

- Overcoming Obstacles to XM with AI (see Figure 9)

- Expected Industry Changes due to AI (see Figure 10)

- Expected Changes to CX due to AI by Market Share (see Figure 11)

- Executive Ambition Toward AI (see Figure 12)

- Using AI in Business Objectives (see Figure 13)

- Expectations for Business Outcomes from AI (see Figure 14)

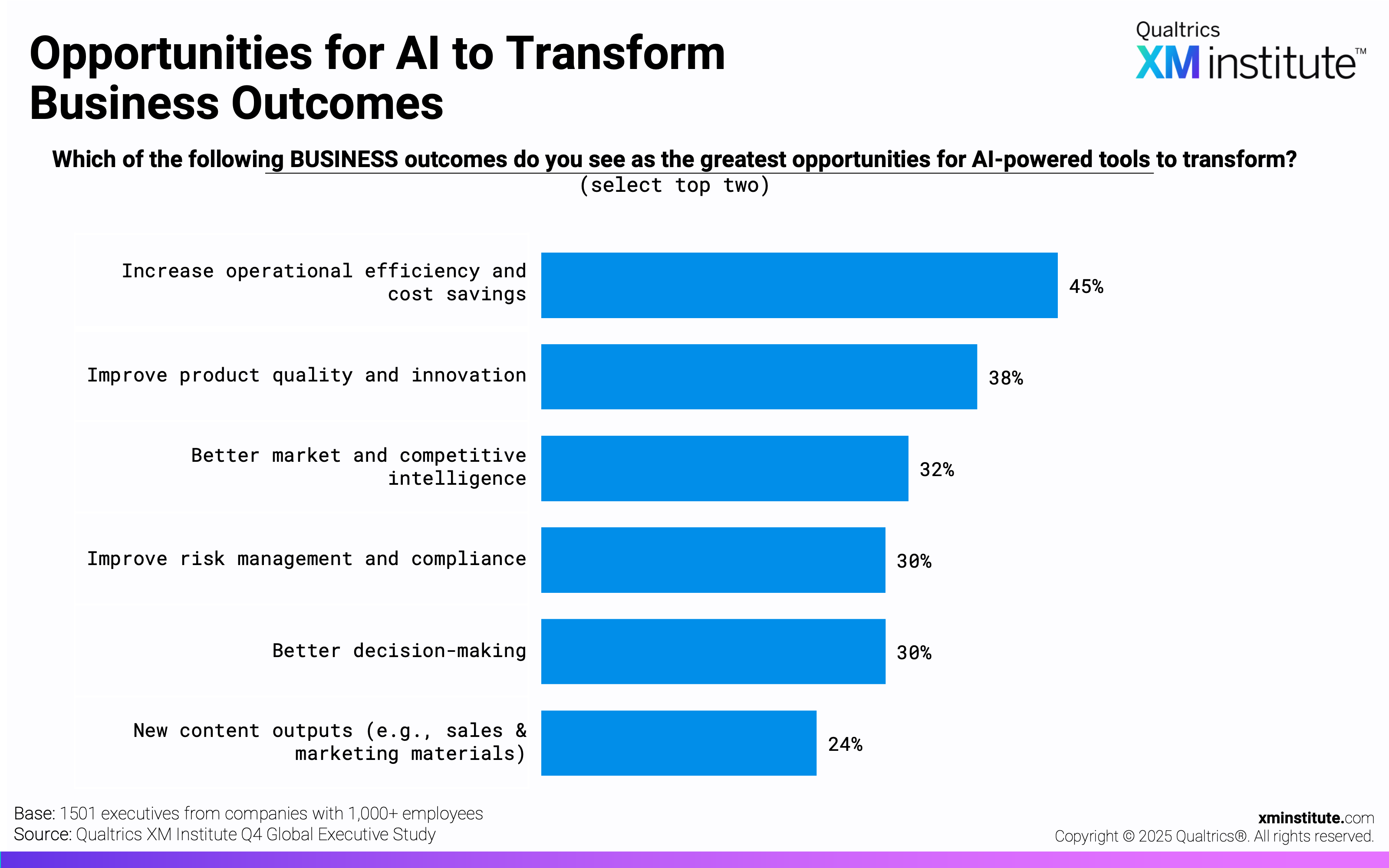

- Opportunities for AI to Transform Business Outcomes (see Figure 15)

- Opportunities for AI to Transform Customer Outcomes (see Figure 16)

- Opportunities for AI to Transform Employee Outcomes (see Figure 17)

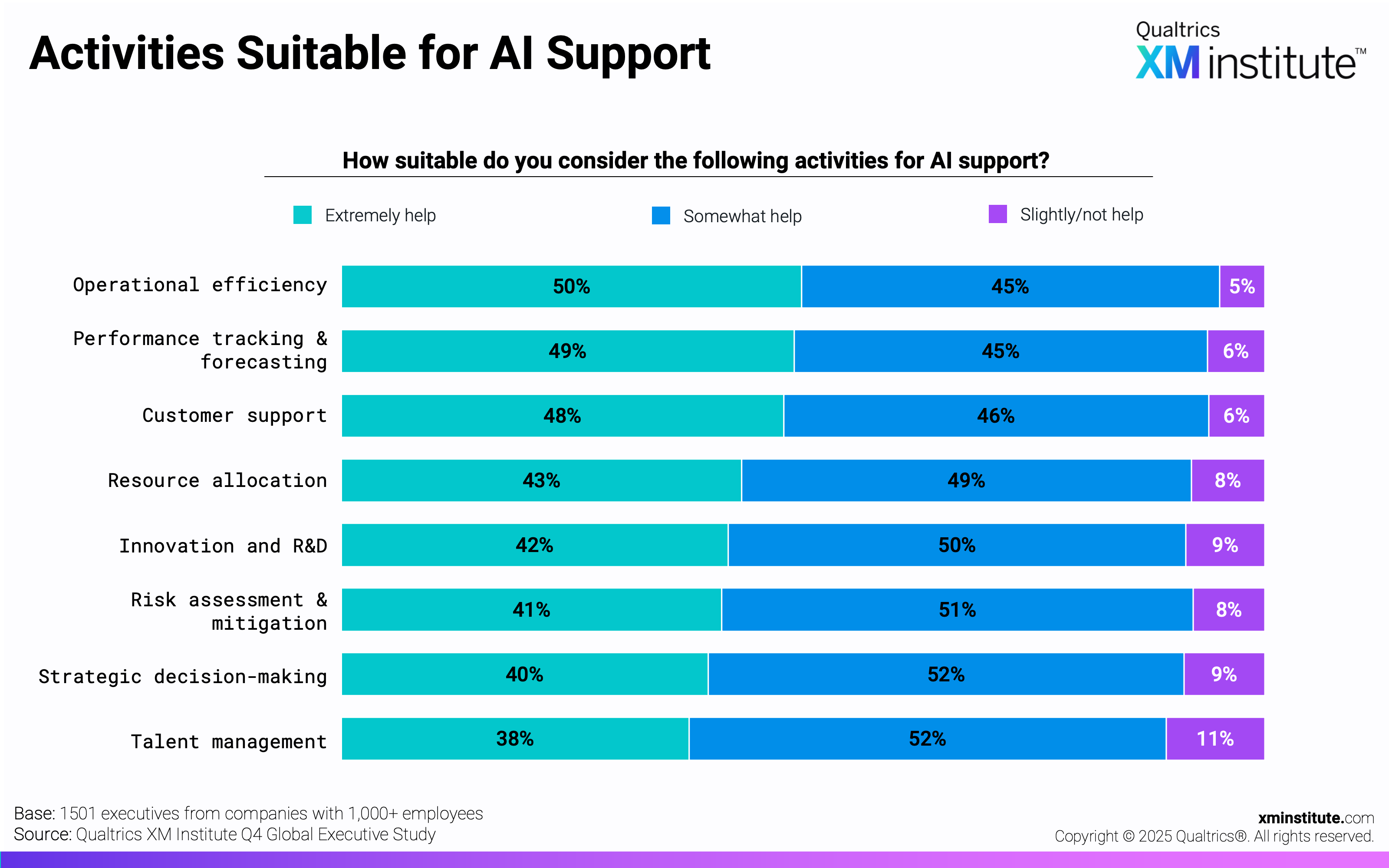

- Activities Suitable for AI Support (see Figure 18)

- Current State of AI Implementation (see Figure 19)

- Current Implementation Efforts (see Figure 20)

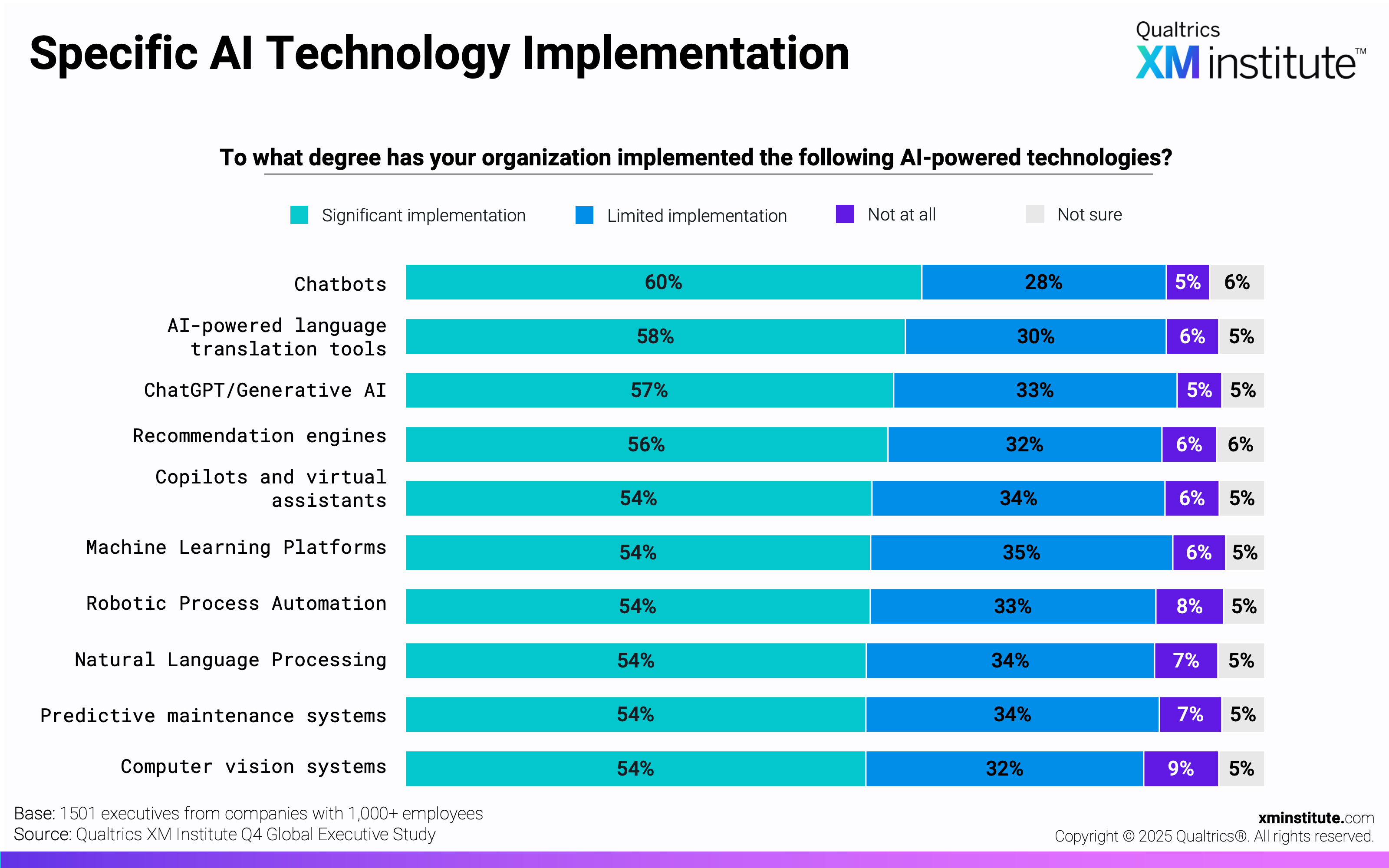

- Specific AI Technology Implementation (see Figure 21)

- Methodology (see Figure 22)