Key Findings

This study examined consumers’ poor experiences and associated spending changes across 17 industries and 18 countries. Key highlights include:

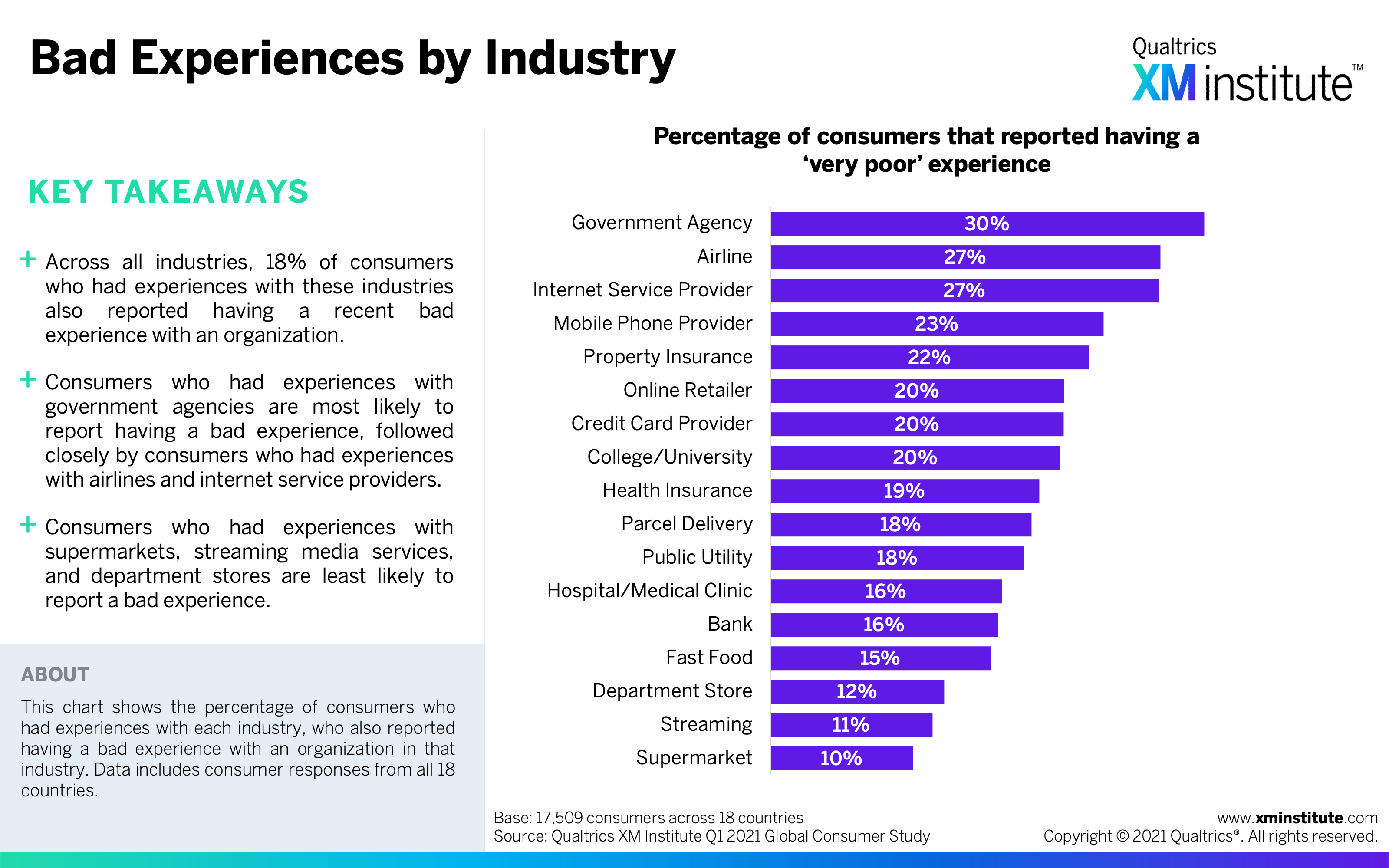

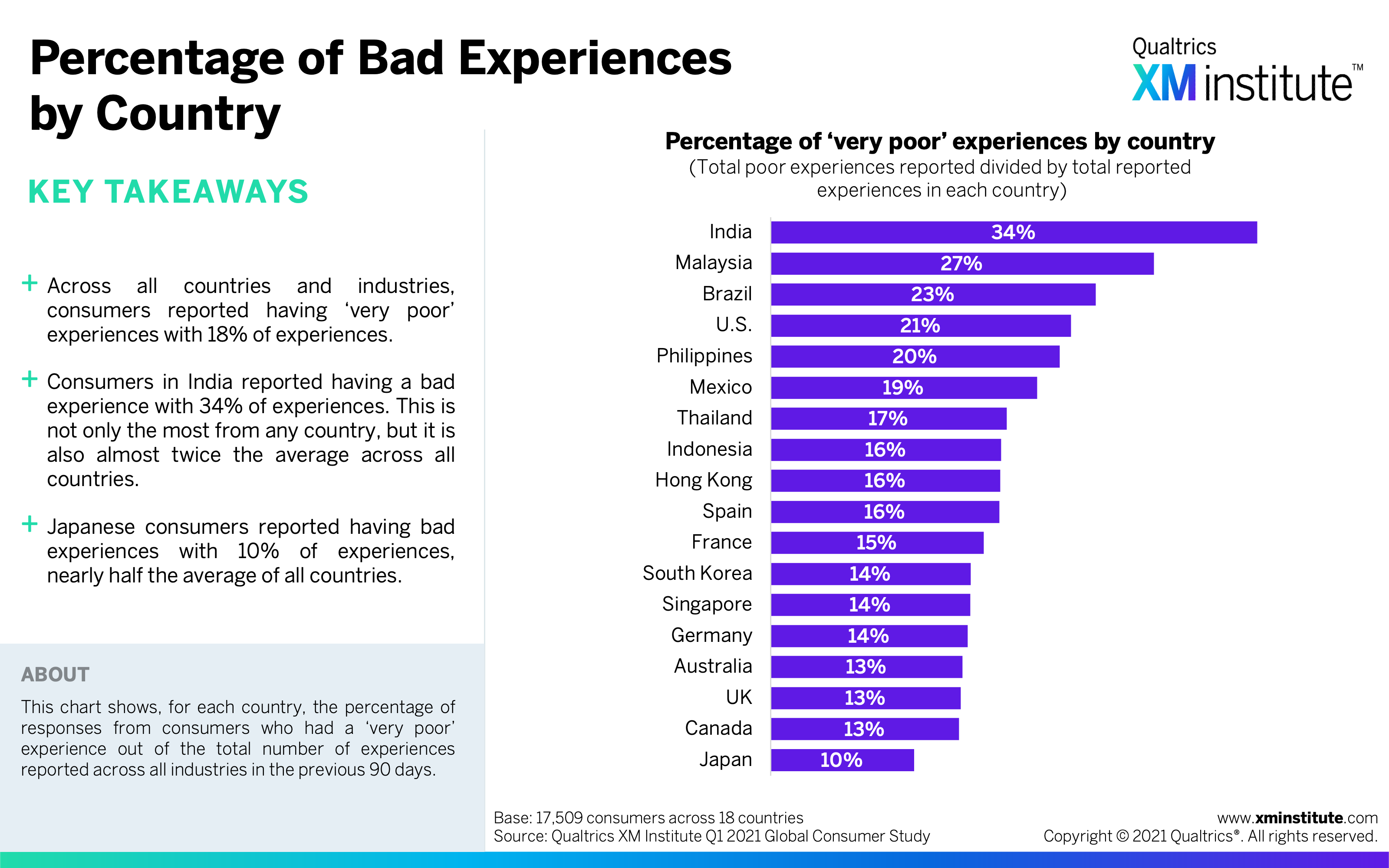

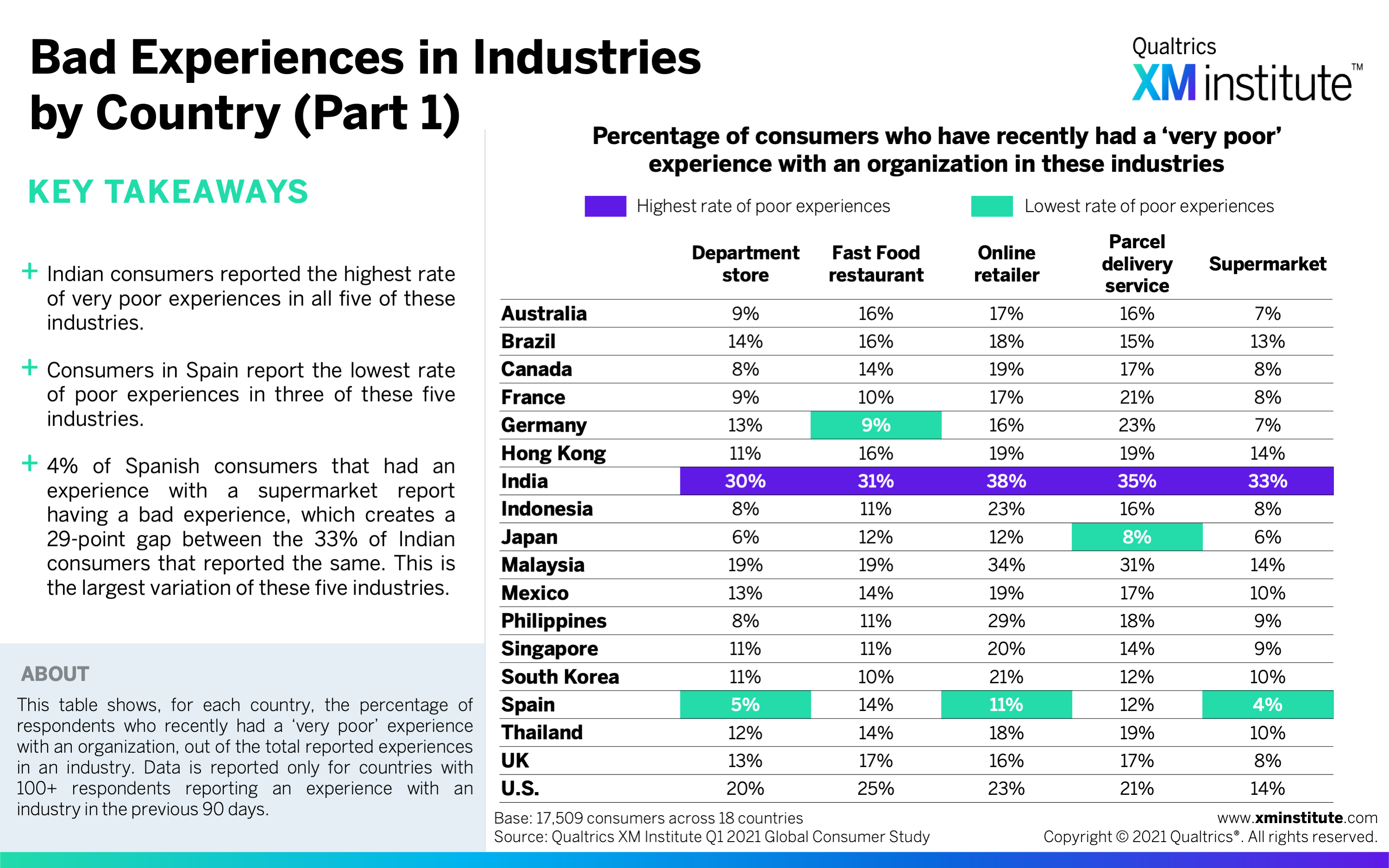

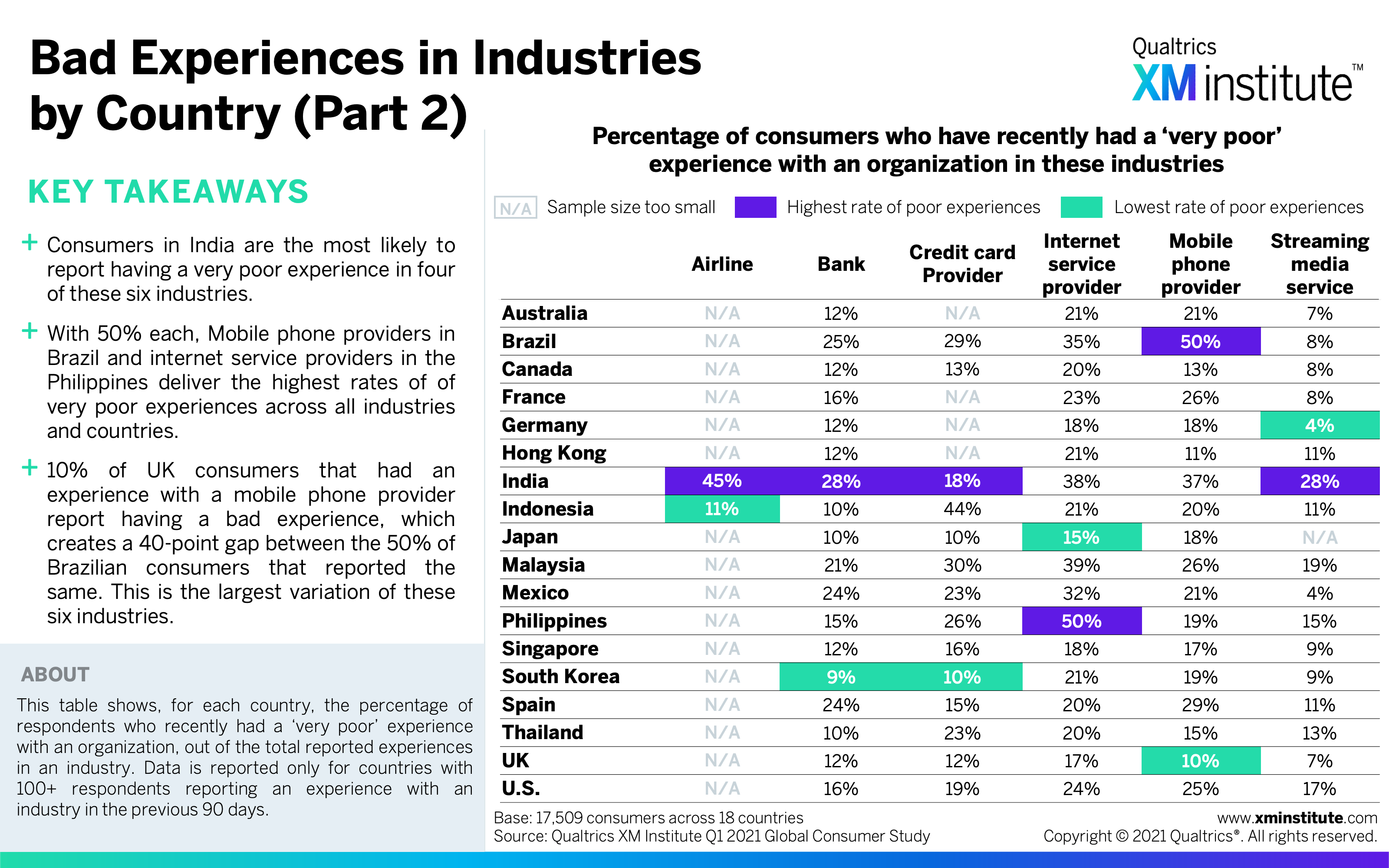

- Organizations disappoint in nearly 1 in 5 experiences. On average, consumers report having a bad experience with 18% of experiences, ranging from a high of 34% in India down to a low of 10% in Japan. Mobile phone providers in Brazil and internet service providers in the Philippines produce the highest rates of very poor experiences; fifty percent of people that had experiences in these industries reported having a bad experience.

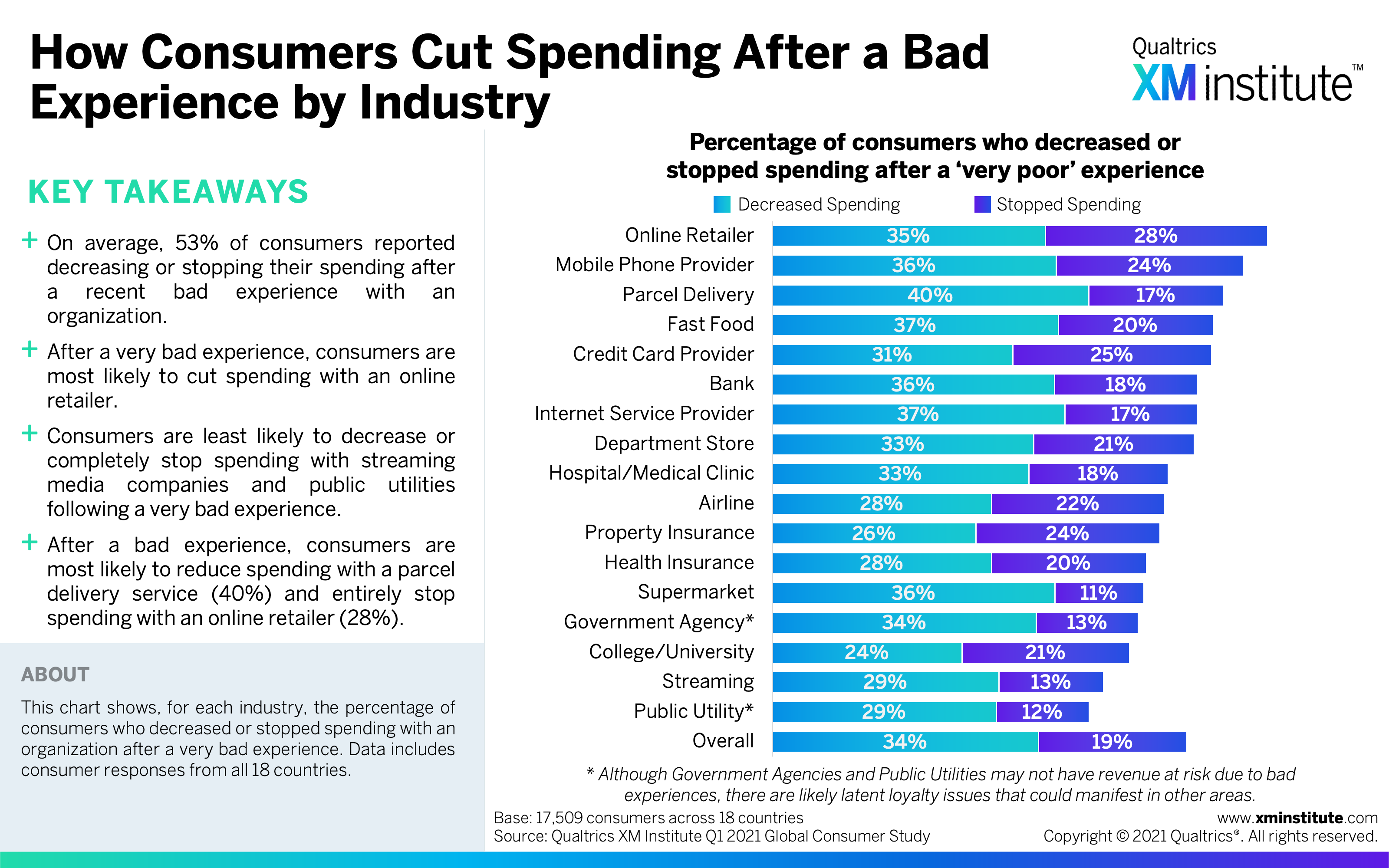

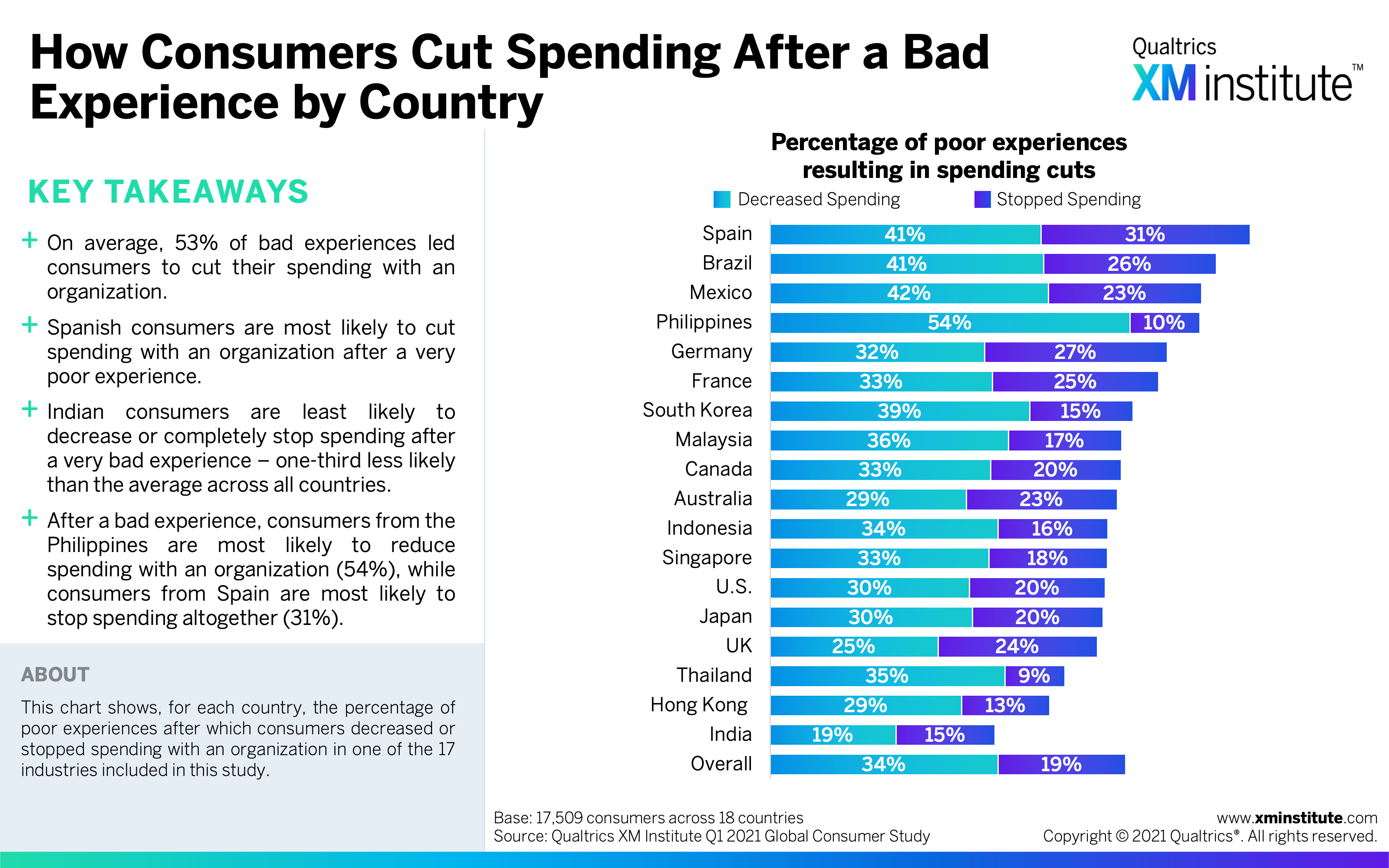

- Consumers cut spending after bad experiences. Across all industries and countries, slightly more than half of consumers said they either decreased or stopped spending with an organization after a recent bad experience. Spanish customers are the most likely to reduce or stop spending after a very poor experience, while Indian customers are the least likely.

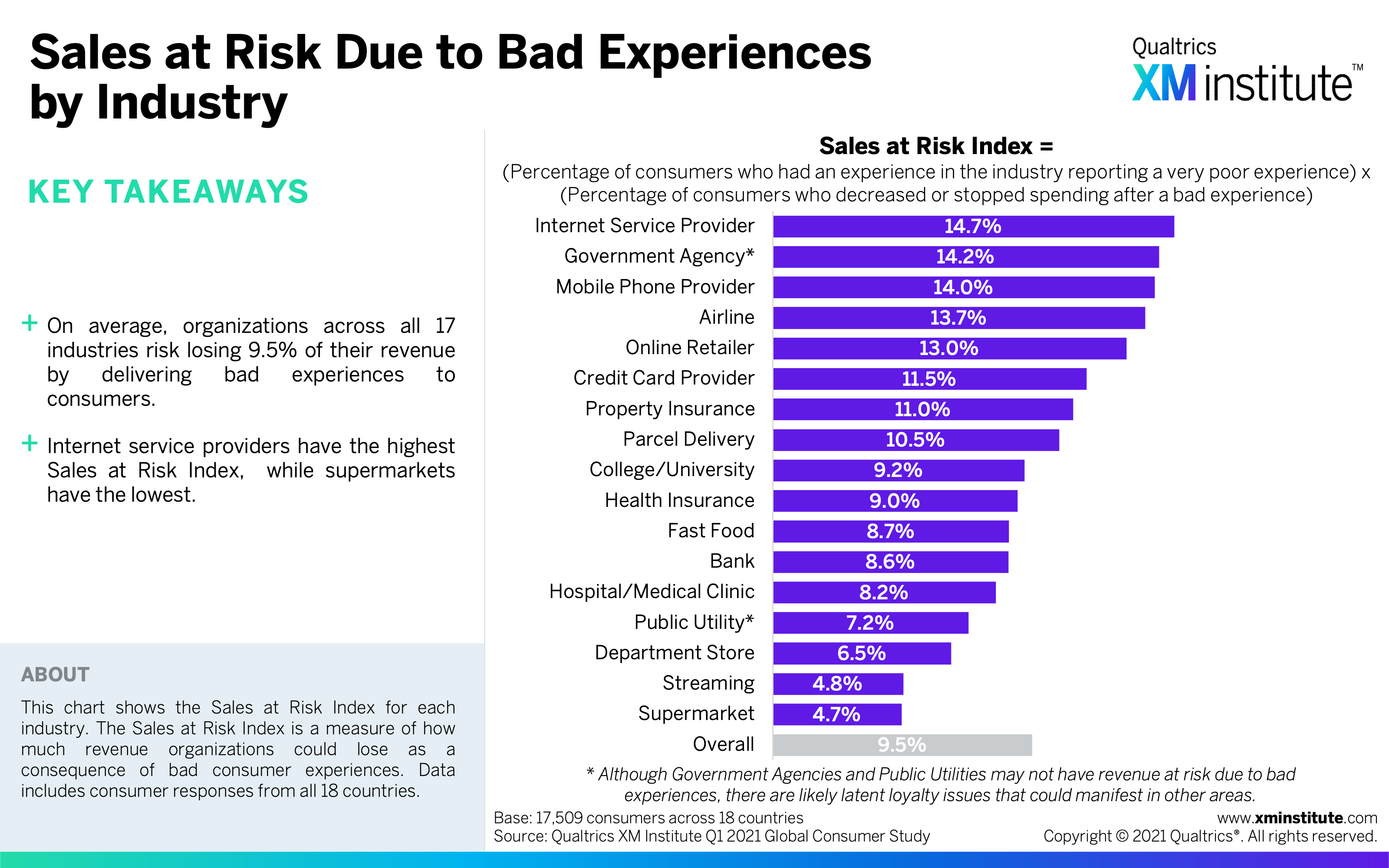

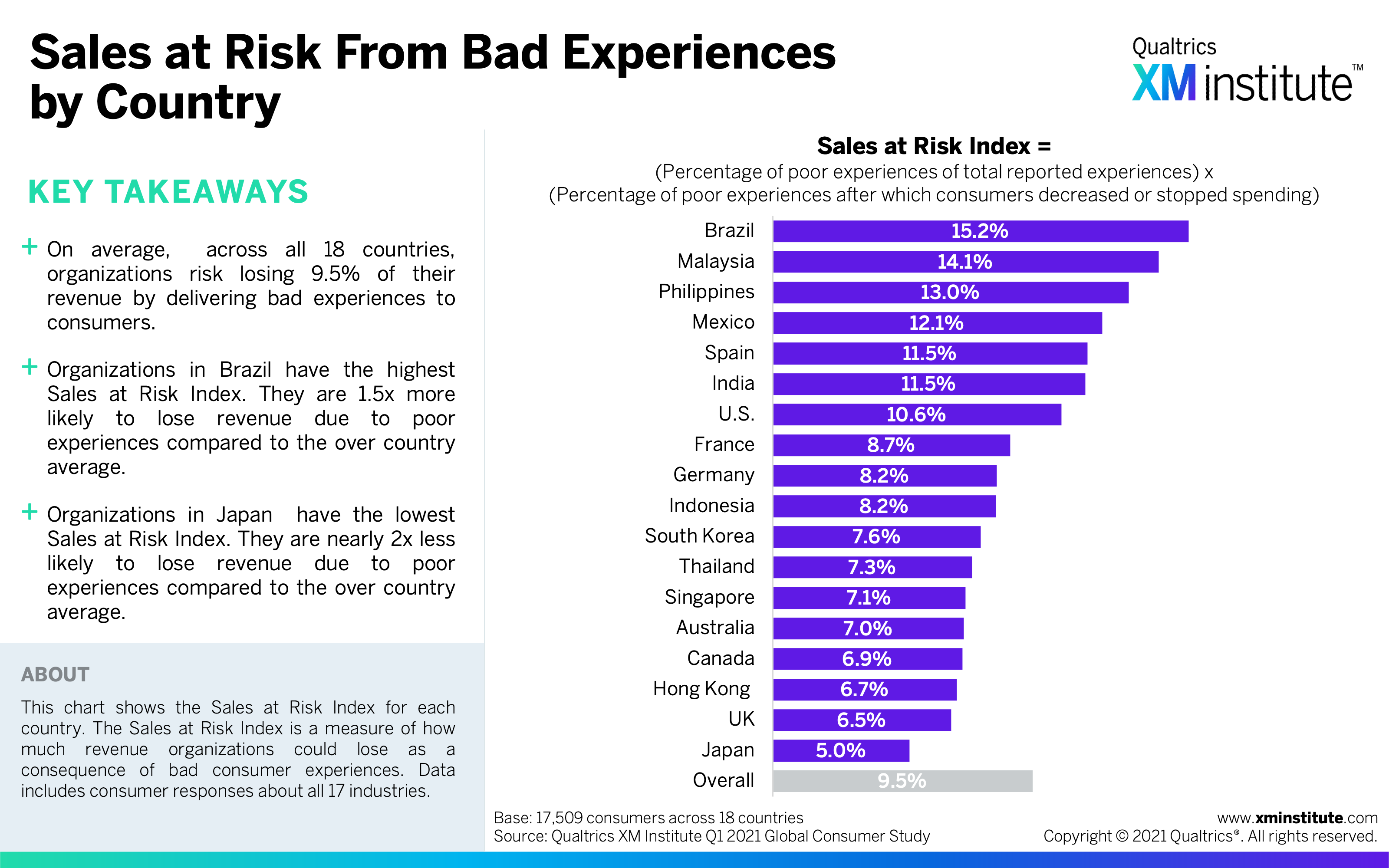

- Bad experiences put sales at risk. On average, organizations risk losing 9.5% of their revenue due to very poor experiences. Internet service providers have the highest percentage of sales at risk due to very poor experiences (14.7%), while supermarkets had the lowest (4.7%). The risk is highest for organizations in Brazil and the lowest for those in Japan.

Figures

Here are the figures for this Data Snapshot:

- Bad Experiences – by Industry (see Figure 1)

- How Consumers Cut Spending After a Bad Experience – by Industry (see Figure 2)

- Sales at Risk Due to Bad Experiences – by Industry (see Figure 3)

- Percentage of Bad Experiences – by Country (see Figure 4)

- How Consumers Cut Spending After a Bad Experience – by Country (see Figure 5)

- Sales at Risk From Bad Experiences – by Country (see Figure 6)

- Bad Experiences in Industries – by Country (Part 1) (see Figure 7)

- Bad Experiences in Industries – by Country (Part 2) (see Figure 8)

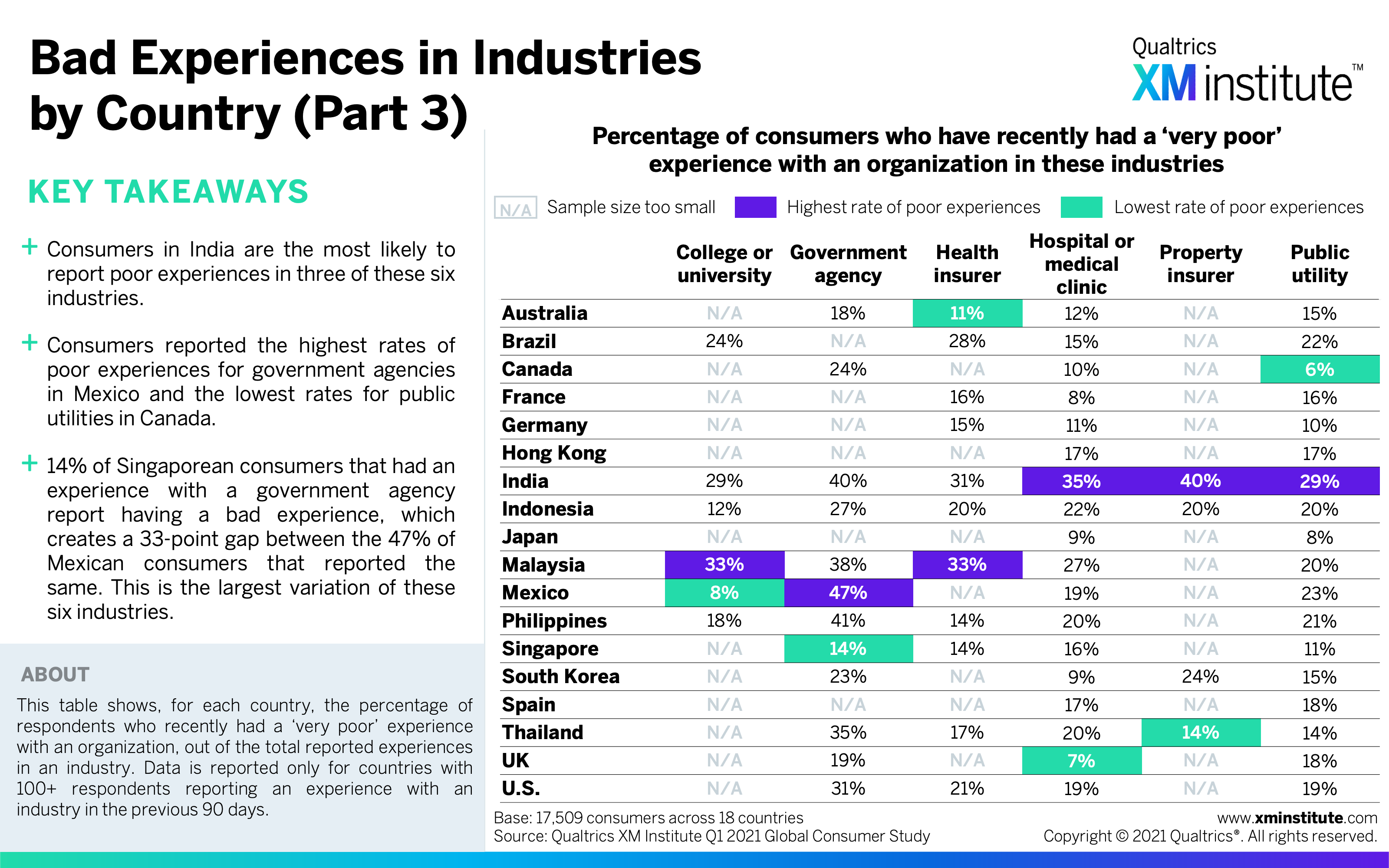

- Bad Experiences in Industries – by Country (Part 3) (see Figure 9)

- Methodology (see Figure 10)