Key Findings

As part of our latest global consumer study, consumers from 24 countries rated their recent experiences with 17 industries on a satisfaction scale of 1-5 stars and told us how likely they are to trust, recommend, and purchase more after that experience. From their responses, we examined the ROI of customer experience. Our analysis found that:

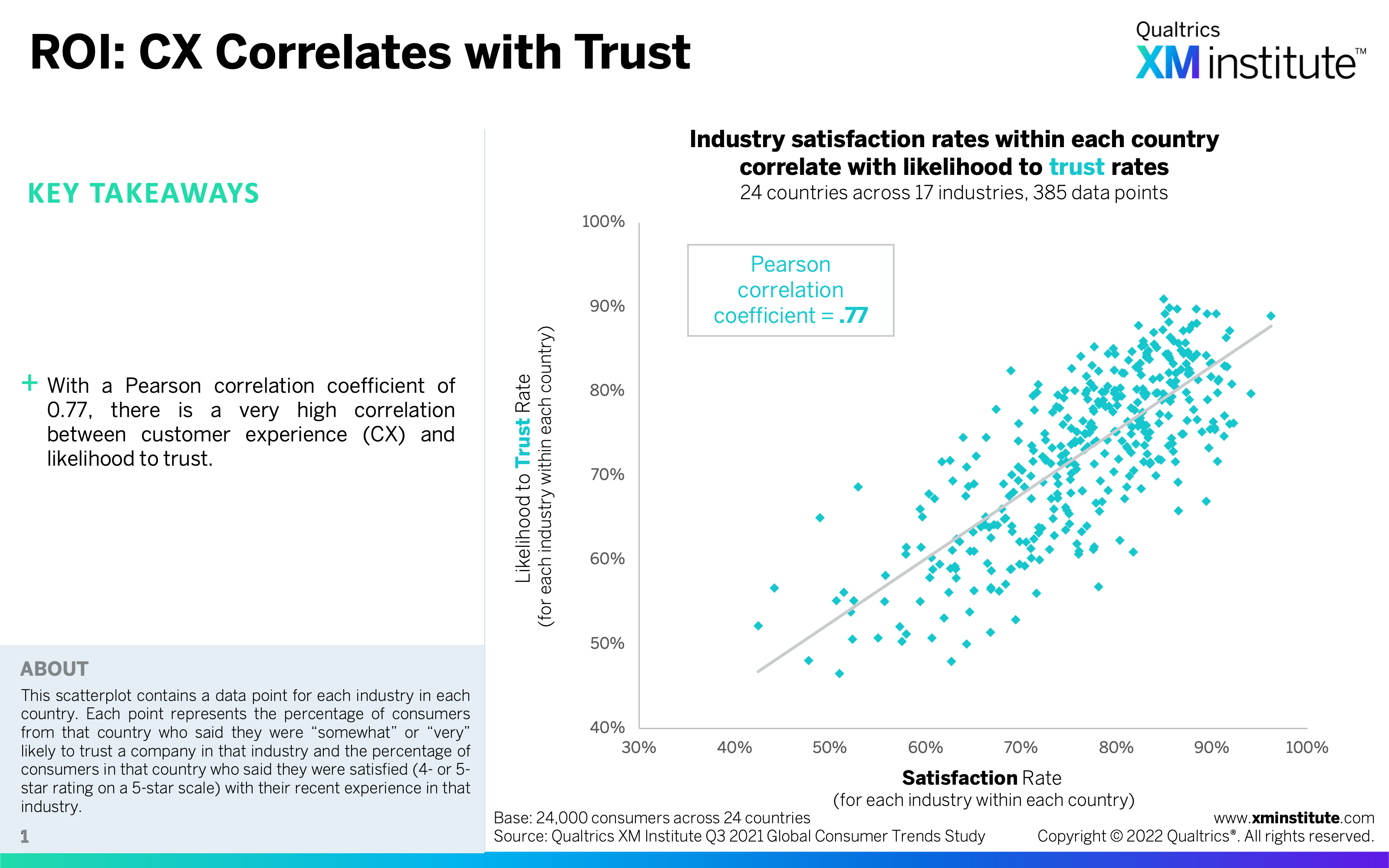

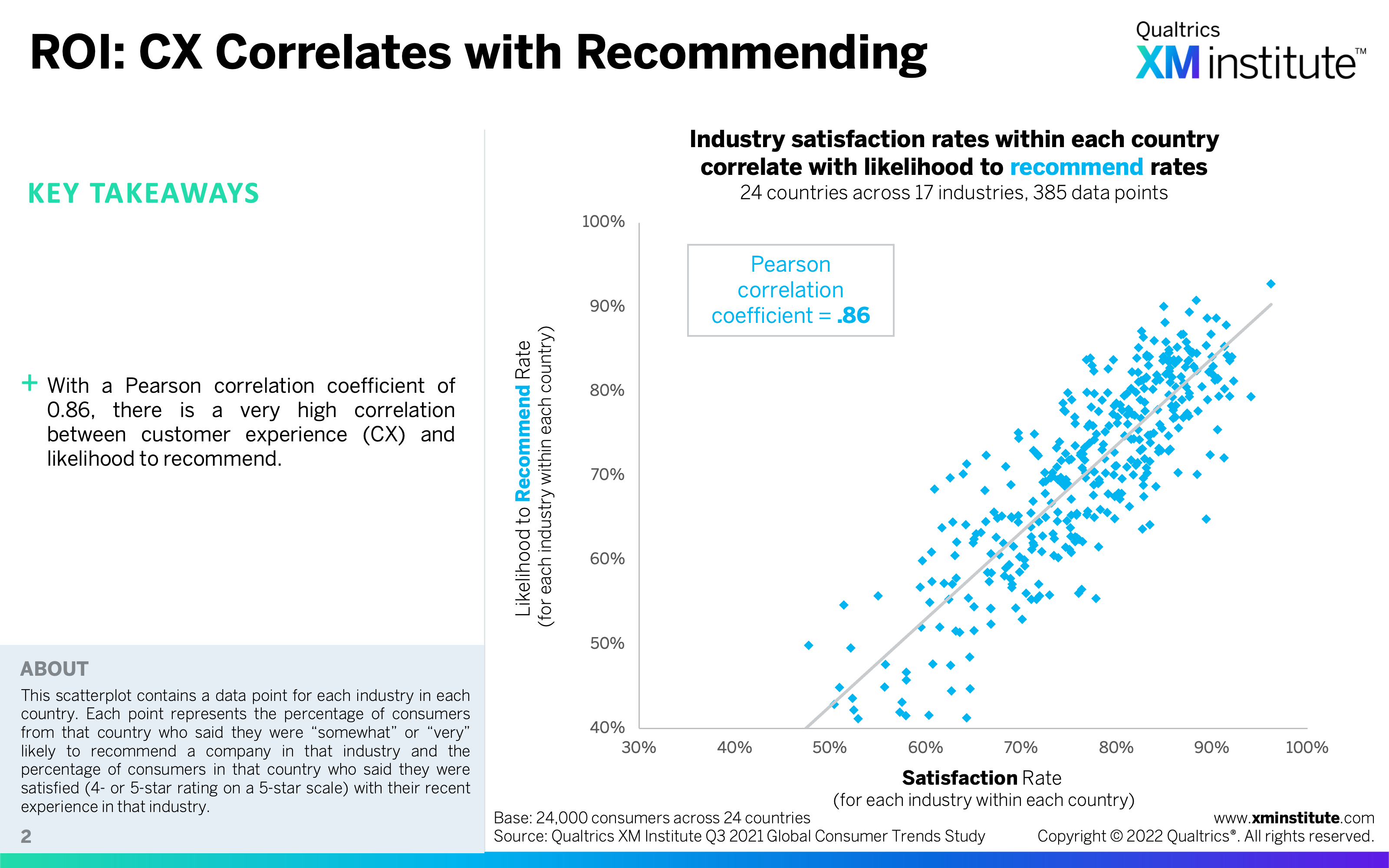

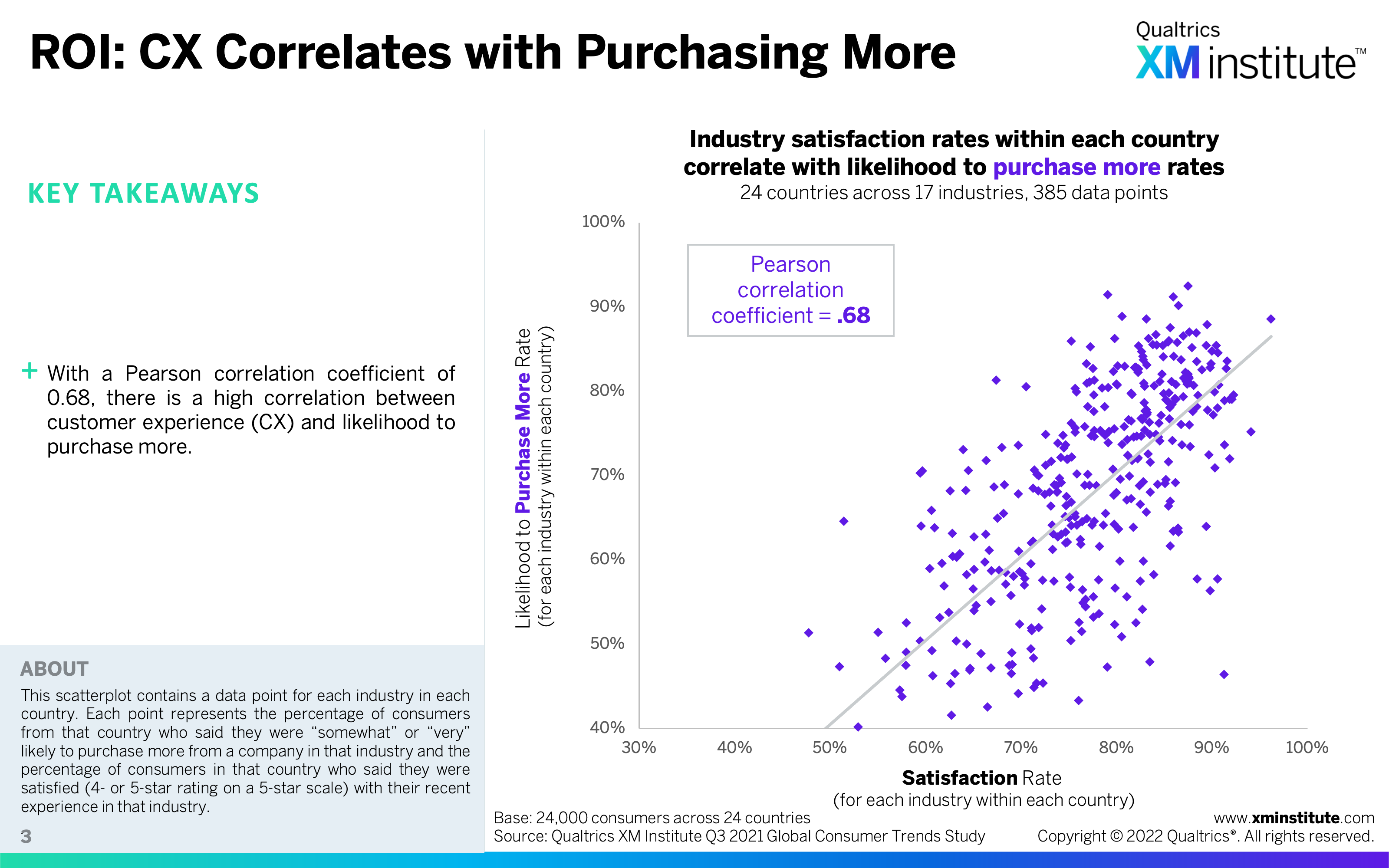

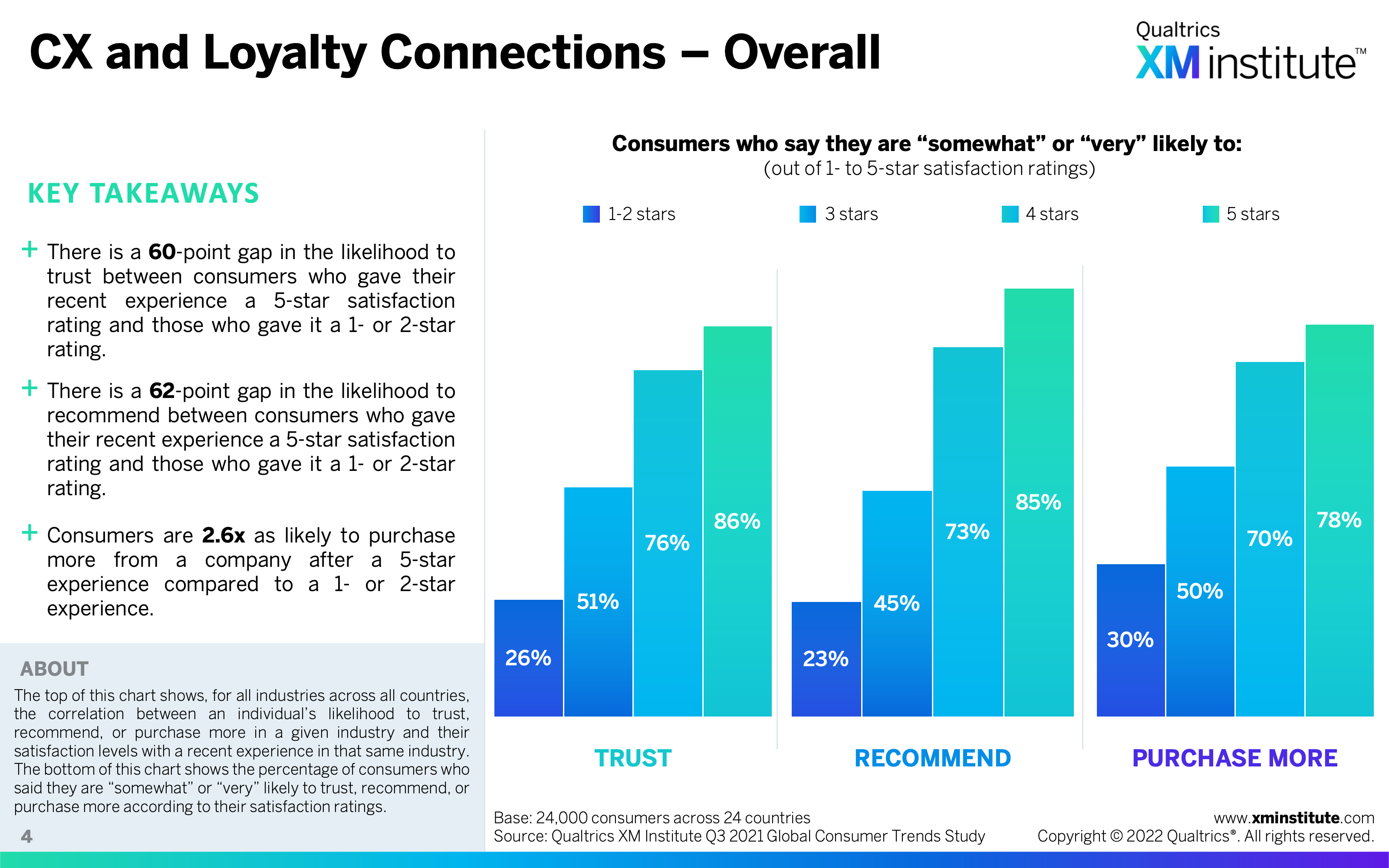

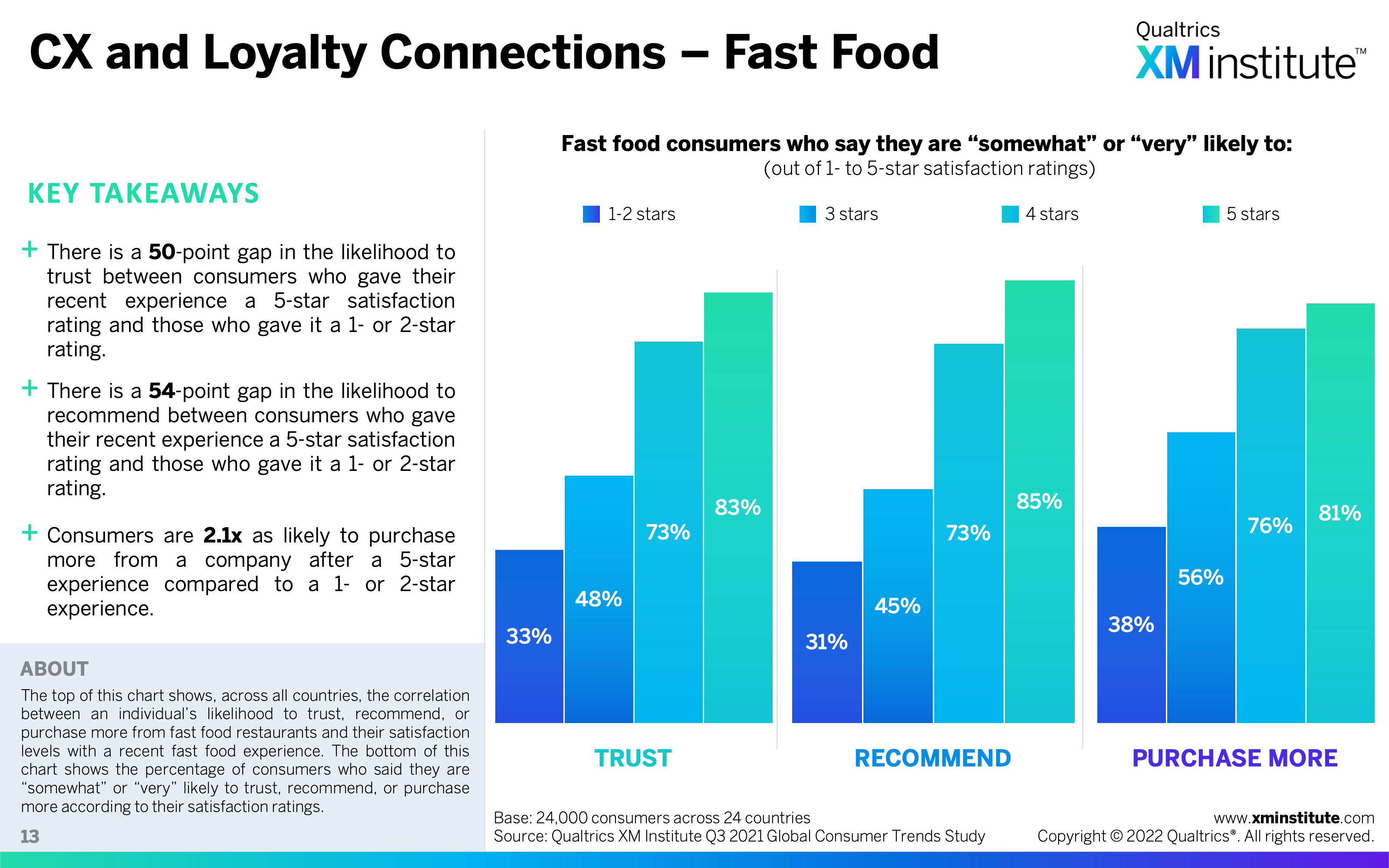

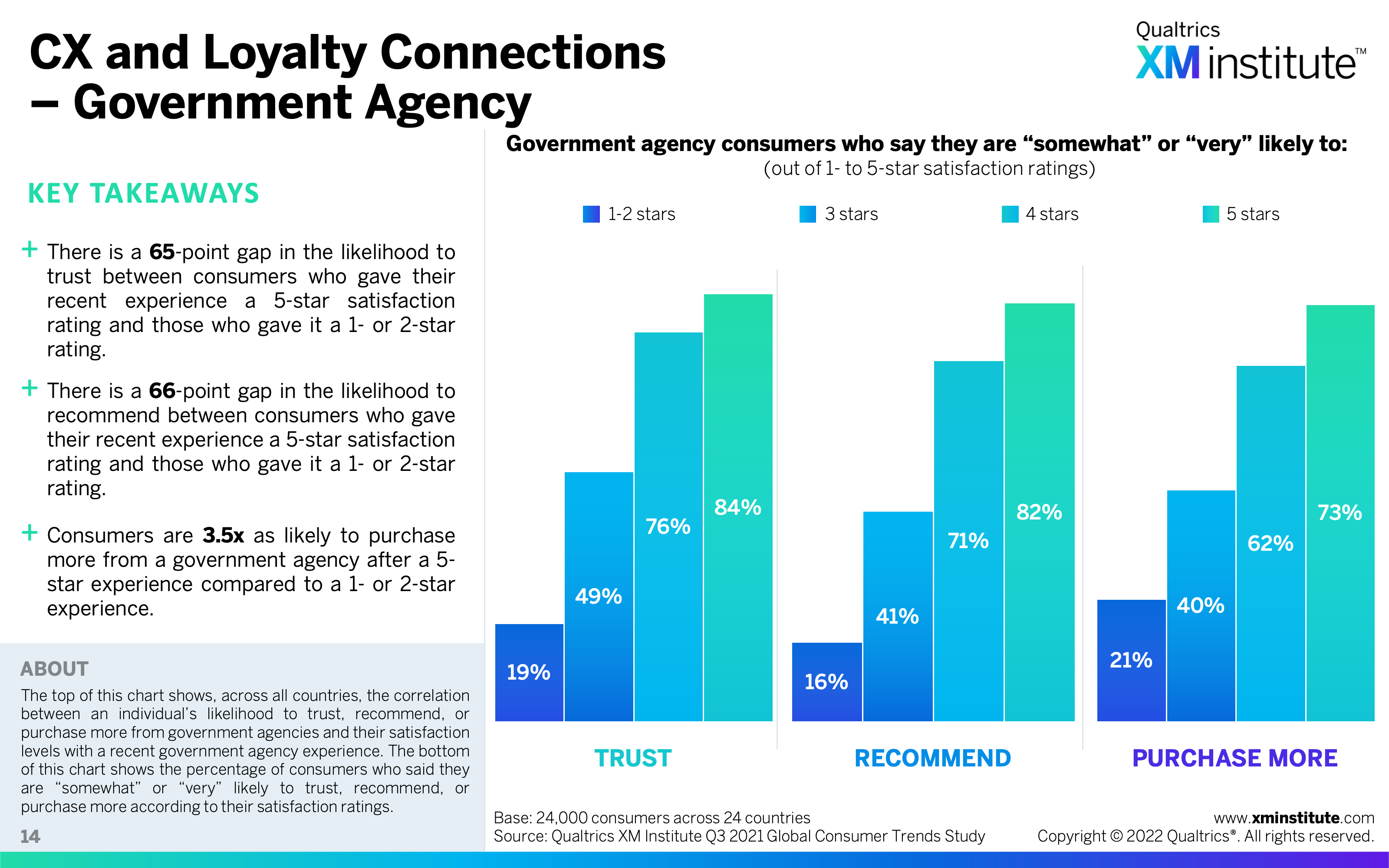

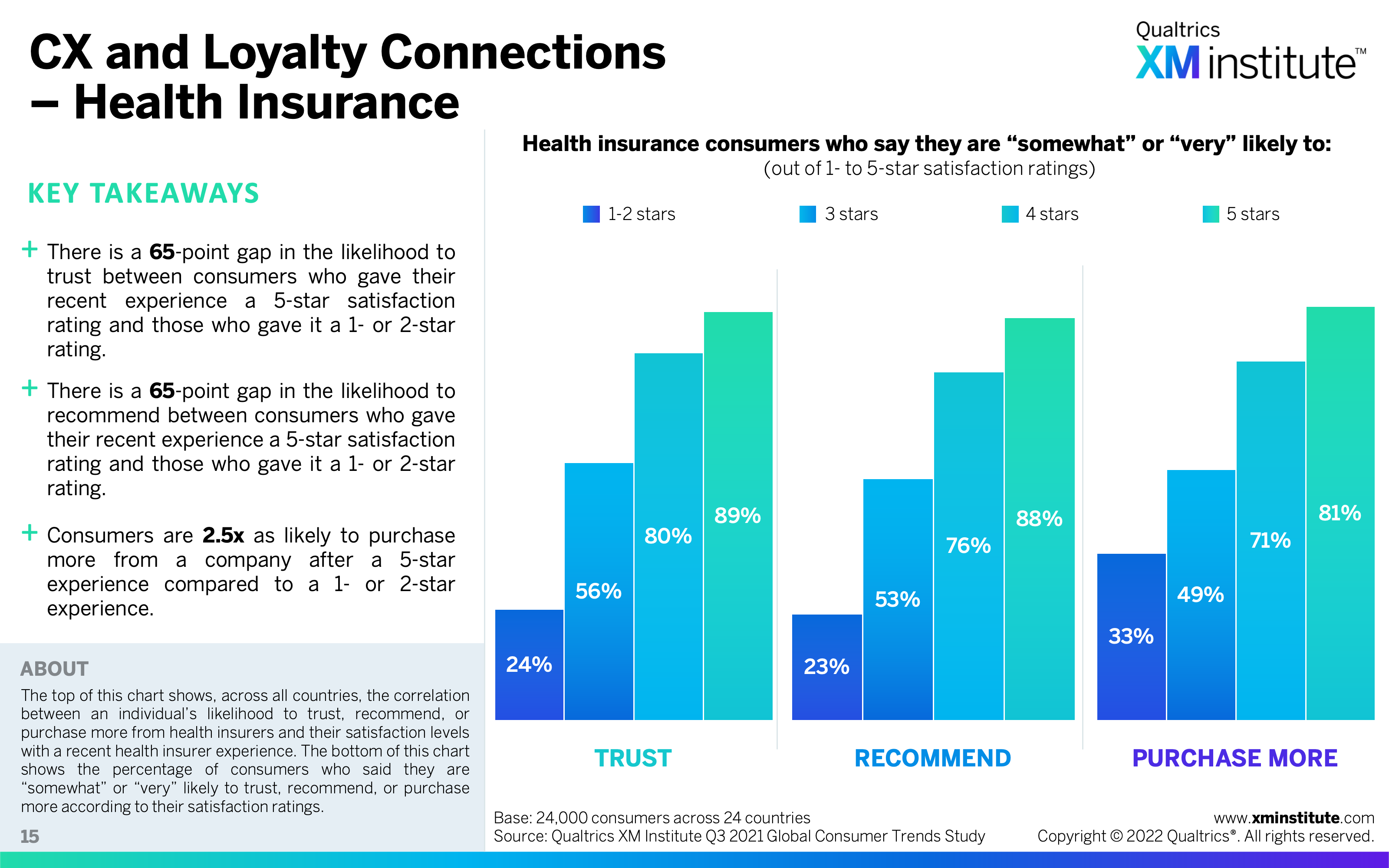

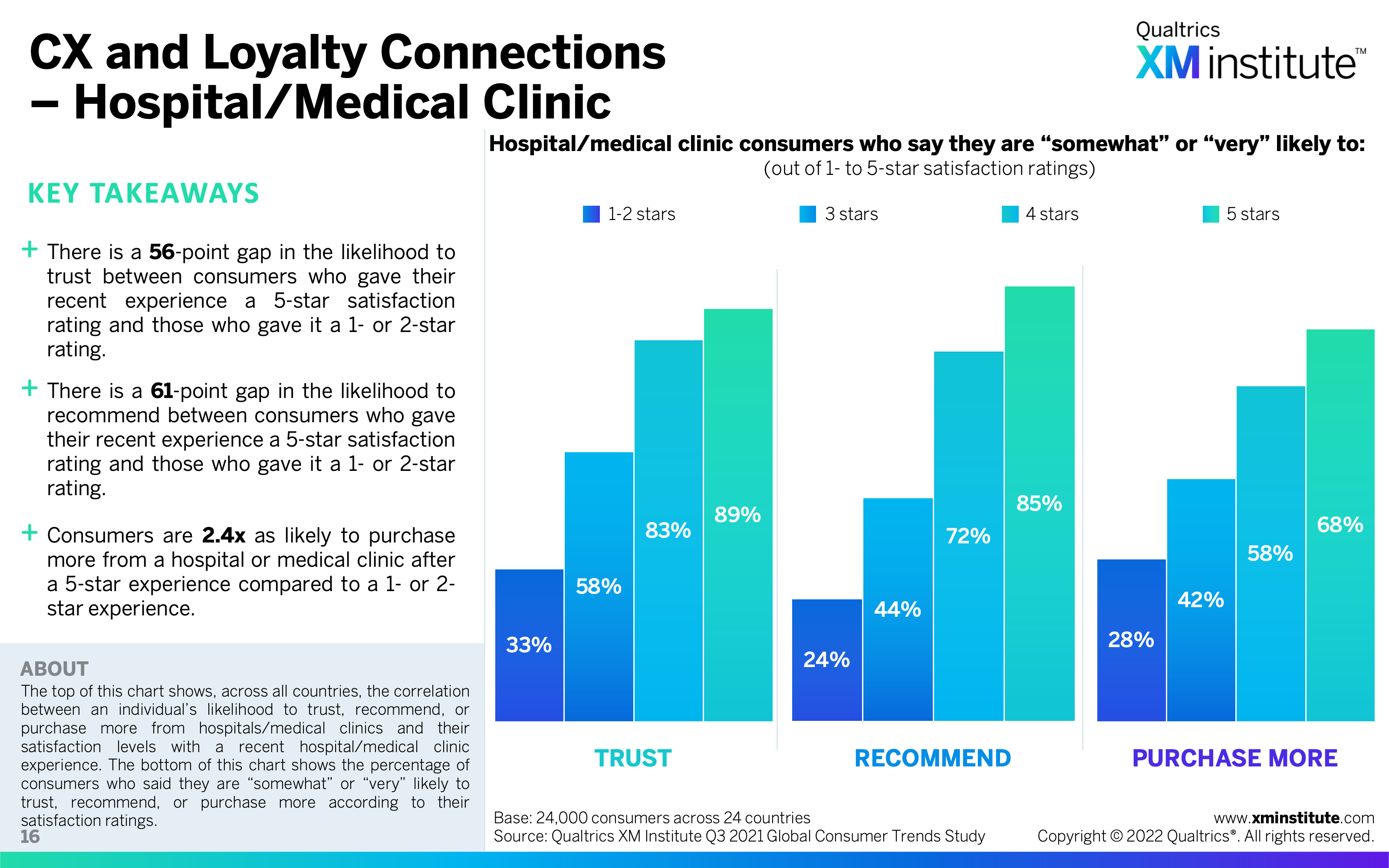

- Consumer satisfaction impacts key loyalty behaviors. Satisfaction has a very strong correlation with consumers’ likelihood to trust, recommend, and purchase more.

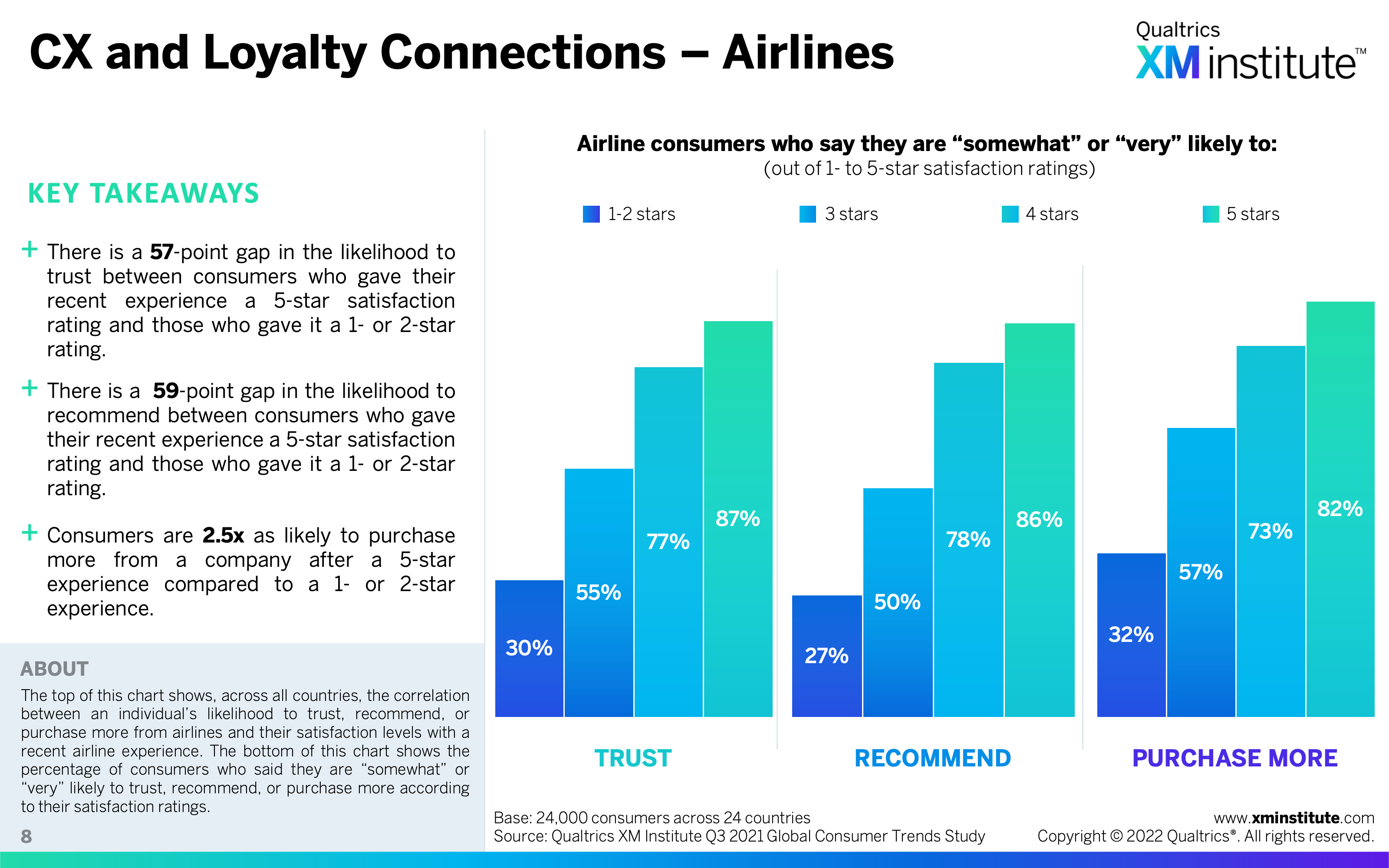

- Consumer likelihood to recommend is most impacted by consumer satisfaction. Compared to after a 1-2- star experience, after a 5- star experience consumers are 3.6x more likely to recommend, 3.3x more likely to trust, and 2.6x more likely to purchase more.

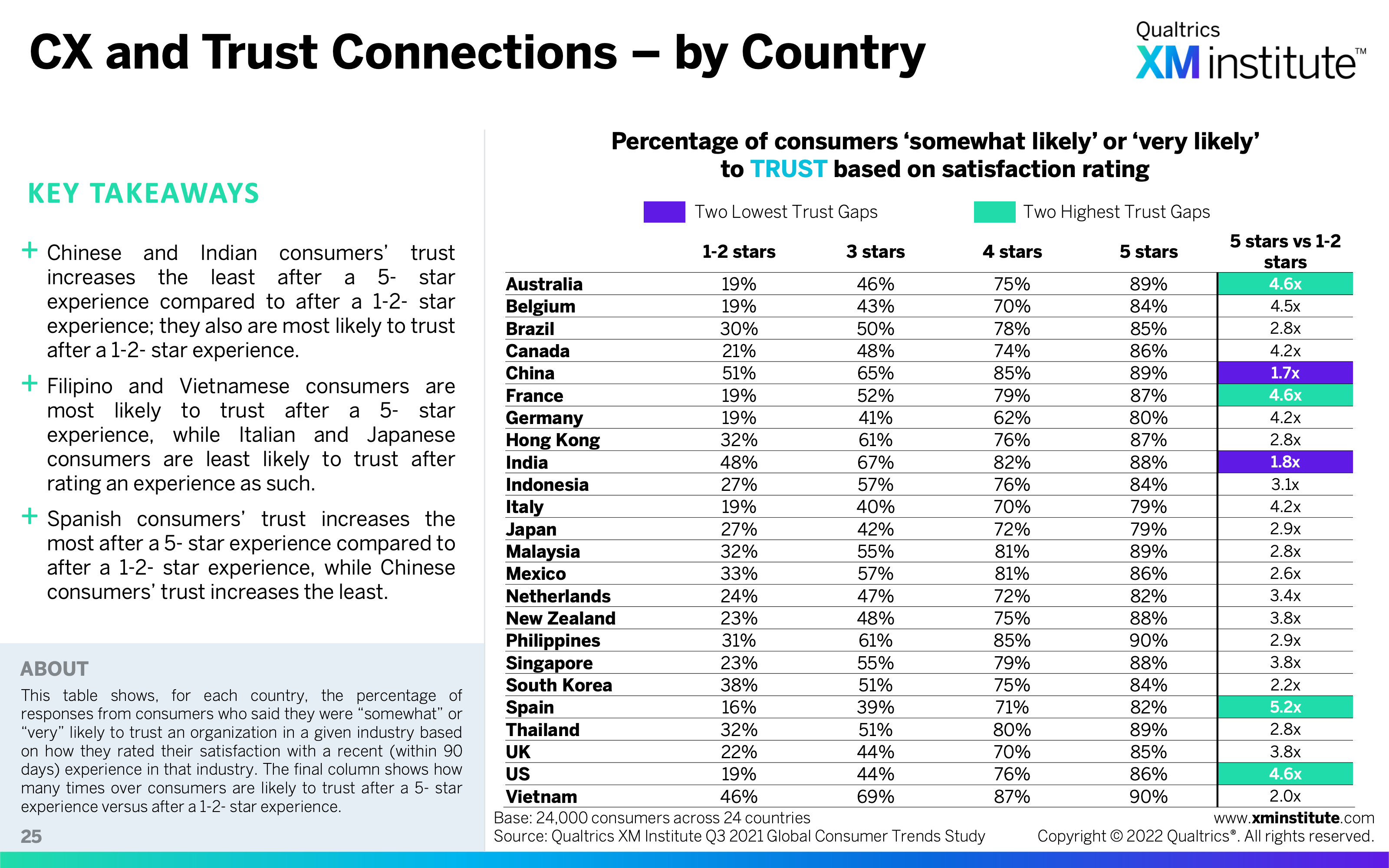

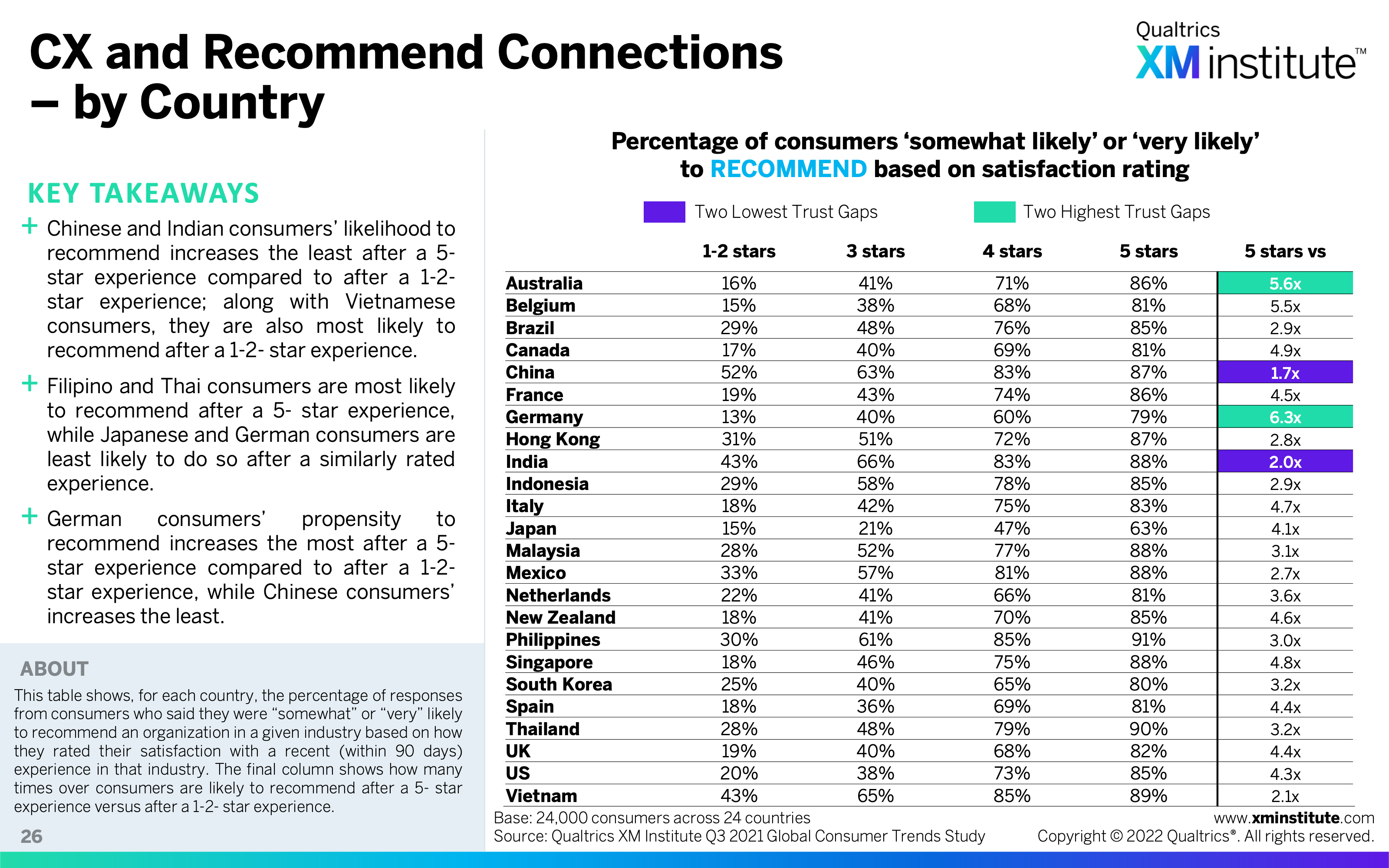

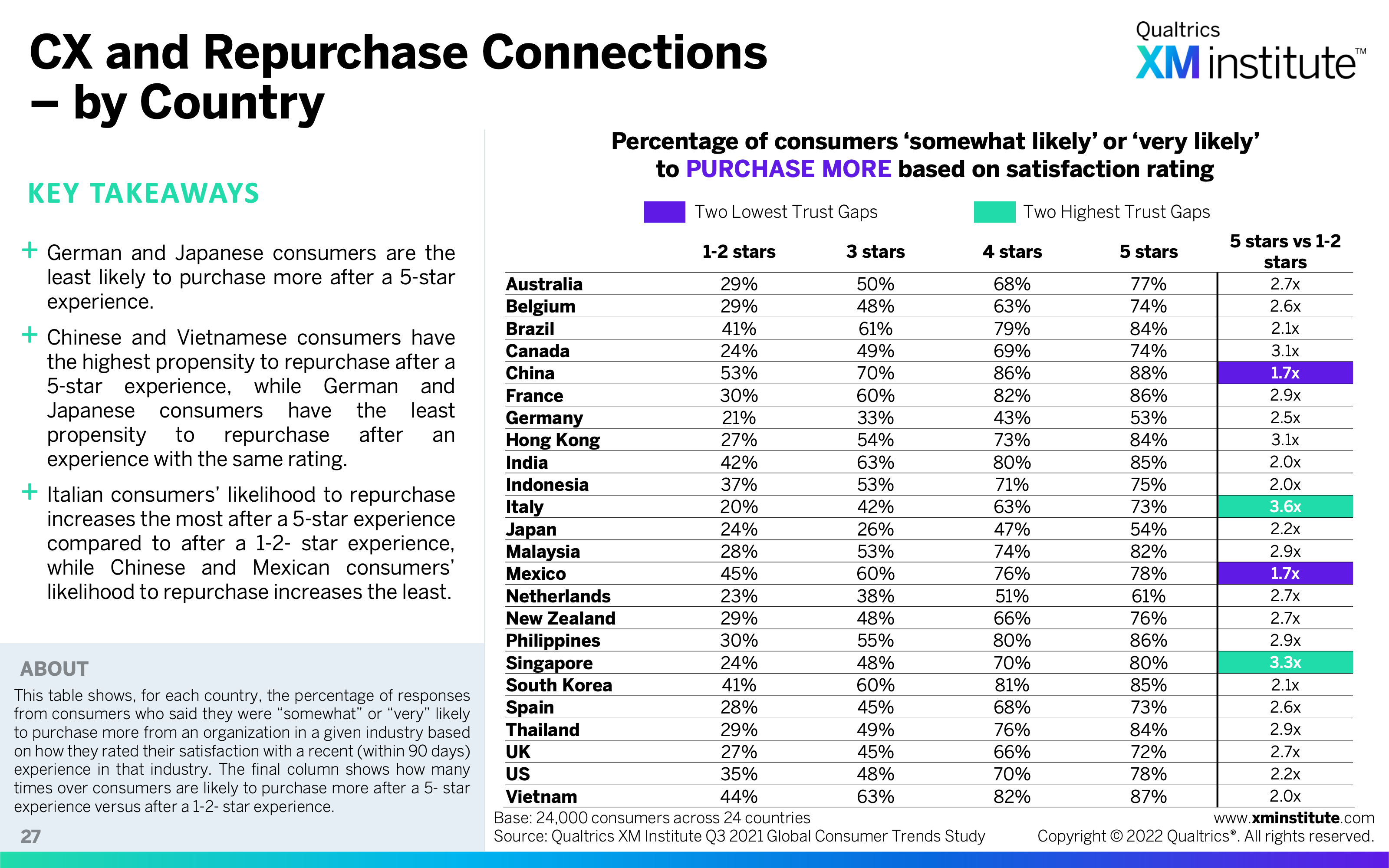

- The impact of satisfaction on loyalty metrics varies by country. Chinese consumers’ likelihood to trust, recommend, and purchase more increases the least (1.7x) after a 5- star satisfying experience compared to after an unsatisfying experience. Comparatively, Germans’ likelihood to recommend increases by 6.3x, Spaniards’ likelihood to trust increases by 5.2x, and Italians’ likelihood to purchase more increases by 3.6x.

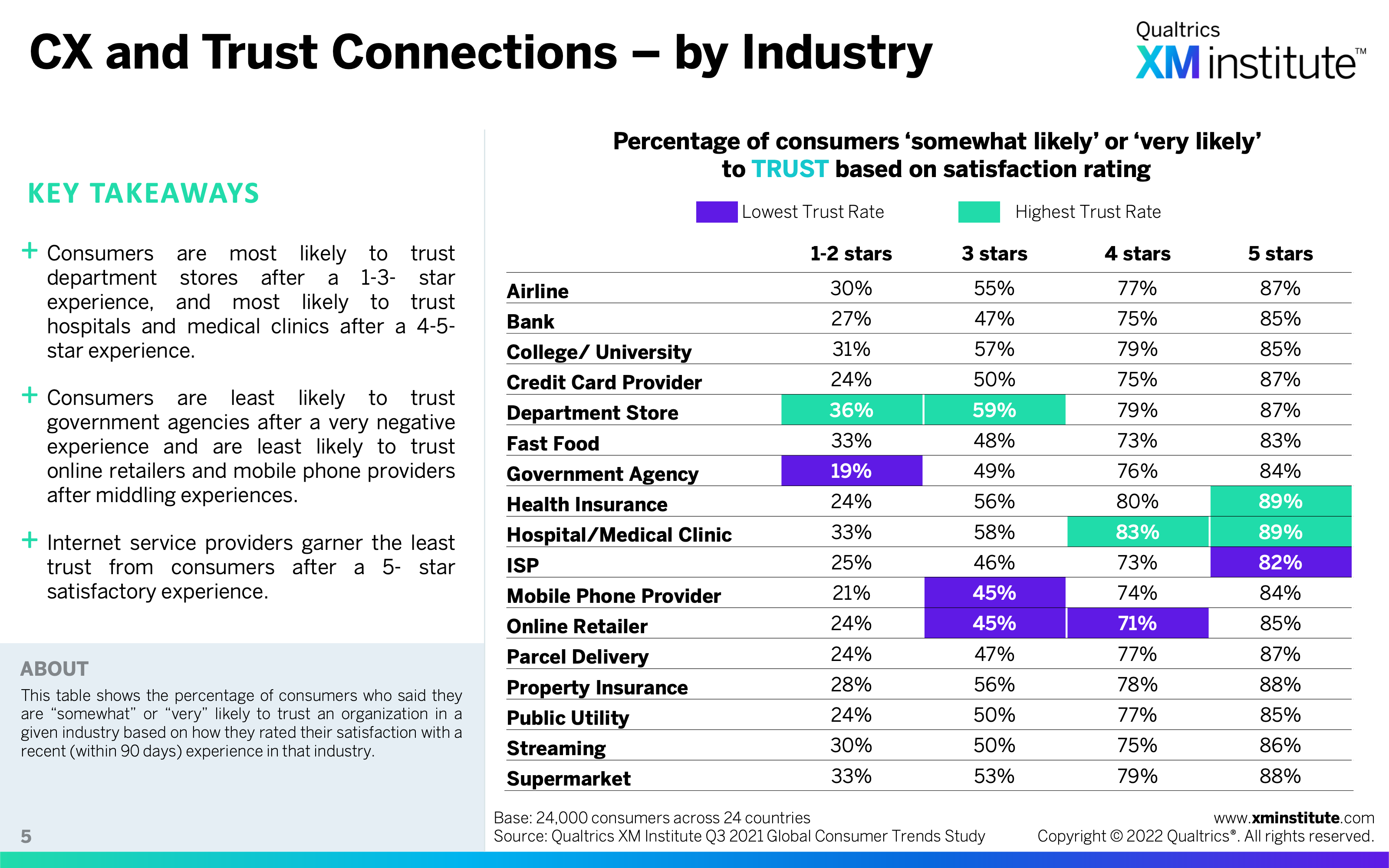

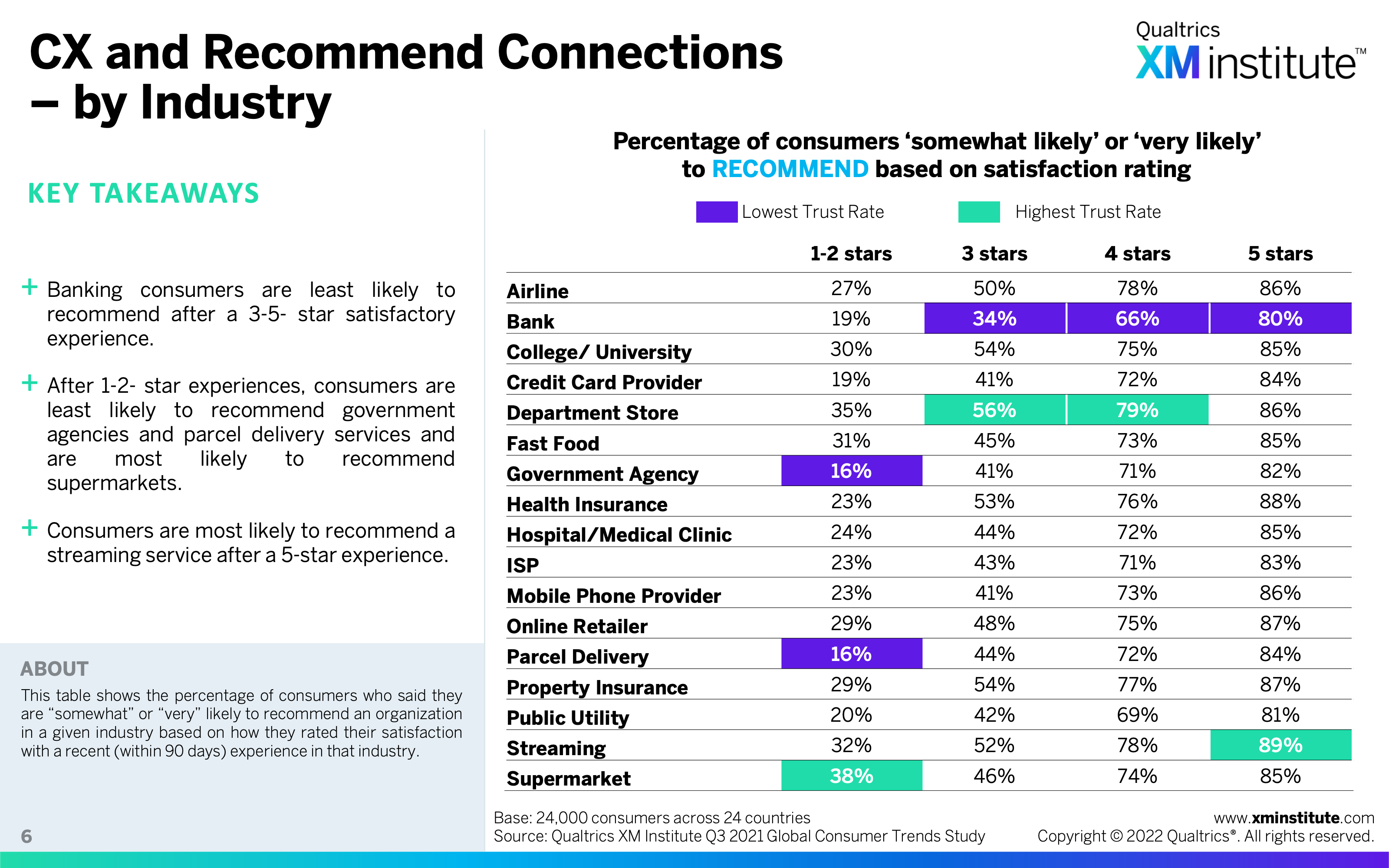

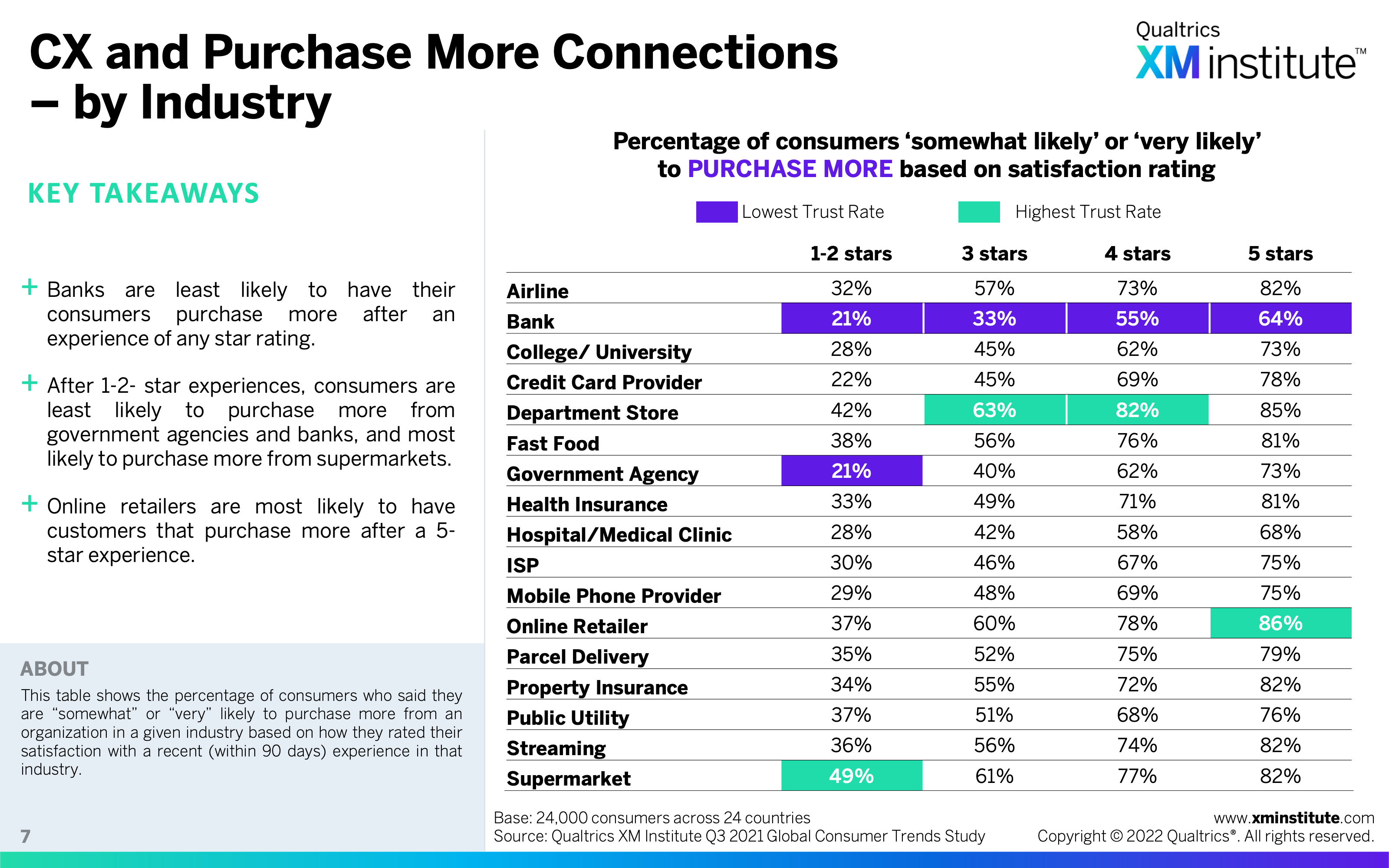

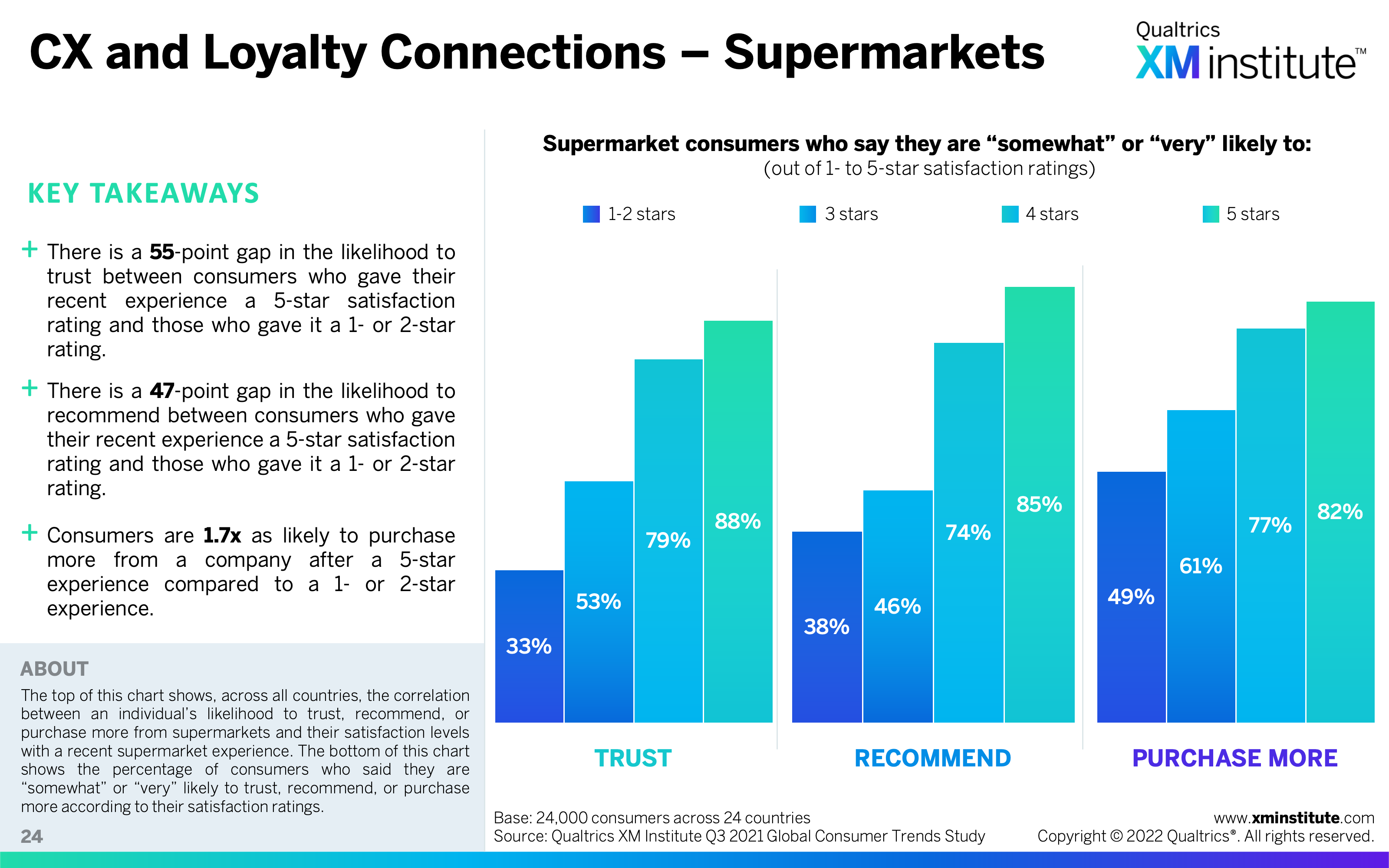

- Unsatisfying experiences impact government agencies’ loyalty metrics the most. Across all industries, consumers are least likely to trust, recommend, and purchase more from a government agency after a 1-2- star experience. Consumers that had an unsatisfying experience with a supermarket are most likely to recommend and purchase more.

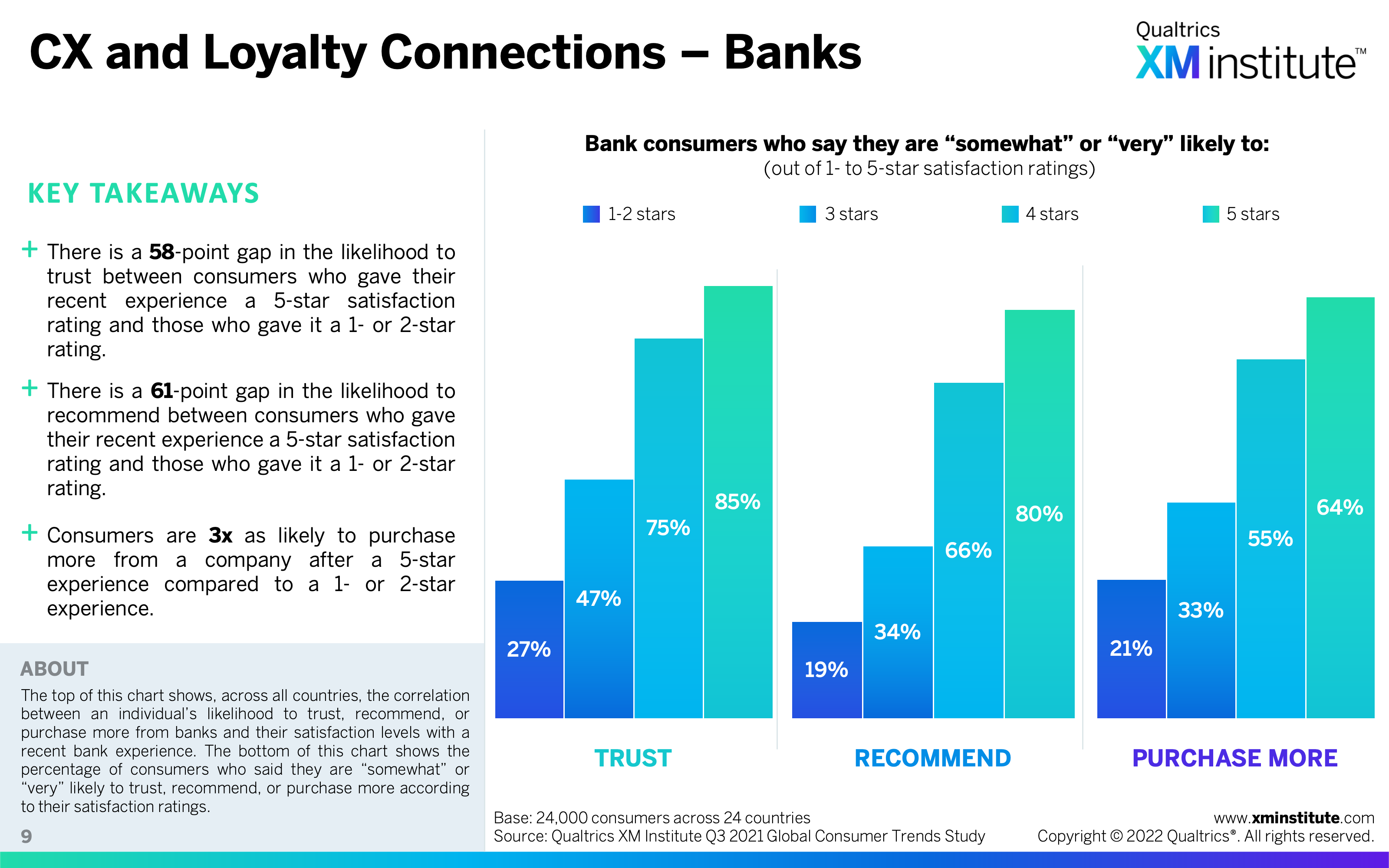

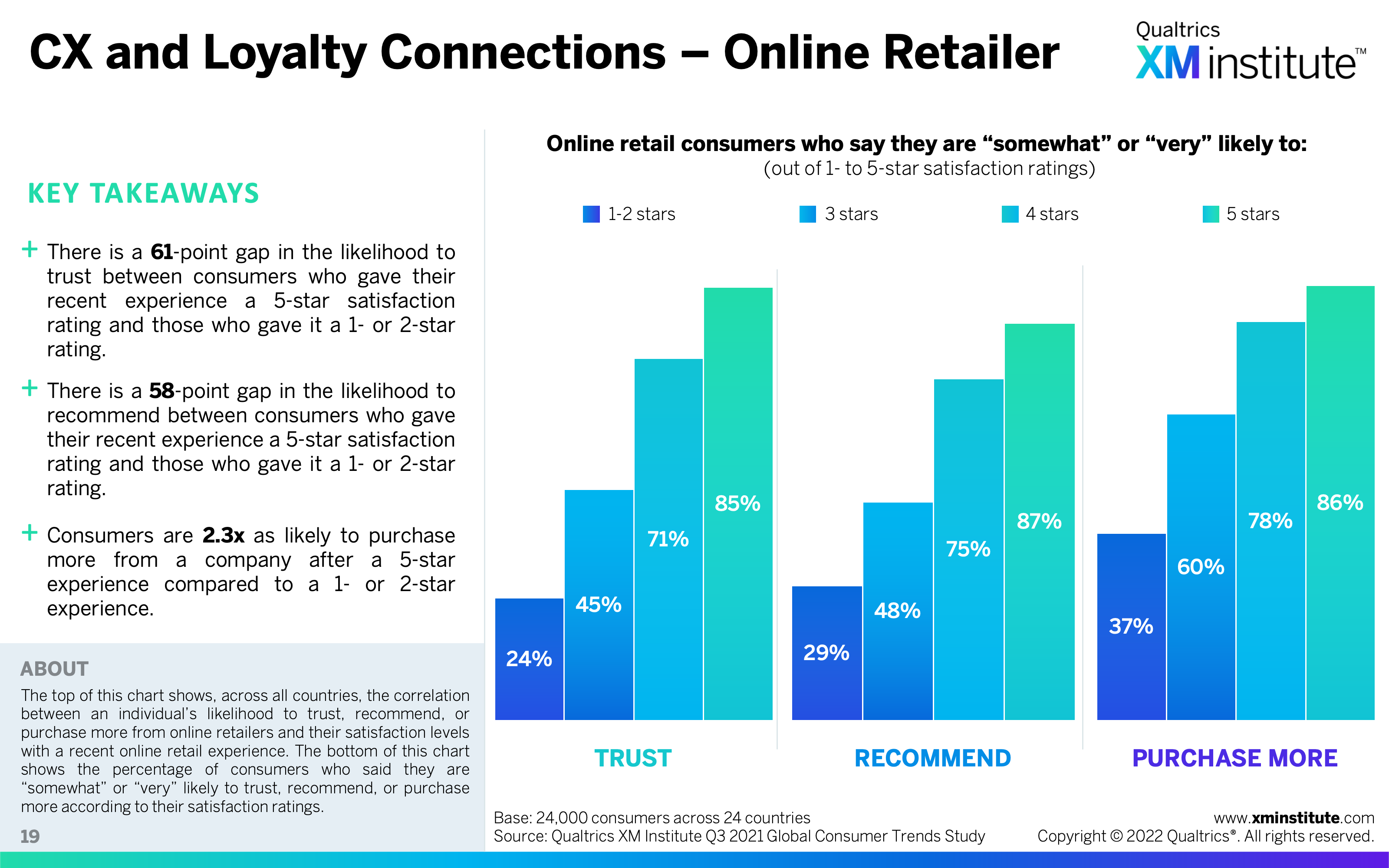

- Banks struggle the most with loyalty after satisfying experiences. After 3-5- star experiences, banking consumers are least likely to recommend and purchase more from banks. Just 64% of banking consumers expect to purchase more after a 5- star experience, compared to 86% of online retail customers.

Figures

Here are the figures in this Data Snapshot:

- ROI: CX Correlates with Trust (see Figure 1)

- ROI: CX Correlates with Recommending (see Figure 2)

- ROI: CX Correlates with Purchasing More (see Figure 3)

- CX and Loyalty Connections – Overall (see Figure 4)

- CX and Trust Connections – by Industry (see Figure 5)

- CX and Recommend Connections – by Industry (see Figure 6)

- CX and Purchase More Connections – by Industry (see Figure 7)

- CX and Loyalty Connections– Airlines (see Figure 8)

- CX and Loyalty Connections– Banks (see Figure 9)

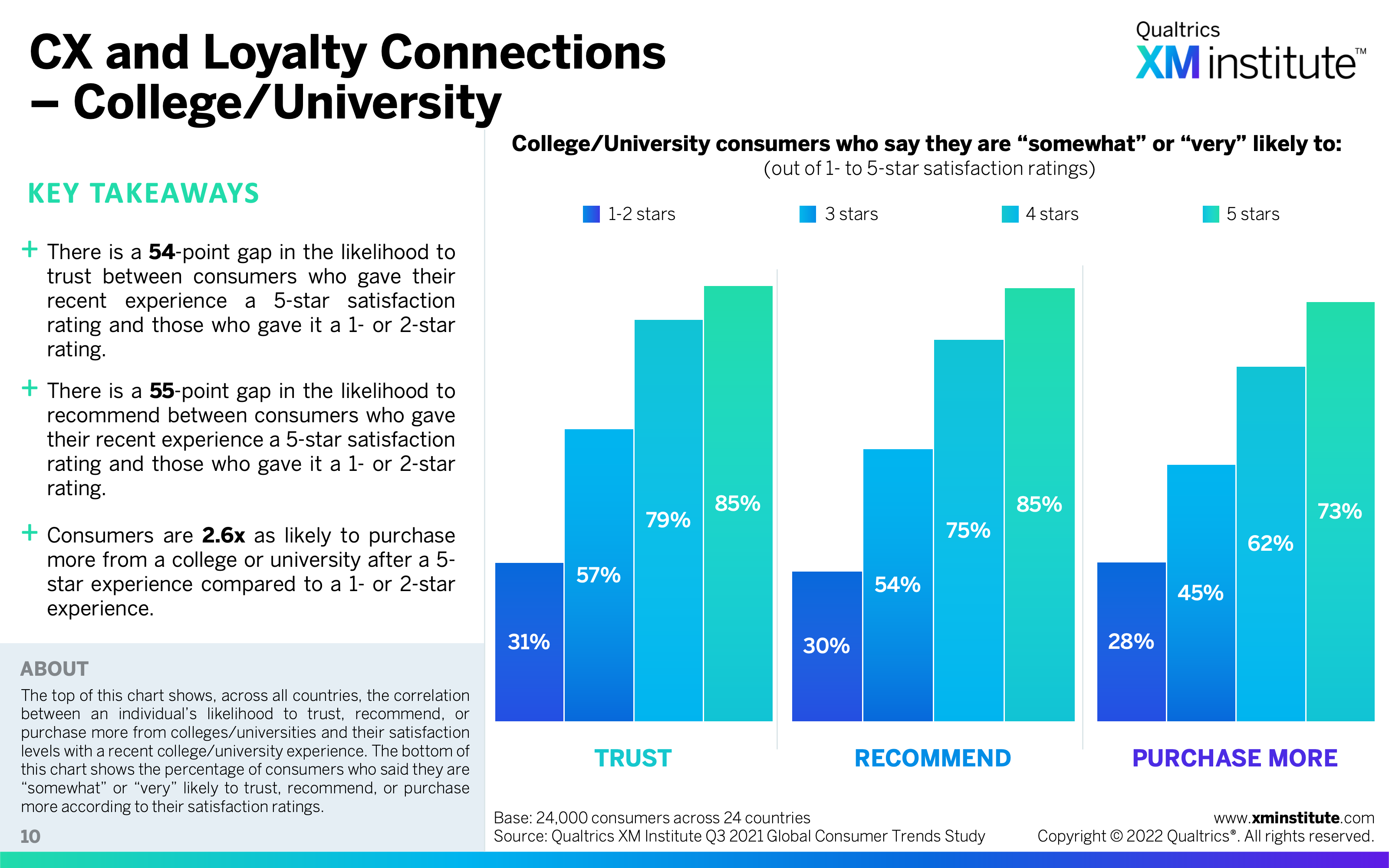

- CX and Loyalty Connections – College / University (see Figure 10)

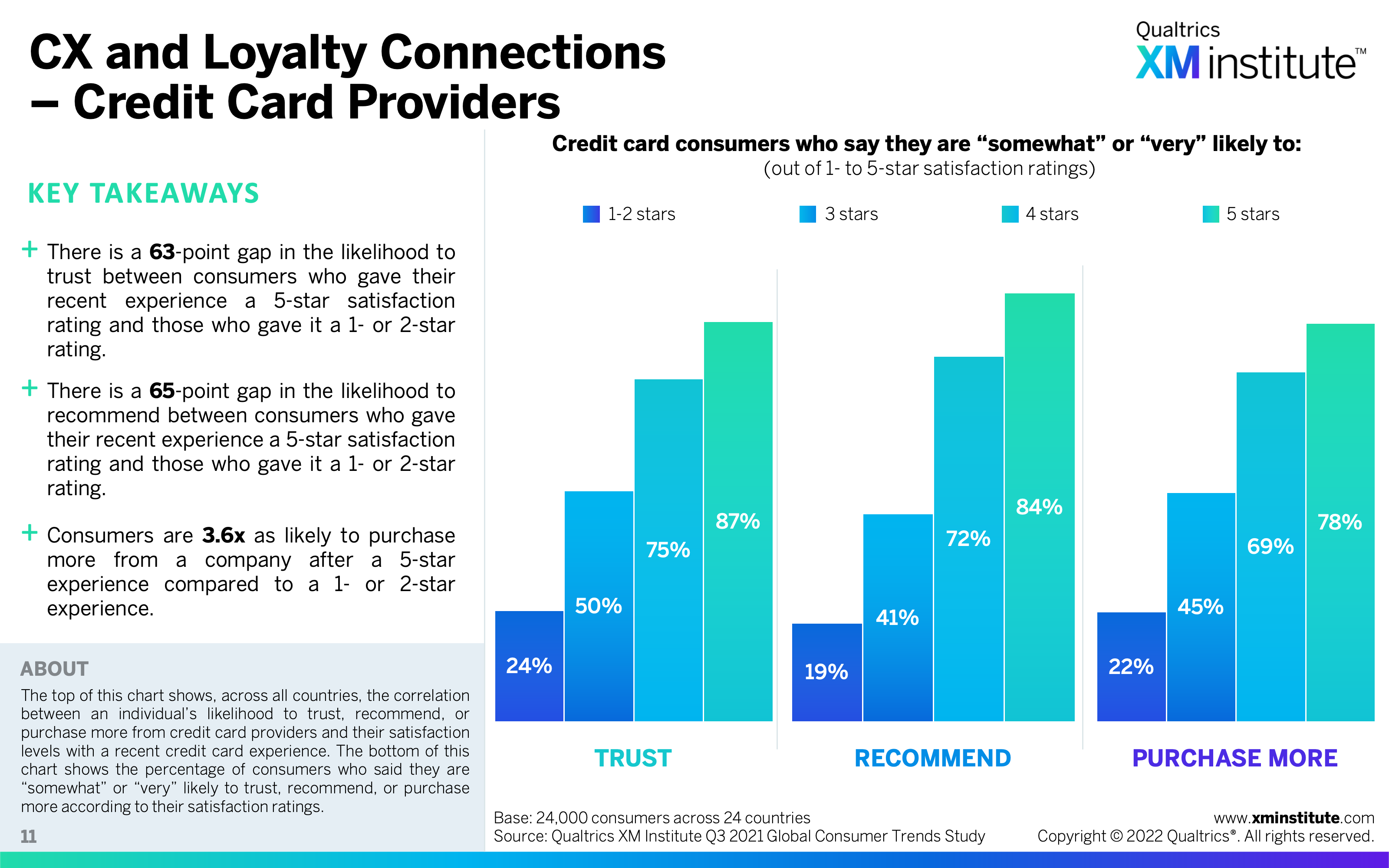

- CX and Loyalty Connections – Credit Card Providers (see Figure 11)

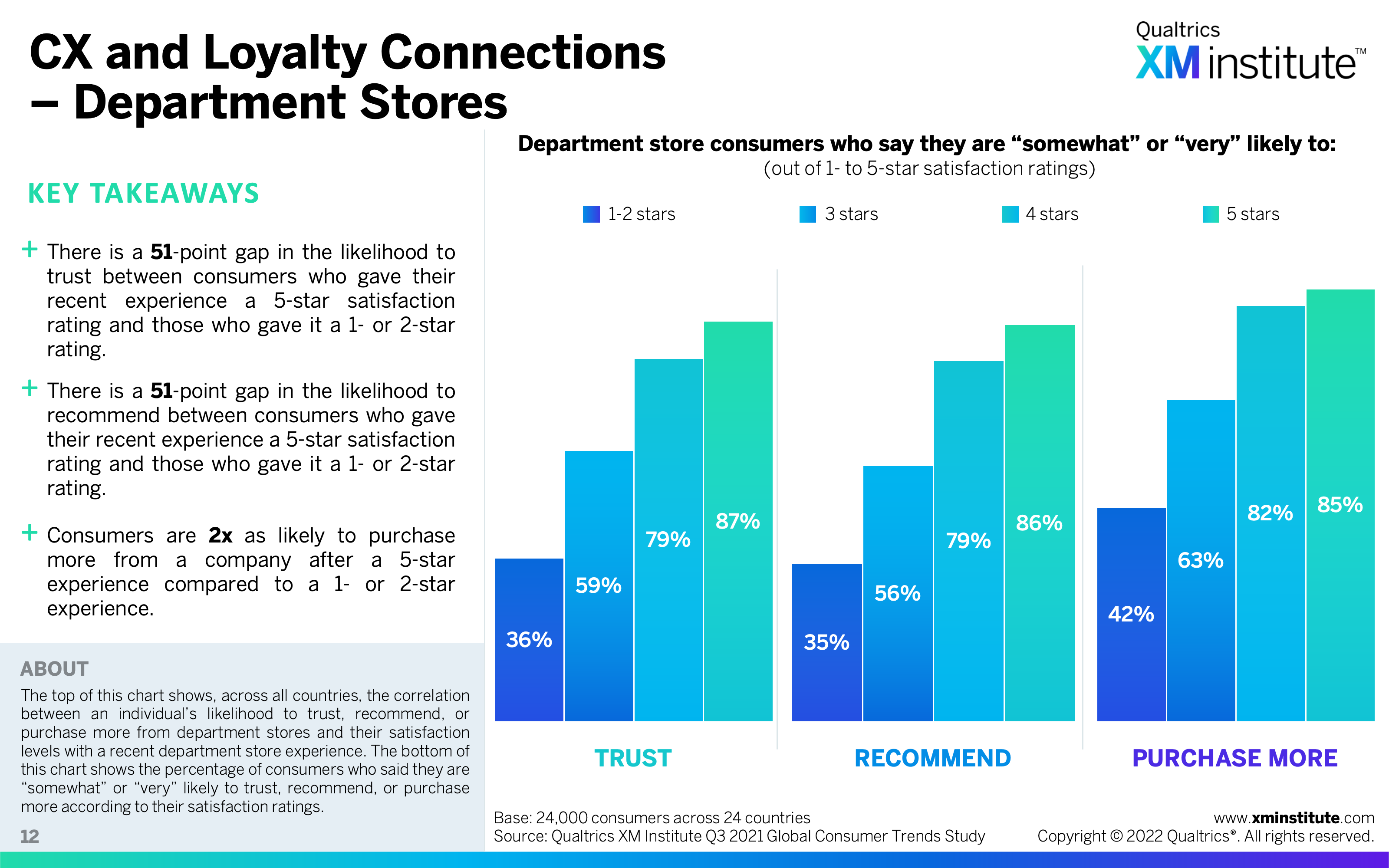

- CX and Loyalty Connections – Department Stores (see Figure 12)

- CX and Loyalty Connections – Fast Food (see Figure 13)

- CX and Loyalty Connections – Government Agency (see Figure 14)

- CX and Loyalty Connections – Health Insurance (see Figure 15)

- CX and Loyalty Connections – Hospital / Medical Clinic (see Figure 16)

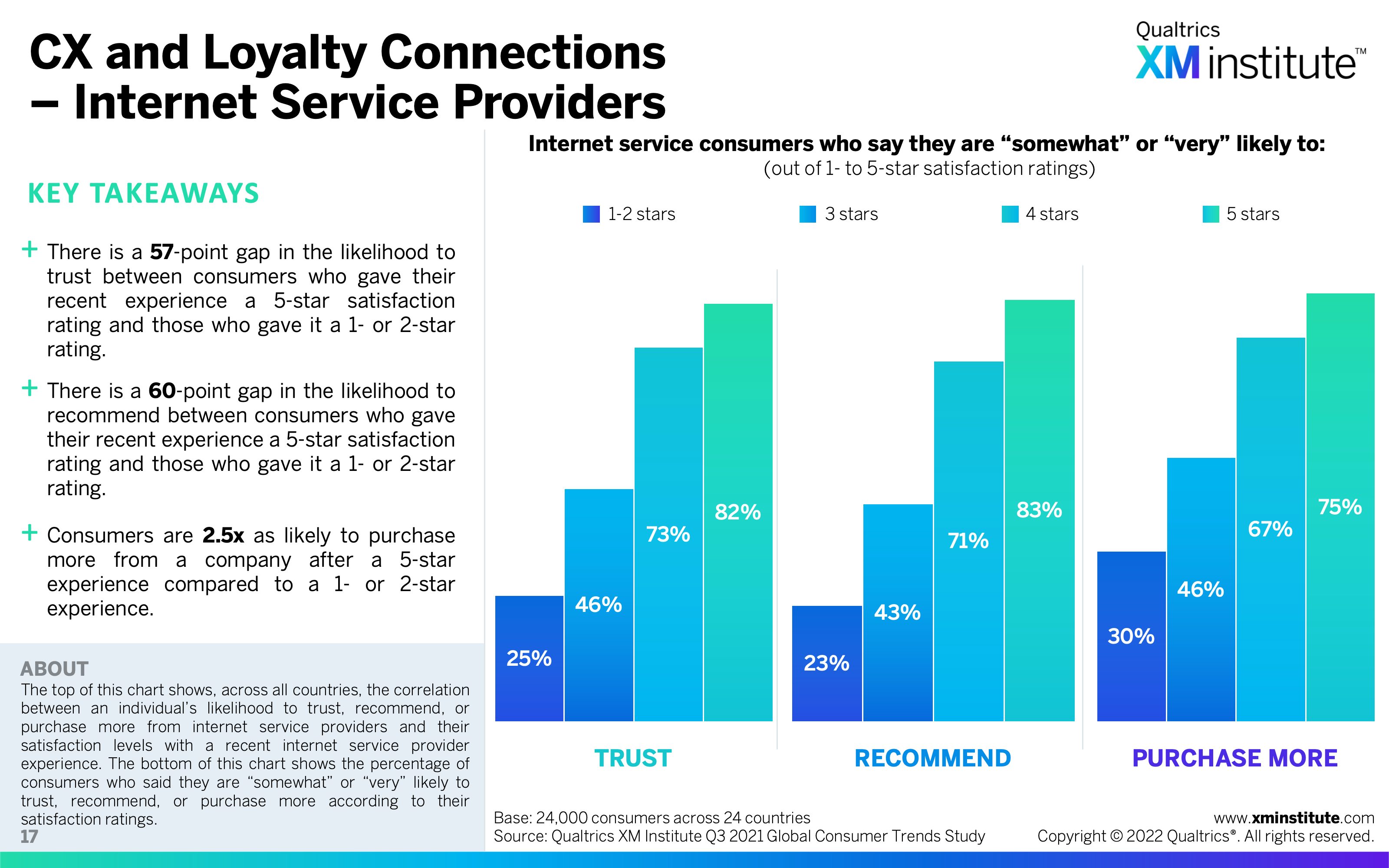

- CX and Loyalty Connections – Internet Service Provider (see Figure 17)

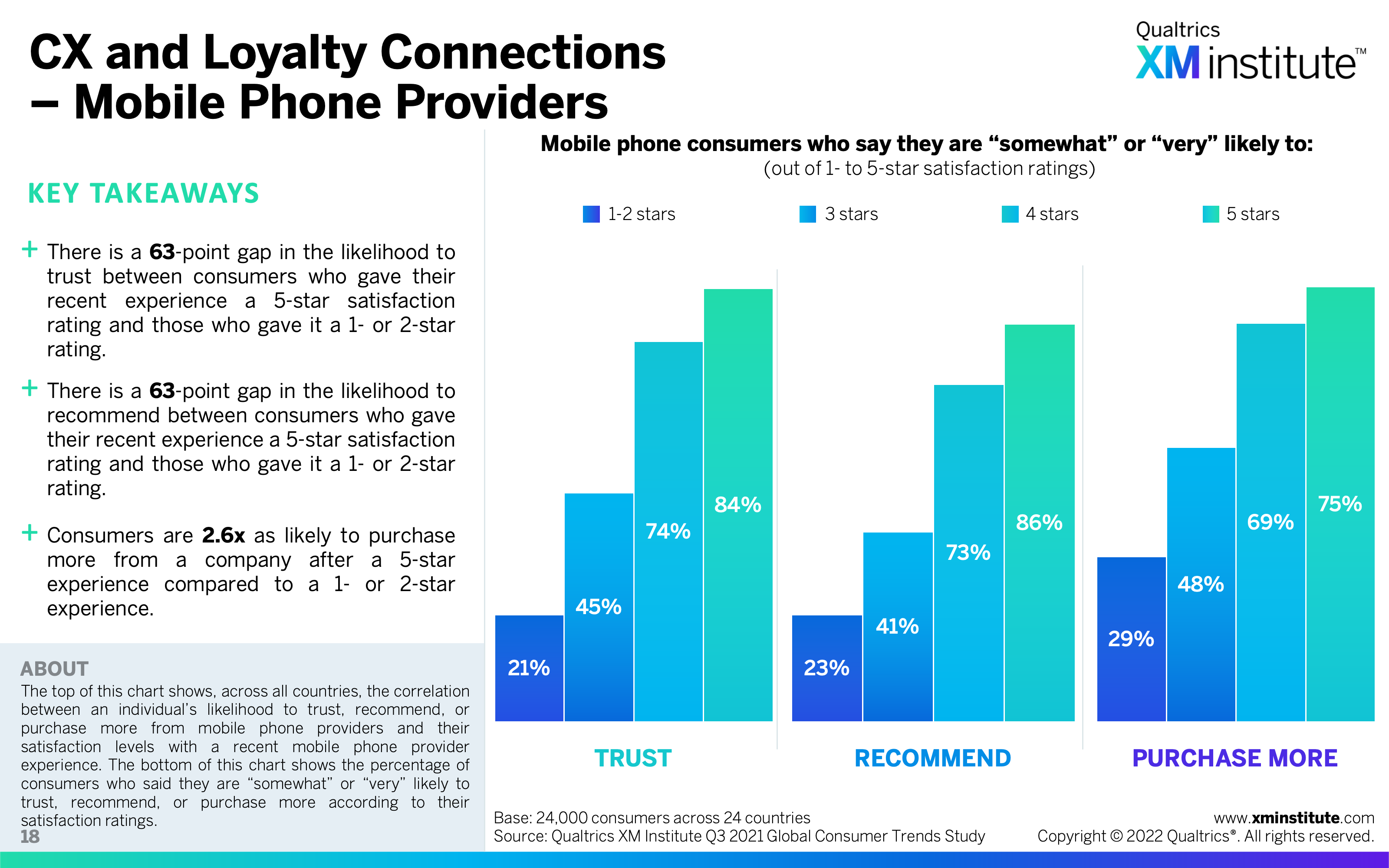

- CX and Loyalty Connections – Mobile Phone Providers (see Figure 18)

- CX and Loyalty Connections – Online Retailer (see Figure 19)

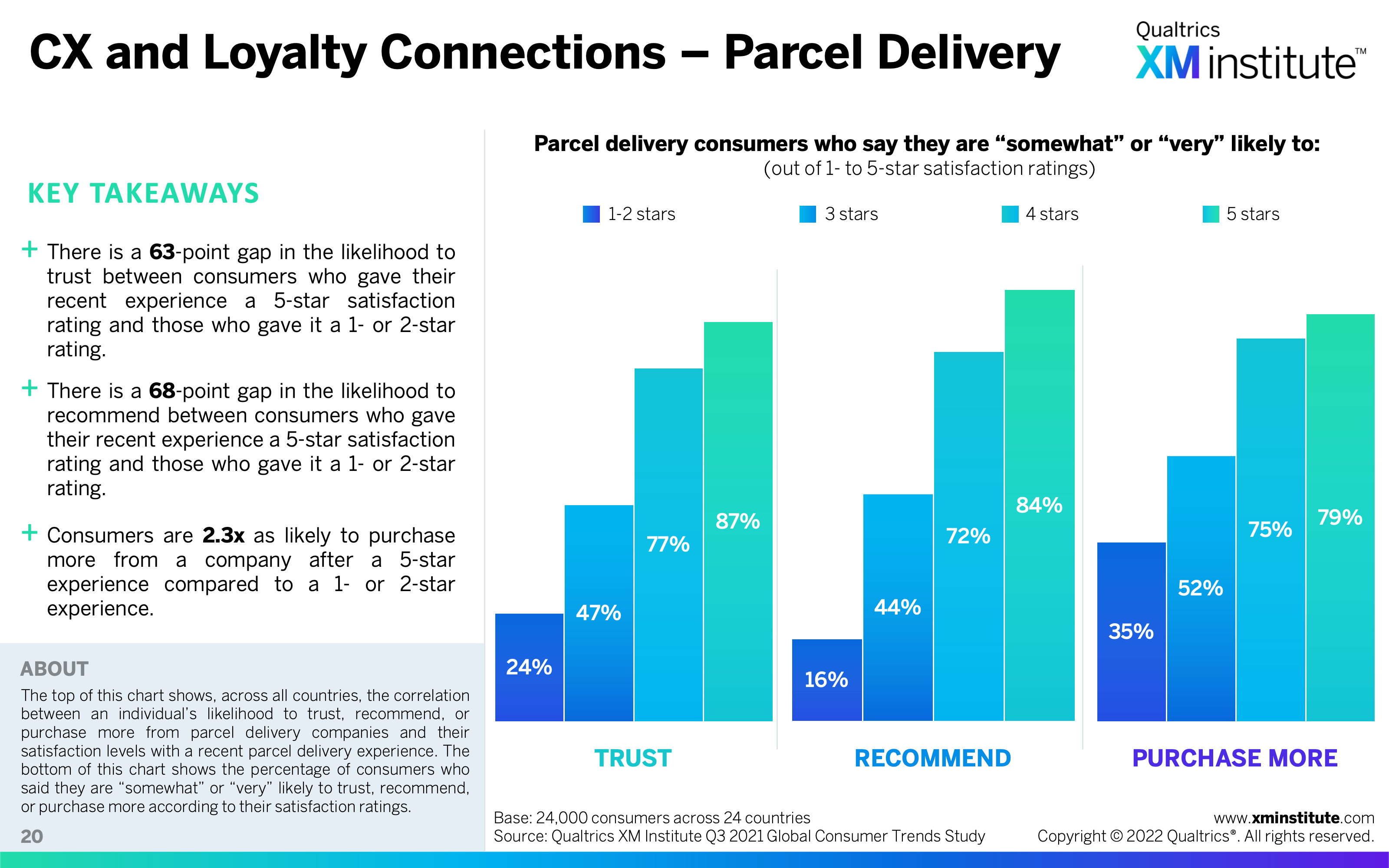

- CX and Loyalty Connections – Parcel Delivery (see Figure 20)

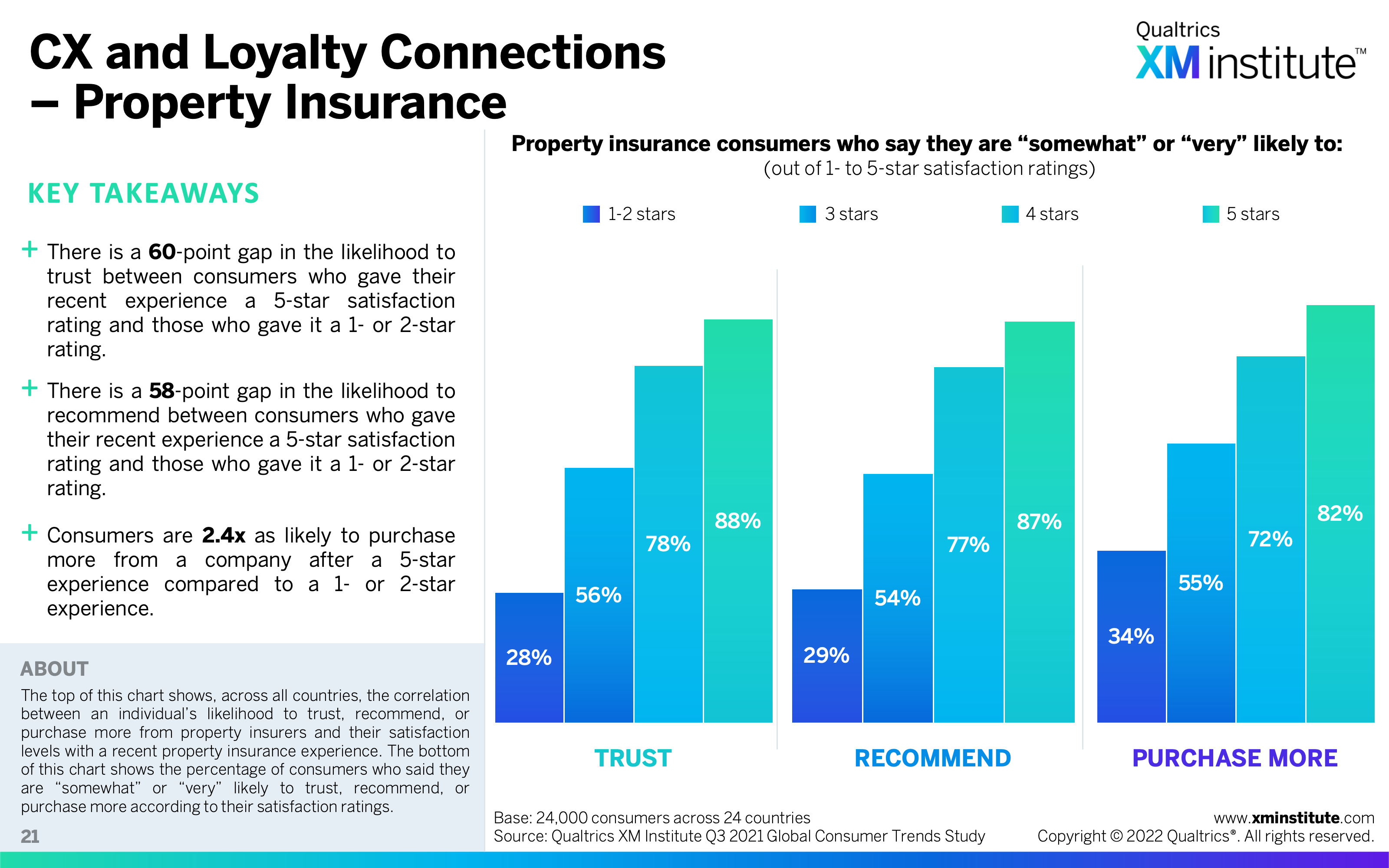

- CX and Loyalty Connections – Property Insurance (see Figure 21)

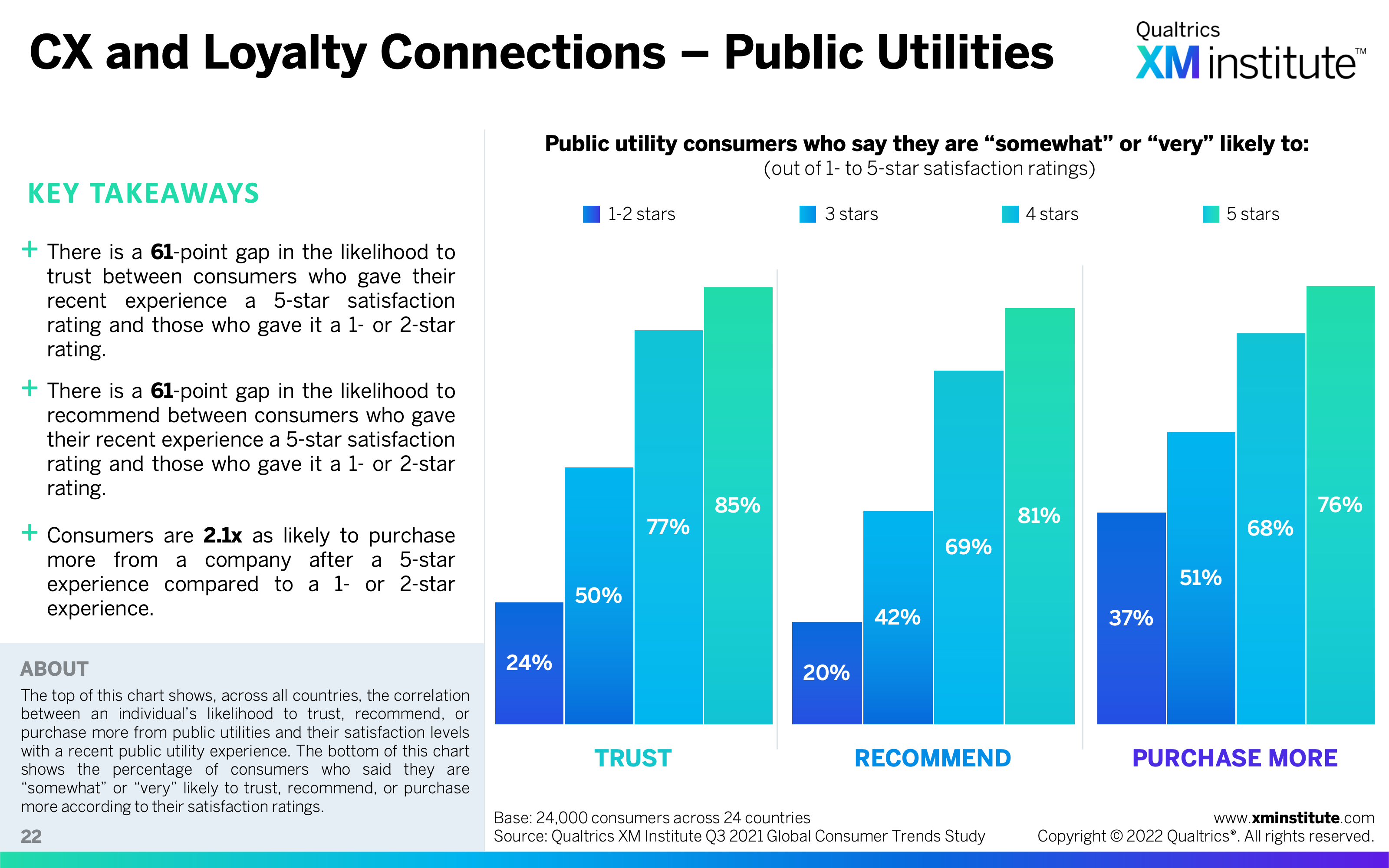

- CX and Loyalty Connections – Public Utilities (see Figure 22)

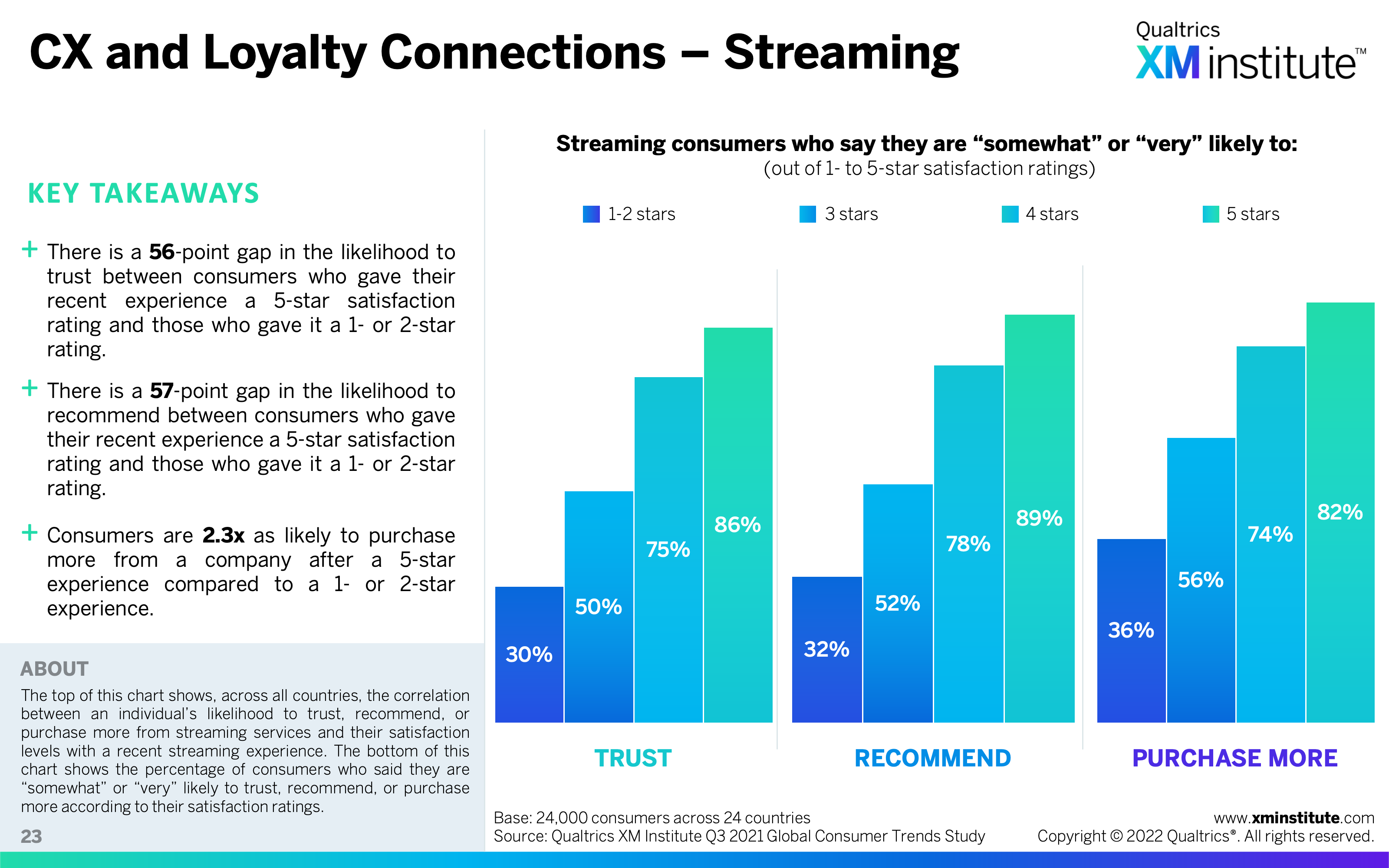

- CX and Loyalty Connections – Streaming (see Figure 23)

- CX and Loyalty Connections – Supermarkets (see Figure 24)

- CX and Trust Connections – by Country (see Figure 25)

- CX and Recommend Connections – by Country (see Figure 26)

- CX and Purchase More Connections – by Country (see Figure 27)

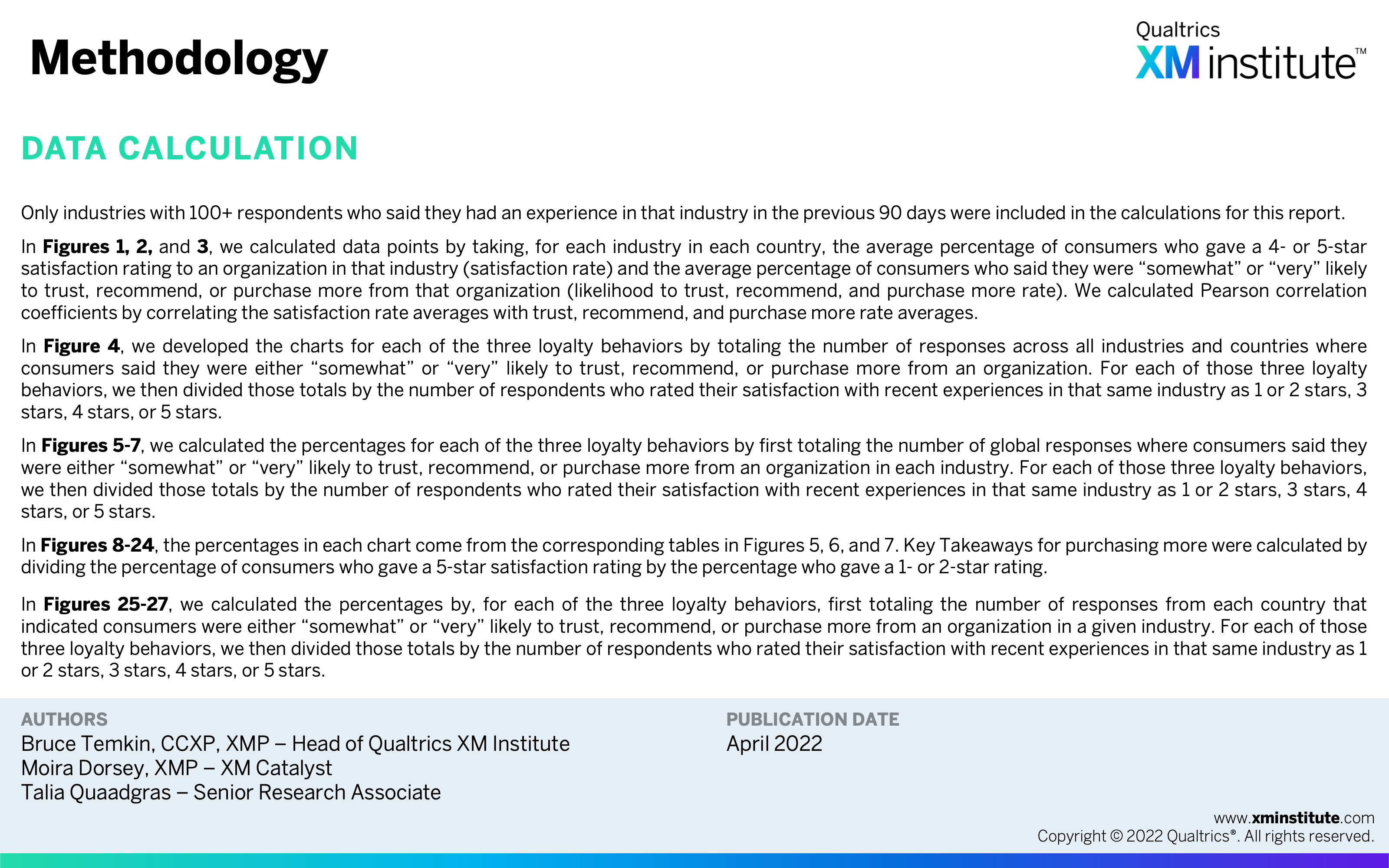

- Methodology (see Figure 28)